Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

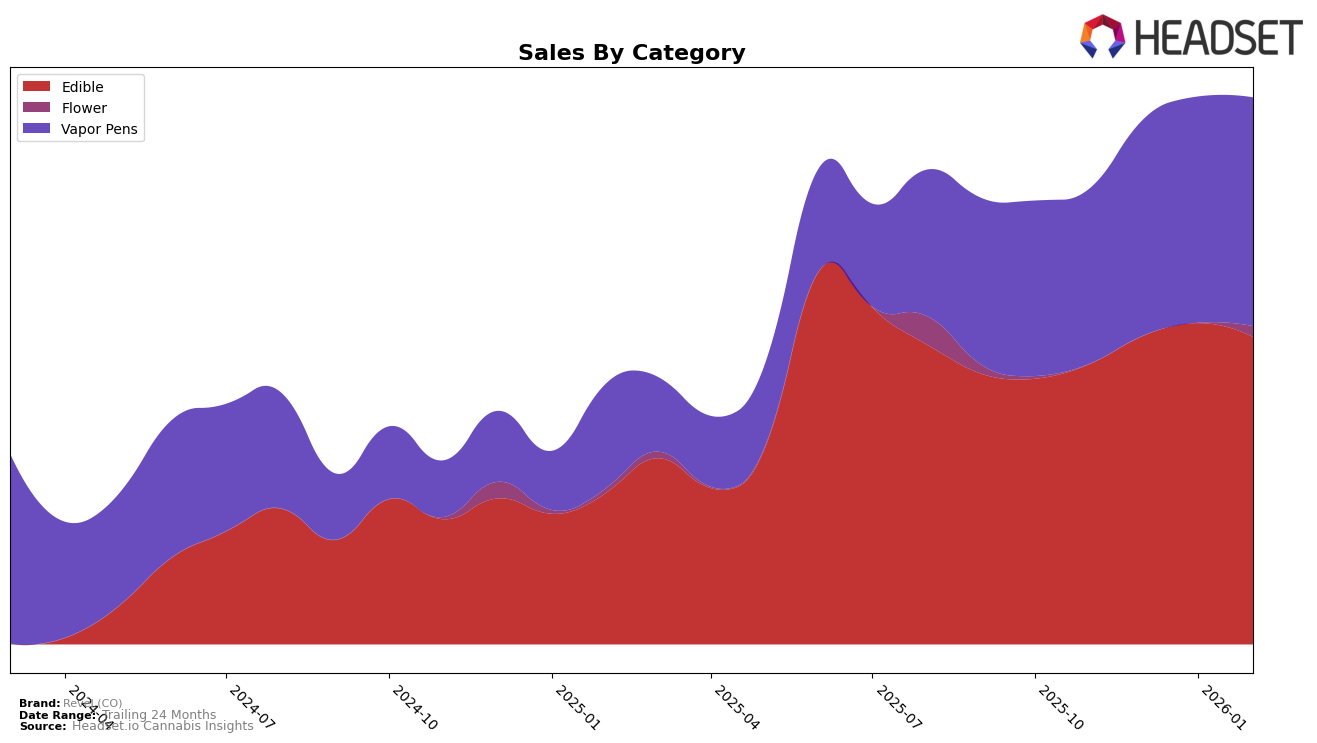

Revel (CO) has consistently maintained its position in the Edible category within Colorado, ranking 8th from November 2025 through February 2026. This stability suggests a strong foothold in the market, likely due to a loyal customer base or effective product offerings. The brand's sales in this category have shown a steady increase, with a notable peak in January 2026 before a slight dip in February. This trend indicates a robust performance, although the slight decline in February could warrant a closer look at potential seasonal factors or market dynamics affecting sales.

In the Vapor Pens category, Revel (CO) has shown promising upward movement within Colorado, improving its ranking from 31st in November 2025 to 22nd by February 2026. This upward trajectory reflects a positive reception of their products or possibly strategic marketing efforts that have resonated well with consumers. However, the absence of a ranking in the Flower category suggests that Revel (CO) has not yet established a significant presence in this segment, which could be an area for future growth or diversification. The overall sales performance across categories indicates a brand that is effectively navigating the competitive landscape, with room for expansion in underrepresented areas.

Competitive Landscape

In the competitive landscape of the Colorado edible market, Revel (CO) consistently holds the 8th rank from November 2025 to February 2026, indicating a stable position amidst fluctuating trends among competitors. Notably, TasteBudz (CO) experienced a slight decline, dropping from 6th to 7th rank by February 2026, which could suggest an opportunity for Revel (CO) to close the gap. Meanwhile, Joyibles improved its rank from 7th to 6th, showcasing stronger sales momentum that Revel (CO) might need to counteract to maintain or improve its standing. Incredibles and Hedy remain static at 9th and 10th positions, respectively, posing less immediate threat to Revel (CO)'s rank. Overall, while Revel (CO) maintains a steady rank, the brand should strategize to leverage the slight declines and gains of its competitors to potentially advance in rank and increase market share.

Notable Products

In February 2026, Revel (CO) saw the THC/CBD/CBC 1:1:1 Relaxed Peach Lemonade Gummies 20-Pack rise to the top rank in sales, with a notable figure of 9963. This product has consistently improved, moving up from the second position in the previous months. The THC/CBG 2:1 Uplifted Mango Tangerine Gummies 10-Pack, previously holding the top spot, dropped to second place. The CBD/CBN/THC 1:1:1 Sleepy Strawberry Gummy 20-Pack maintained its steady third-place ranking throughout the months. Meanwhile, the Energetic Lemon Lime Gummy and THC-V/THC 1:2 Focus Grape Gummies retained their fourth and fifth positions respectively, showing consistent sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.