Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

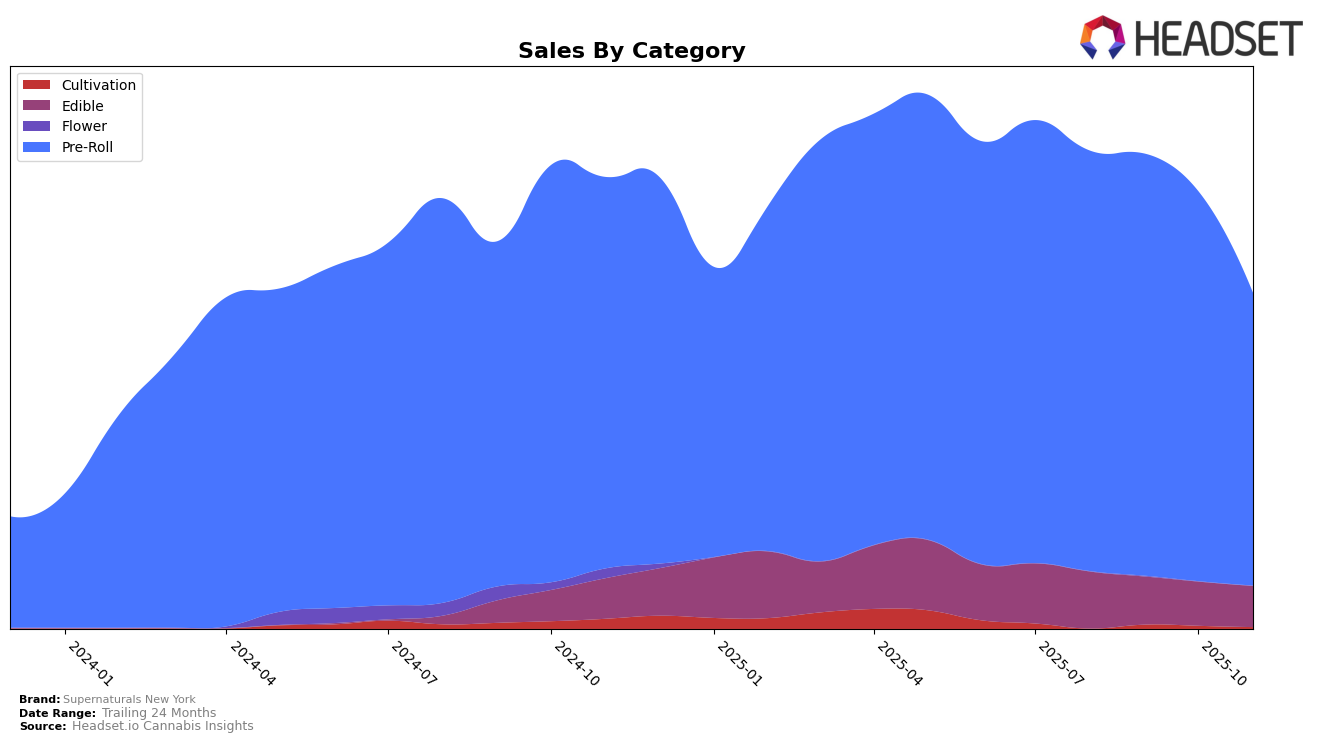

In New York, Supernaturals New York has shown varied performance across different product categories. In the Edible category, the brand has consistently remained outside the top 30 rankings from August to November 2025, indicating a challenging market presence. The ranking for Edibles has hovered around the 40th position, with a slight decline in sales from $51,286 in August to $36,878 in November. This downward trend suggests potential issues in consumer demand or increased competition in the Edible segment.

Conversely, the Pre-Roll category has seen more dynamic movements. Supernaturals New York was ranked 20th in August, improved to 17th in both September and October, but then fell to 28th by November. Despite a strong start, the decline in ranking and sales, which dropped from $381,023 in August to $264,558 in November, highlights a significant shift. This could be attributed to increased competition or changes in consumer preferences. The fluctuation in this category underscores the volatile nature of the cannabis market in New York.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in New York, Supernaturals New York has experienced notable fluctuations in its ranking, which could impact its market positioning and sales trajectory. While Supernaturals New York maintained a strong rank of 17th place in September and October 2025, it saw a significant drop to 28th place by November. This decline could be attributed to increased competition from brands like KOA Exotics, which improved its rank from 37th in September to 24th in October, although it slipped to 30th in November. Additionally, Electraleaf consistently hovered around the mid-20s, maintaining a steady presence that could siphon market share from Supernaturals New York. Meanwhile, Lowell Herb Co / Lowell Smokes showed a downward trend, falling out of the top 20 by October, which might present an opportunity for Supernaturals New York to reclaim its higher ranking if it can capitalize on this competitor's decline. Overall, the dynamic shifts in rankings highlight the competitive pressures Supernaturals New York faces and underscore the importance of strategic positioning to regain its footing in the market.

Notable Products

In November 2025, the top-performing product for Supernaturals New York was the Interspecies Erotica Pre-Roll 5-Pack (3.5g) in the Pre-Roll category, which climbed to the number one spot after maintaining second place for the previous two months. The Blue Dream Pre-Roll 2-Pack (1.5g) made a notable debut at rank two with sales of 1521 units. The Trop GMO Pre-Roll 2-Pack (1.5g) held steady at the third position, showing consistent performance across several months. Super Lemon Piss Pre-Roll 5-Pack (3.5g) improved its ranking to fourth, up from fifth in October. Meanwhile, the CBD/THC 1:1 Lifter Pre-Roll 2-Pack (1.5g) dropped to fifth place, experiencing a decline in sales compared to the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.