Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

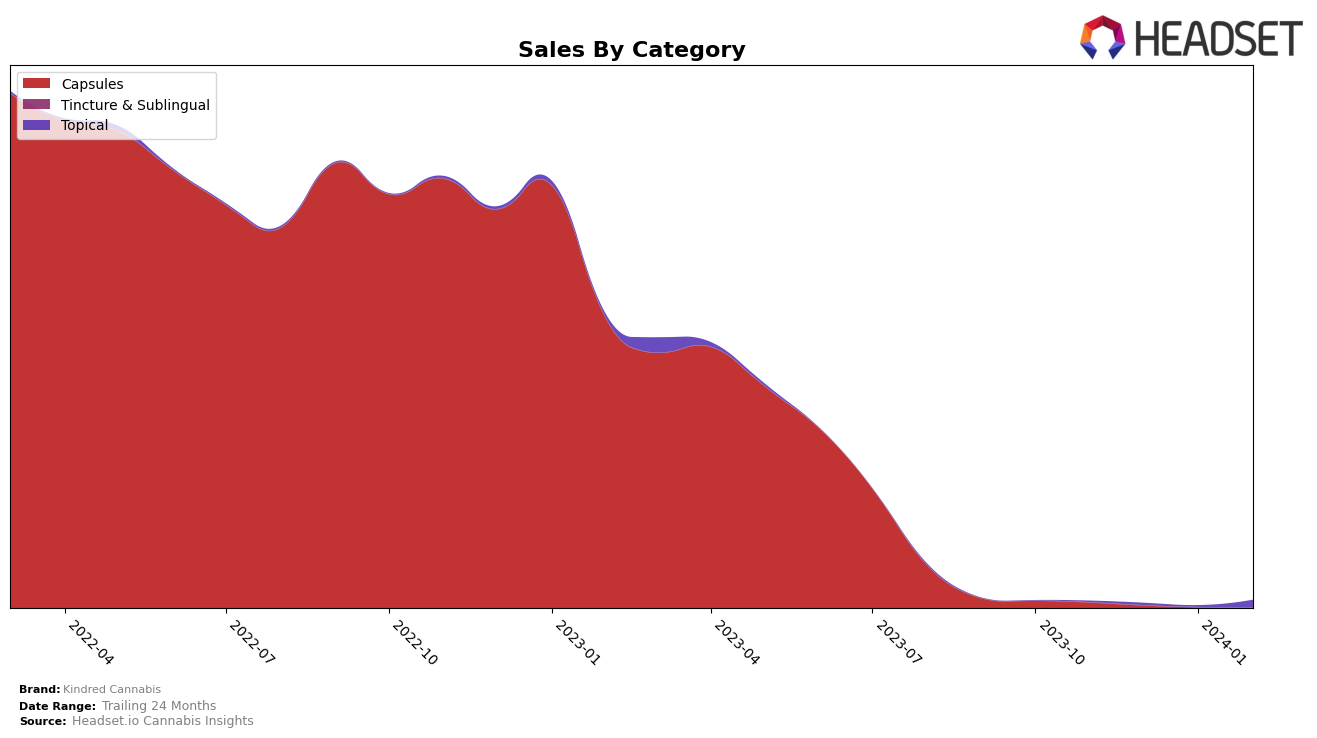

In the competitive cannabis market of Arizona, Kindred Cannabis has shown notable performance in specific categories, albeit with some fluctuations. In the Capsules category, the brand maintained a strong presence in the top 5 rankings during November and December of 2023, securing the 4th and 5th positions, respectively. However, their absence in the rankings for January and February of 2024 indicates a potential decline or shift in consumer preferences, which could be a point of concern. Sales figures reveal a significant drop from 1064 units in November to just 434 units in December, underscoring the volatility and competitive nature of the market. This trend suggests that while Kindred Cannabis had a strong foothold in the Capsules category, maintaining consistency in consumer demand poses a challenge.

On a more positive note, Kindred Cannabis has demonstrated impressive resilience and growth in the Topical category within the same Arizona market. Their ranking improved steadily from 14th place in November and December of 2023 to 9th place by February of 2024, indicating a strong upward trajectory. This improvement is further highlighted by a remarkable increase in sales from 234 units in November to an impressive 1502 units in February, showcasing a significant boost in consumer interest and market share. Such performance not only illustrates the brand's ability to adapt and grow but also underscores the potential for further expansion and dominance in this category. The consistent improvement in rankings and sales within the Topical category is a clear indicator of Kindred Cannabis's successful strategies and consumer appeal in this segment.

Competitive Landscape

In the competitive landscape of the topical cannabis market in Arizona, Kindred Cannabis has shown a notable upward trajectory in its rankings, moving from 14th place in November 2023 to 9th by February 2024. This rise is significant when compared to its competitors, such as OGEEZ which entered the rankings at 10th place in February 2024, and CBD Wellness, which experienced a slight decline from 8th to 11th place in the same period. Notably, Halo Infusions and DermaFreeze have maintained stable positions within the top 10, with Halo Infusions even showing a significant increase in sales. Kindred Cannabis's sales also saw a substantial increase in February 2024, indicating a growing consumer interest. This upward movement in both rank and sales for Kindred Cannabis suggests a strengthening position within Arizona's topical cannabis market, potentially challenging the dominance of established brands like Halo Infusions and DermaFreeze.

Notable Products

In February 2024, Kindred Cannabis saw CBD Intimacy Oil (300mg CBD) from the Topical category as its top-selling product, with a notable sales figure of 44 units, maintaining its number one rank from January. The product has shown a consistent performance, holding the top position for two consecutive months. The Capsules category had significant representation previously, but specific sales figures for February are missing, indicating a potential shift in consumer preference towards Topicals. Notably, CBD/THC 1:1 Sativa Mind Capsules 10-Pack and CBD:THC 1:1 Revelry Night Capsules 10-Pack, both from the Capsules category, did not continue their sales trend into February. This shift underscores a dynamic change in consumer demand within Kindred Cannabis's product range, with a clear preference emerging for CBD-focused Topical applications over Capsules.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.