Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

In British Columbia, Tenzo has shown a notable upward trajectory in the Flower category. Starting from a rank of 61 in October 2025, the brand climbed to 49 by January 2026, reflecting a consistent improvement in its market position. This positive movement is supported by increasing sales figures, with January 2026 sales reaching 75,787, indicating a growing consumer base. However, the Pre-Roll category tells a different story, as Tenzo was not in the top 30 rankings for October, November, or December 2025, only appearing at rank 96 in January 2026. This suggests that while Tenzo is gaining traction in Flower, there is significant room for improvement in Pre-Rolls within the British Columbia market.

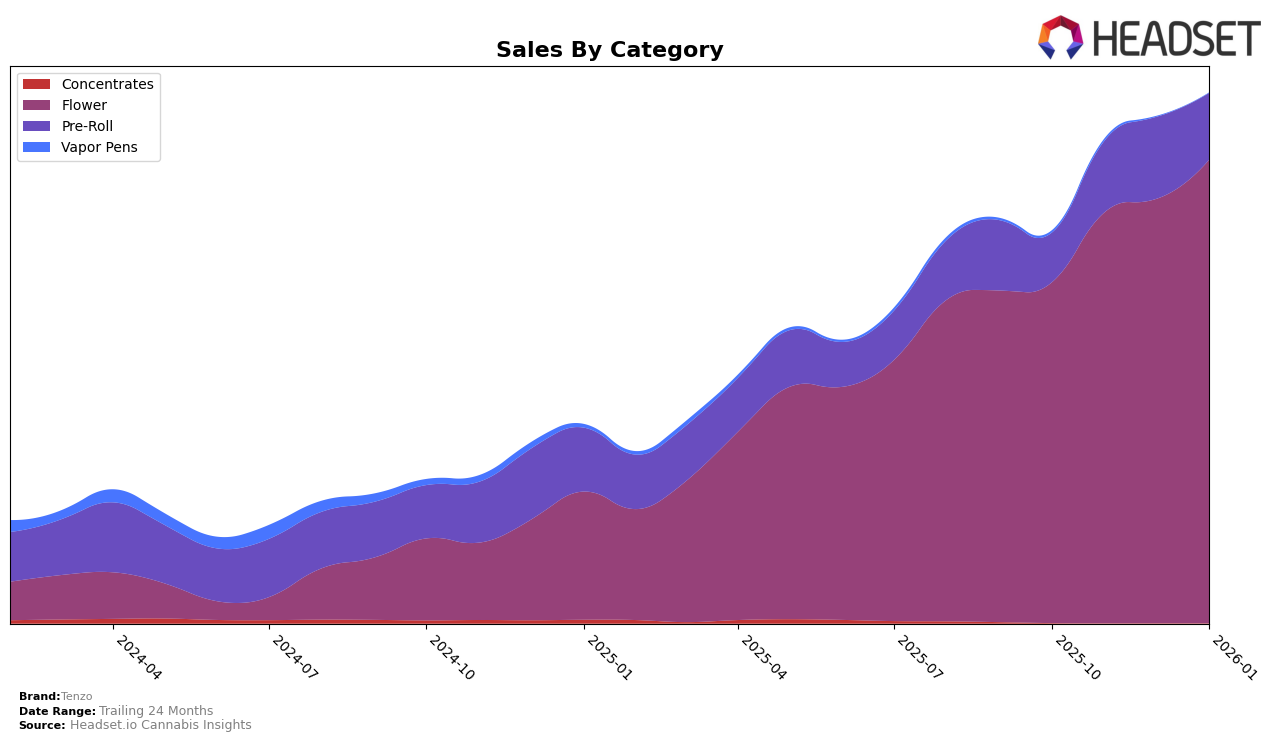

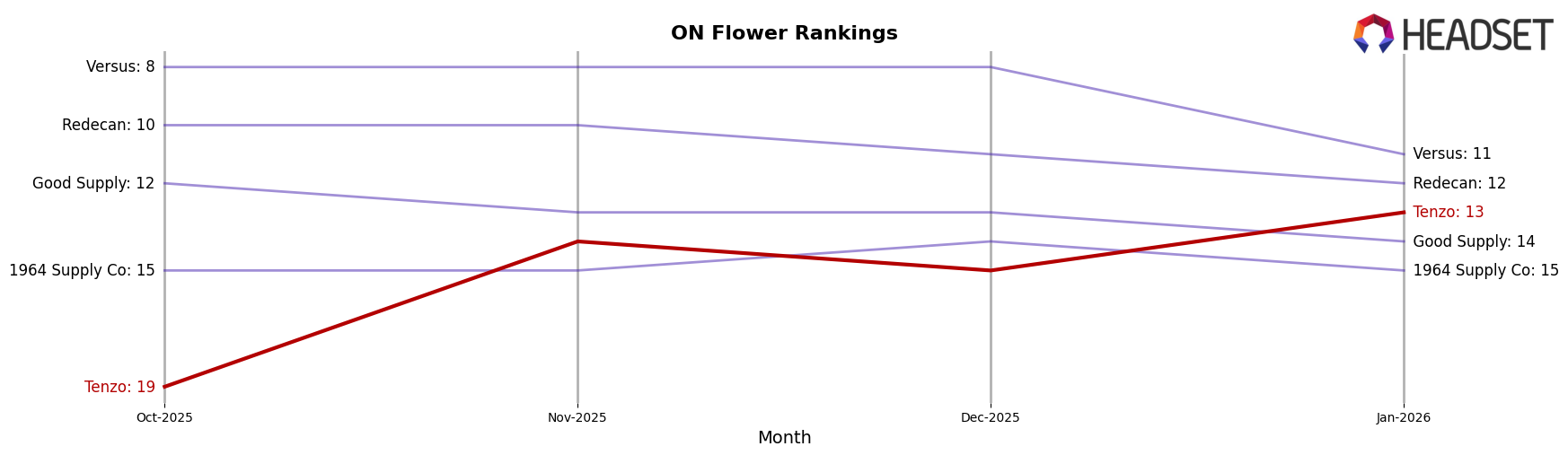

In Ontario, Tenzo has maintained a strong presence in the Flower category, consistently ranking within the top 20 brands. The brand improved from 19th position in October 2025 to 13th by January 2026, showcasing its solid footing and appeal in this category. The sales figures support this ranking, with a steady increase culminating in 1,436,035 in January 2026. Conversely, in the Pre-Roll category, Tenzo's performance has been less stable, with rankings fluctuating between 81 and 56 over the same period. Despite this, the brand has shown some potential for growth, as evidenced by its ability to maintain a presence within the top 100, pointing to opportunities for further expansion in Ontario's Pre-Roll market.