Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

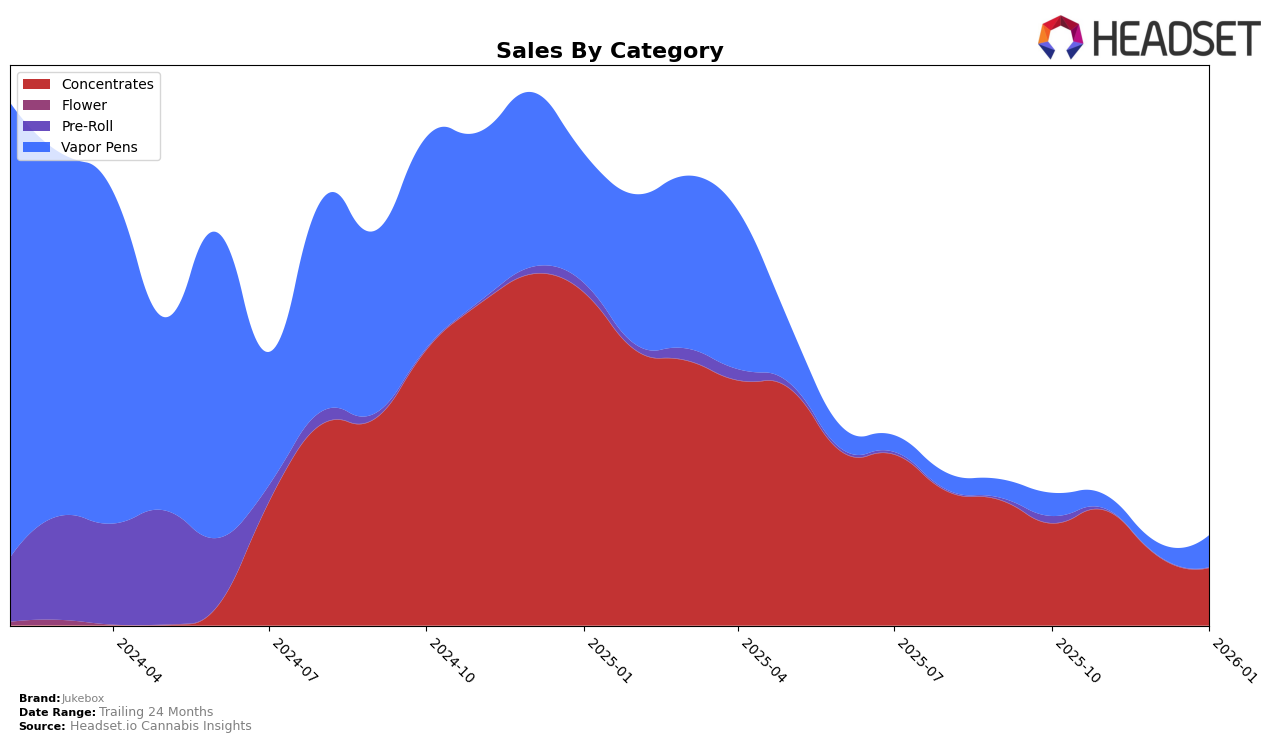

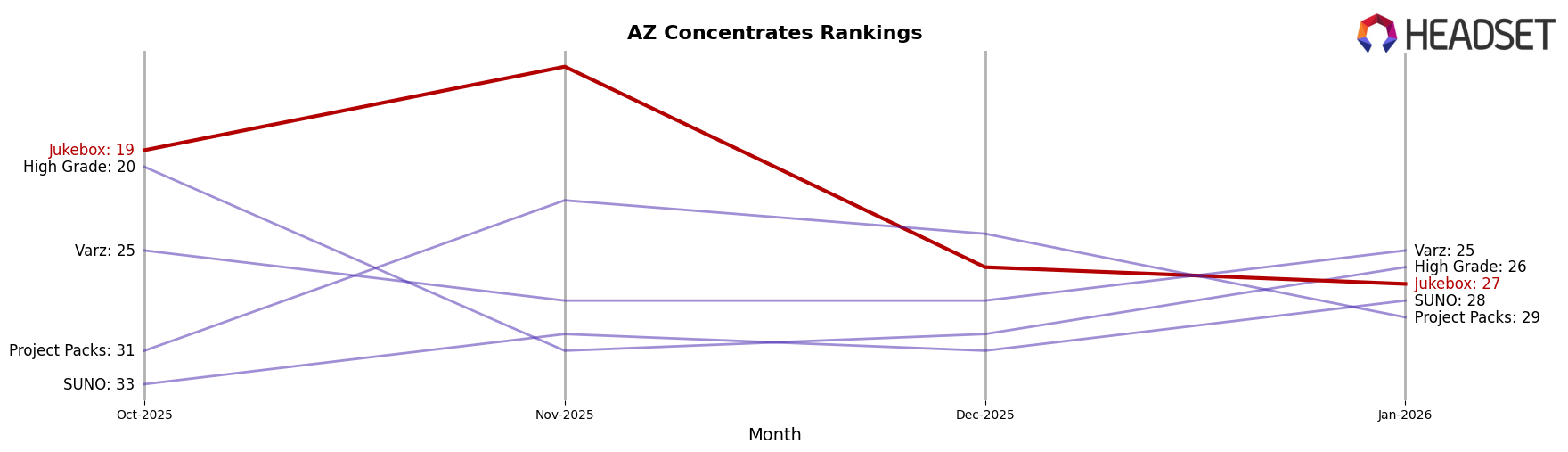

Jukebox has shown varied performance across different categories and states, reflecting a dynamic presence in the cannabis market. In the Arizona concentrates category, Jukebox experienced fluctuating rankings, moving from 19th in October 2025 to 27th by January 2026. This decline in ranking corresponds with a decrease in sales from $56,532 in October to $31,827 in January, pointing to a potential challenge in maintaining market share in this category. However, it's noteworthy that Jukebox maintained a presence in the top 30 throughout this period, indicating a consistent, albeit challenged, foothold in the concentrates market.

In contrast, Jukebox's performance in the vapor pens category in Arizona highlights a different trend. After not ranking in the top 30 for November and December 2025, Jukebox re-emerged in January 2026 at 54th place. This resurgence, along with an increase in sales from $12,686 in October to $17,612 in January, suggests a positive momentum and potential growth opportunity in the vapor pens sector. The brand's ability to re-enter the rankings after a temporary absence may indicate strategic adjustments or market conditions that favor their offerings in this category. Overall, Jukebox's performance across these categories reveals both challenges and opportunities, with room for strategic initiatives to bolster their market presence further.

