Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

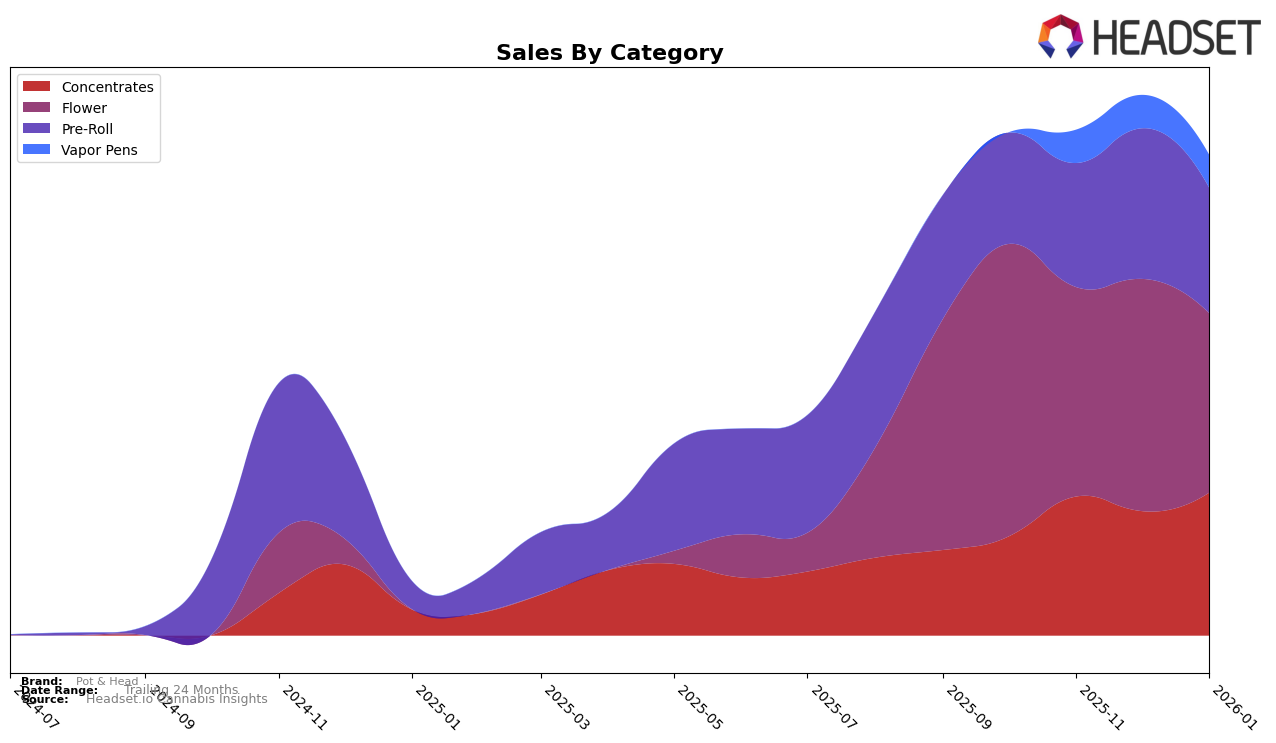

In the state of New York, Pot & Head has shown notable performance across various product categories. Concentrates, in particular, have seen a steady climb, moving from 16th place in October 2025 to 14th in January 2026, indicating a positive reception and growing market share. This category's sales have also seen consistent growth, with a peak in November 2025. On the other hand, the Flower category has experienced a decline, dropping from 51st to 79th place over the same period, which suggests challenges in maintaining competitiveness or consumer preference shifts. Such movements hint at strategic opportunities for Pot & Head to reassess their product offerings or marketing strategies in this category.