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Tenzo has shown a notable upward trajectory in its rankings from October 2025 to January 2026. Starting from the 19th position in October, Tenzo climbed to the 13th spot by January, indicating a positive shift in market presence. This improvement is particularly significant when compared to competitors like 1964 Supply Co, which maintained a relatively stable position around the 14th and 15th ranks, and Good Supply, which experienced a slight decline from 12th to 14th. Meanwhile, Redecan and Versus saw a downward trend in their rankings, with Redecan dropping from 10th to 12th and Versus from 8th to 11th. This shift suggests that Tenzo's strategies may be effectively capturing market share from these established brands, as evidenced by its consistent sales growth over the same period, contrasting with the declining sales of some competitors.

Notable Products

In January 2026, Big Smallz (14g) emerged as the top-performing product for Tenzo, climbing to the number one spot with sales of 5745 units. Fun Trip Milled (7g), previously holding the top rank, moved to second place with a slight dip in sales to 5288 units. The Pink Passionfruit & Peach Infused Pre-Roll (0.5g) maintained its third position consistently over the last three months. Sweet Dreams (7g) showed significant improvement, moving up to fourth place from its fifth position in the previous two months. Meanwhile, 97 Octane Smalls (7g) saw a slight decline, dropping to fifth place from its fourth position in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.