Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

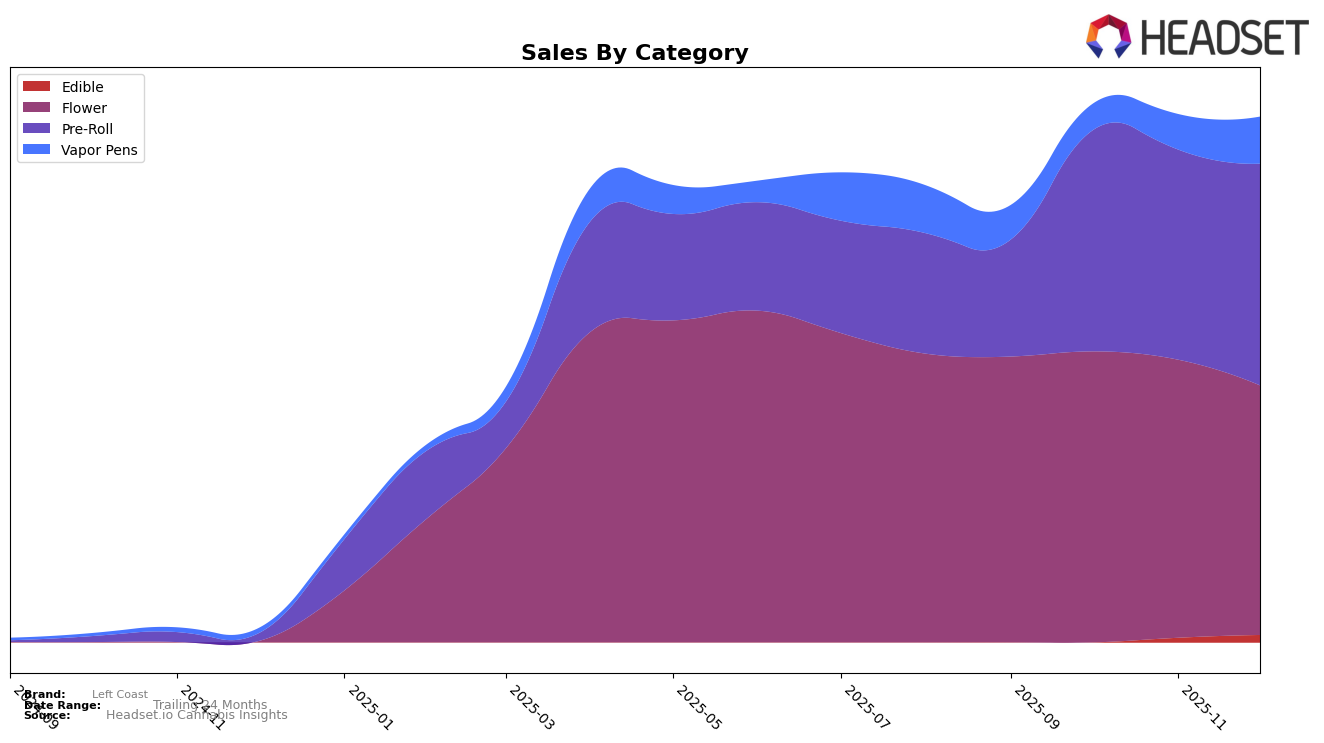

Left Coast has experienced varied performance across different product categories in New York. In the Flower category, the brand has seen a decline in its ranking, slipping from 30th in September 2025 to 37th by December 2025. This downward trend is concerning as it indicates that Left Coast is losing its competitive edge in this category. Meanwhile, the Pre-Roll category tells a more positive story, with the brand climbing from the 44th position in September to 26th by December. This upward trajectory suggests a growing consumer preference for Left Coast's Pre-Roll offerings.