Competitive Landscape

In the competitive landscape of the concentrates category in Arizona, Jukebox has experienced notable fluctuations in its ranking over the past few months. In October 2025, Jukebox was ranked 19th, showing a strong position compared to competitors like High Grade and Varz, who were ranked 20th and 25th, respectively. By November 2025, Jukebox improved its rank to 14th, surpassing Project Packs, which climbed to 22nd. However, Jukebox's rank slipped to 26th in December 2025 and further to 27th in January 2026, indicating a decline in its competitive edge. Despite this, Jukebox's sales remained relatively robust, particularly in November 2025, where it outperformed High Grade significantly. The data suggests that while Jukebox has faced challenges in maintaining its rank, its sales performance indicates potential for recovery and growth in the Arizona concentrates market.

Notable Products

In January 2026, Papaya Badder (1g) from Jukebox maintained its top position from December 2025, continuing to be the leading product in the Concentrates category with sales of 1017 units. Papaya Melonz Shatter (1g) emerged as the second best-selling product, marking its debut in the rankings. Super Boof Badder (1g) followed closely, securing the third position. Gastro Pop #4 Badder (1g), which was the top product in November 2025, slipped to fourth place. Island Lime Haze Distillate Cartridge (1g) rounded out the top five, indicating a strong performance in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.