In the Pre-Roll category, Pot & Head has shown resilience, improving its rank from 75th in October 2025 to 66th in December before slightly retreating to 71st in January 2026. This fluctuation could be attributed to seasonal demand or competitive pressures. Meanwhile, the Vapor Pens category presents a challenging landscape, as Pot & Head was not in the top 30 in October 2025 and only managed to enter the rankings in November at 93rd, with a slight improvement to 86th by January 2026. The absence from the top 30 in October highlights the competitive intensity in this segment, suggesting room for strategic initiatives to enhance brand visibility and product differentiation. Overall, these insights reveal a dynamic market environment where Pot & Head is navigating both opportunities and challenges.

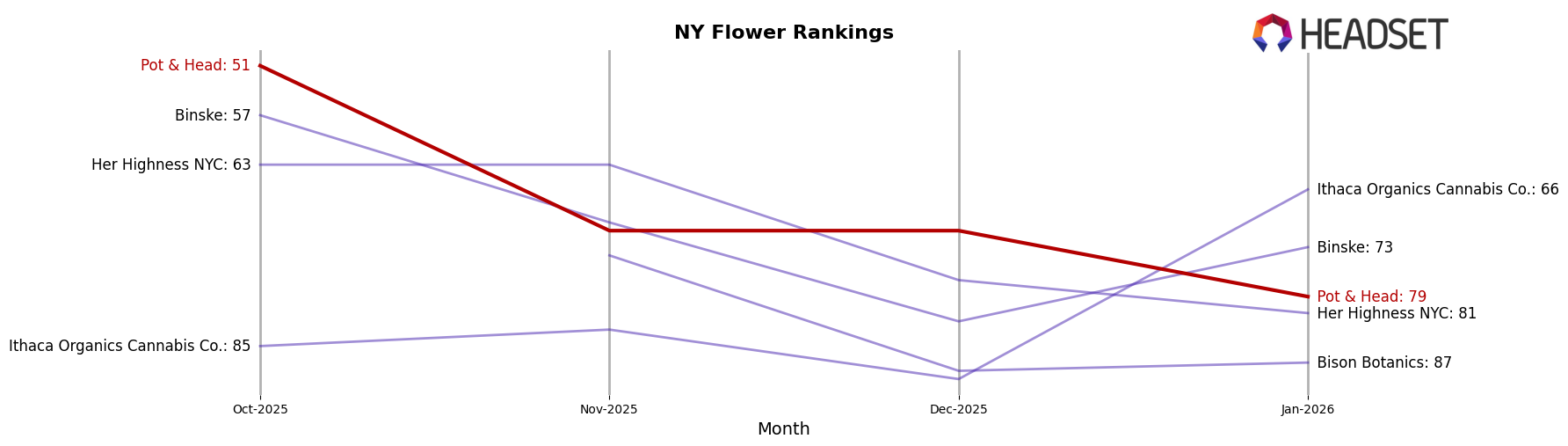

Competitive Landscape

In the competitive landscape of the New York flower category, Pot & Head has experienced notable fluctuations in its market position from October 2025 to January 2026. Starting at a rank of 51 in October, Pot & Head saw a decline to 79 by January, indicating a downward trend in its competitive standing. This shift is mirrored by a decrease in sales over the same period. Meanwhile, competitors such as Binske and Her Highness NYC have also experienced declines in their rankings, though Ithaca Organics Cannabis Co. managed to improve its position from 85 to 66, suggesting a potential shift in consumer preferences. The competitive dynamics in this market highlight the importance for Pot & Head to reassess its strategies to regain its footing and counteract the sales decline observed in recent months.

Notable Products

In January 2026, OG Kush Pre-Roll (1g) emerged as the top-performing product for Pot & Head, climbing from the second position in December 2025 to first place, with notable sales figures of 1182 units. Vanilla Kush Pre-Roll (1g) also showed significant improvement, advancing from fifth place in December to second in January. Super Boof Pre-Roll (1g), which previously held the top spot, slipped to third place. Lemon Trees Pre-Roll (1g) made its debut in the rankings at fourth place. Blue Dream Pre-Roll (1g) experienced a slight decline, moving from fourth in December to fifth in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.