Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

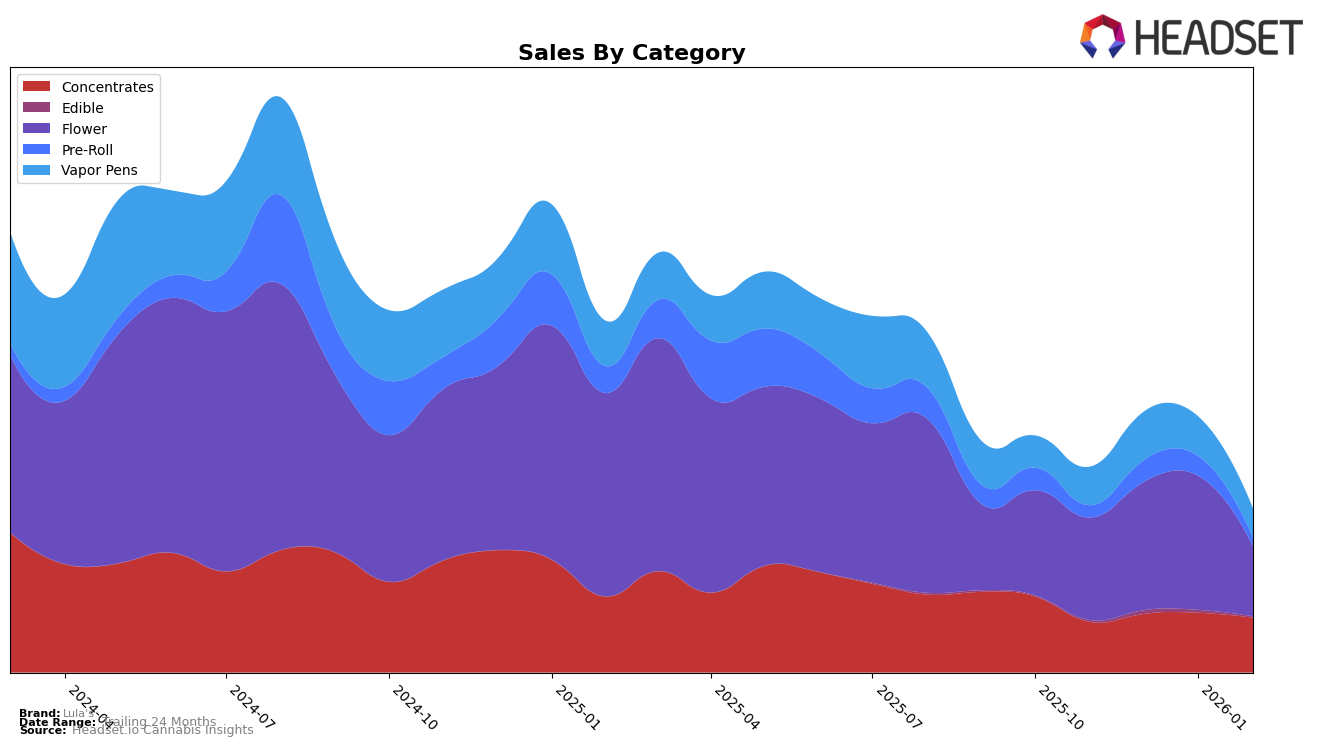

Lula's has shown a consistent performance in the Illinois market, particularly within the Concentrates category. The brand maintained a stable 7th position from December 2025 through February 2026, following a slight improvement from 9th place in November 2025. This steady ranking indicates a strong foothold in this category, with sales peaking in January 2026 before experiencing a slight dip in February. However, the performance in the Flower category tells a different story. Lula's slipped from the 29th position in January 2026 to 37th in February, indicating a potential challenge in maintaining competitiveness or possibly a strategic shift in focus away from this category.

In other categories, Lula's performance in Pre-Rolls and Vapor Pens in Illinois has been less consistent. The brand was unable to break into the top 30 for Pre-Rolls, with rankings fluctuating and ultimately falling to 53rd in February 2026. Similarly, Vapor Pens experienced a drop from a peak position of 37th in December 2025 to 48th by February 2026. These movements suggest potential volatility or a need for strategic adjustments to regain a stronger market presence in these categories. Despite these challenges, the brand's ability to maintain a top 10 position in Concentrates highlights a core strength that could be leveraged for future growth.

Competitive Landscape

In the competitive landscape of the Flower category in Illinois, Lula's has experienced notable fluctuations in its ranking and sales performance over the recent months. From November 2025 to February 2026, Lula's maintained a relatively stable position, ranking 30th in November and December, and 29th in January, before dropping to 37th in February. This decline in rank coincides with a significant drop in sales from January to February, suggesting potential challenges in maintaining market share. In contrast, Seed & Strain Cannabis Co. consistently ranked lower than Lula's, with a downward trend from 31st to 39th place, indicating a more severe sales decline. Meanwhile, In House showed a positive trajectory, improving its rank from 44th in November to 38th in February, which could signal a rising threat to Lula's market position. Additionally, Blaze Craft Cannabis Flower (IL) demonstrated a more stable performance, maintaining a rank close to Lula's, while (the) Essence showed a notable improvement, moving from 46th to 36th, suggesting a potential gain in consumer preference. These dynamics highlight the competitive pressures Lula's faces and underscore the importance of strategic initiatives to regain its competitive edge in the Illinois Flower market.

Notable Products

In February 2026, Lula's top-performing product was Miss Citron Pre-Roll (1g) in the Pre-Roll category, which climbed to the number one spot from its previous position at second in January, with notable sales reaching 2468 units. The Blackberry Lemonade Distillate Cartridge (0.5g) in the Vapor Pens category secured the second spot, although its sales decreased from January's 1773 units to 1368 units in February. Cherry Limeade Distillate Tank Cartridge (0.5g) emerged as a new entrant in the rankings at third place. Banana Drank Cured Budder (1g) and Bubble Gum Marker Cured Sauce (1g) in the Concentrates category rounded out the top five, ranking fourth and fifth respectively. These shifts suggest a dynamic market with consumers showing a strong preference for pre-rolls and vapor pens this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.