In the Vapor Pens category, Left Coast's performance has been relatively stable, although the brand has not managed to break into the top 30 rankings, peaking at 69th place in December 2025. Despite this, there is a positive trend in sales figures, indicating that while the brand is not yet a leader in this category, there is potential for growth. The mixed results across these categories highlight the challenges and opportunities that Left Coast faces in the New York market, suggesting areas for strategic focus and potential expansion.

Competitive Landscape

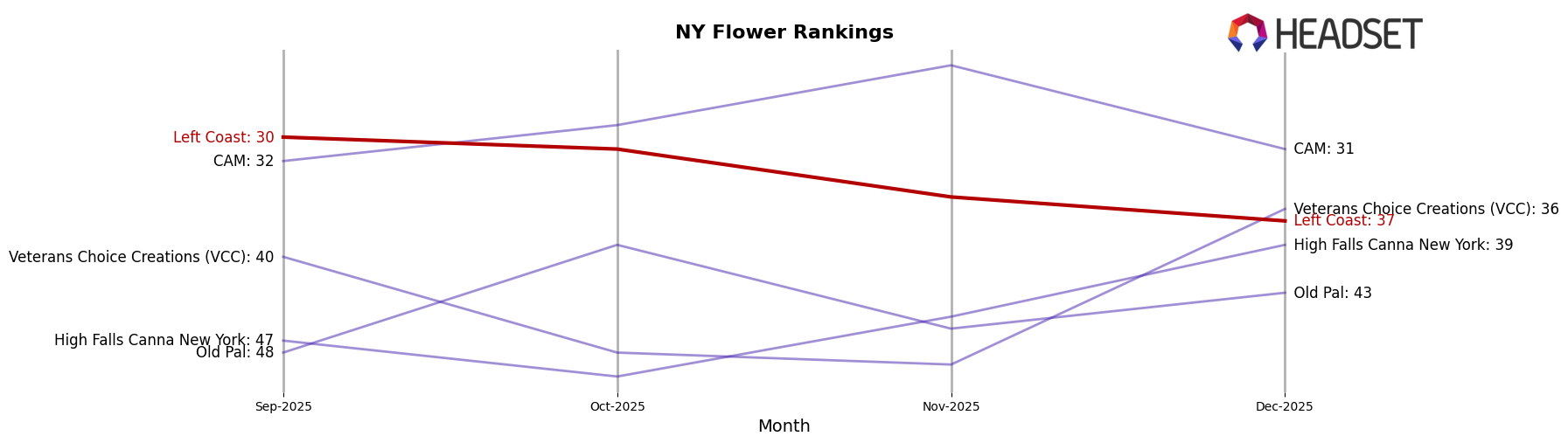

In the competitive landscape of the Flower category in New York, Left Coast has experienced a slight decline in its rank from September to December 2025, moving from 30th to 37th position. Despite this downward trend, Left Coast maintains a competitive edge in sales, with figures consistently higher than brands like Old Pal and High Falls Canna New York, which have fluctuated between ranks 39 to 50 during the same period. Meanwhile, CAM has shown a stronger performance, consistently ranking higher than Left Coast, peaking at 24th in November. The data suggests that while Left Coast's sales remain robust, the brand faces increasing competition from brands like CAM, which could be impacting its rank. This dynamic indicates a need for strategic marketing efforts to bolster Left Coast's position in the New York Flower market.

Notable Products

In December 2025, the top-performing product for Left Coast was Maui Waui Infused Pre-Roll (1g) in the Pre-Roll category, climbing to the number one spot with sales of 1383 units. Sour Diesel (3.5g) slipped to second place after maintaining the top rank for three consecutive months. Watermelon Mojito Infused Pre-Roll 5-Pack (3.75g) held a strong position at third, despite a slight drop in sales compared to November. Super Sour Diesel Diamond Infused Pre-ground (7g) saw a decline to fourth place, while White Widow (3.5g) maintained its fifth-place ranking from November. Notably, Maui Waui Infused Pre-Roll (1g) showed significant improvement, rising from fourth to first place over the last month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.