Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

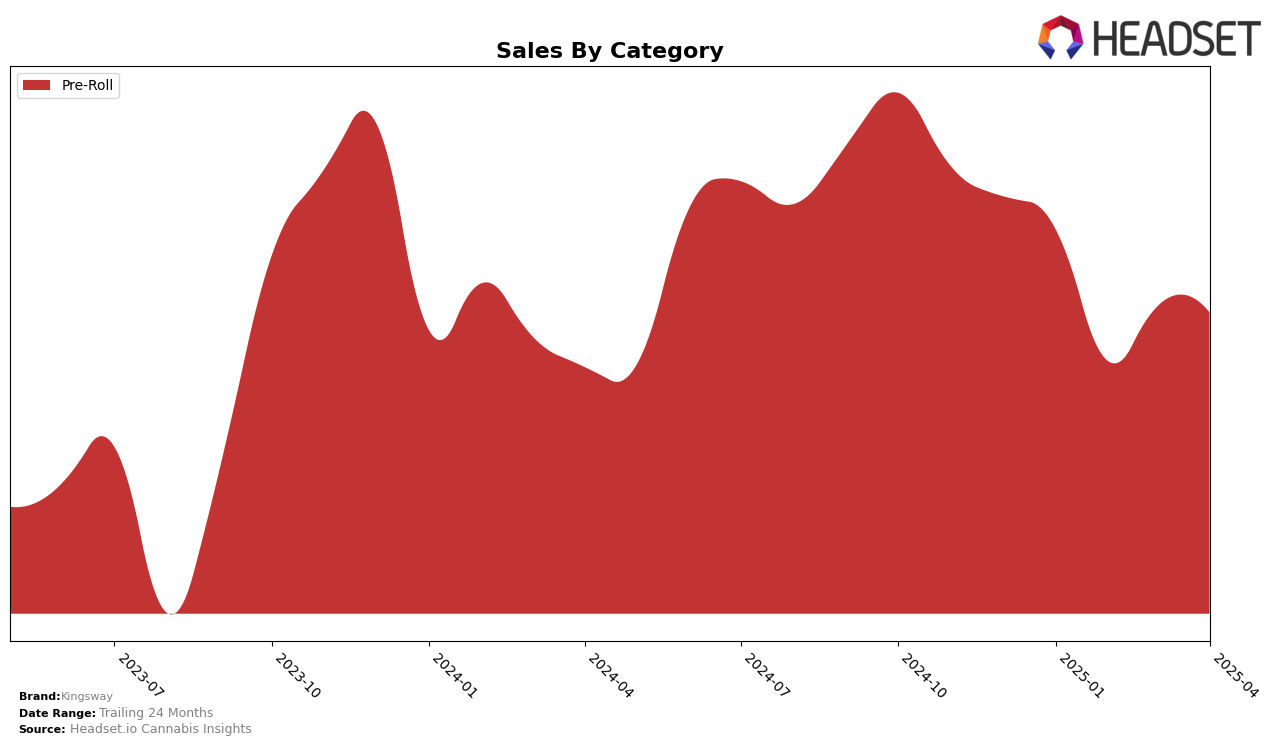

In British Columbia, Kingsway's performance in the Pre-Roll category has seen a downward trend in terms of rankings, slipping from 56th in January 2025 to 63rd by April 2025. Despite this decline in rank, there was a slight recovery in sales from March to April, indicating a potential stabilization or reversal of the downward trend. This could be an area to watch for future performance improvements, as maintaining or improving sales amidst a declining rank suggests a competitive market landscape. The fact that Kingsway did not make it into the top 30 brands in this category highlights the challenges faced in this region.

In contrast, Saskatchewan presents a different scenario for Kingsway, where the brand experienced a more volatile ranking movement within the Pre-Roll category. Starting the year strong at 12th position in January, Kingsway's rank dropped to 20th by April. This fluctuation is mirrored in the sales figures, which saw a notable decrease from January to April. The drop in rank and sales could be indicative of increased competition or shifts in consumer preferences within the province. The absence of Kingsway in the top 30 brands in other categories might suggest a focus or specialization in Pre-Rolls, but it also points to opportunities for diversification and growth in other product categories.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, Kingsway has shown a fluctuating performance in terms of rank and sales. Over the first four months of 2025, Kingsway's rank varied from 56th in January to 63rd in April, indicating a slight decline in its competitive standing. Despite this, Kingsway's sales figures showed a modest recovery in April after a dip in March. Comparatively, Tenzo maintained a relatively stable position, ranking between 51st and 61st, and consistently achieving higher sales than Kingsway. Meanwhile, Tweed and Virtue Cannabis both experienced lower sales, with Tweed's rank hovering in the 60s and Virtue Cannabis entering the top 20 only in April. Interestingly, Uncle Bob showed a significant jump in rank from 79th in January to 62nd in April, surpassing Kingsway in the latest month. These dynamics suggest that while Kingsway faces stiff competition, particularly from Tenzo, there are opportunities for growth if it can leverage its modest sales recovery and address the competitive pressures from emerging brands like Uncle Bob.

Notable Products

In April 2025, the top-performing product for Kingsway was the Split Shift Pre-Roll 14-Pack (7g) in the Pre-Roll category, maintaining its first-place rank for the fourth consecutive month with sales of 2871 units. The Dayshift High Pre-Roll 5-Pack (2.5g) secured the second position, consistent with its ranking from February and March, though it experienced a decrease in sales compared to March. The Nightshift Pre-Roll 5-Pack (2.5g) held steady in third place, showing a slight increase in sales from the previous month. The Kingsway Pre-Roll 7-Pack (3.5g) remained in fourth place, with a notable improvement in sales figures compared to March. Lastly, the Splitshift Pre-Roll 2-Pack (1g) continued to rank fifth, although its sales saw a decline over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.