Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

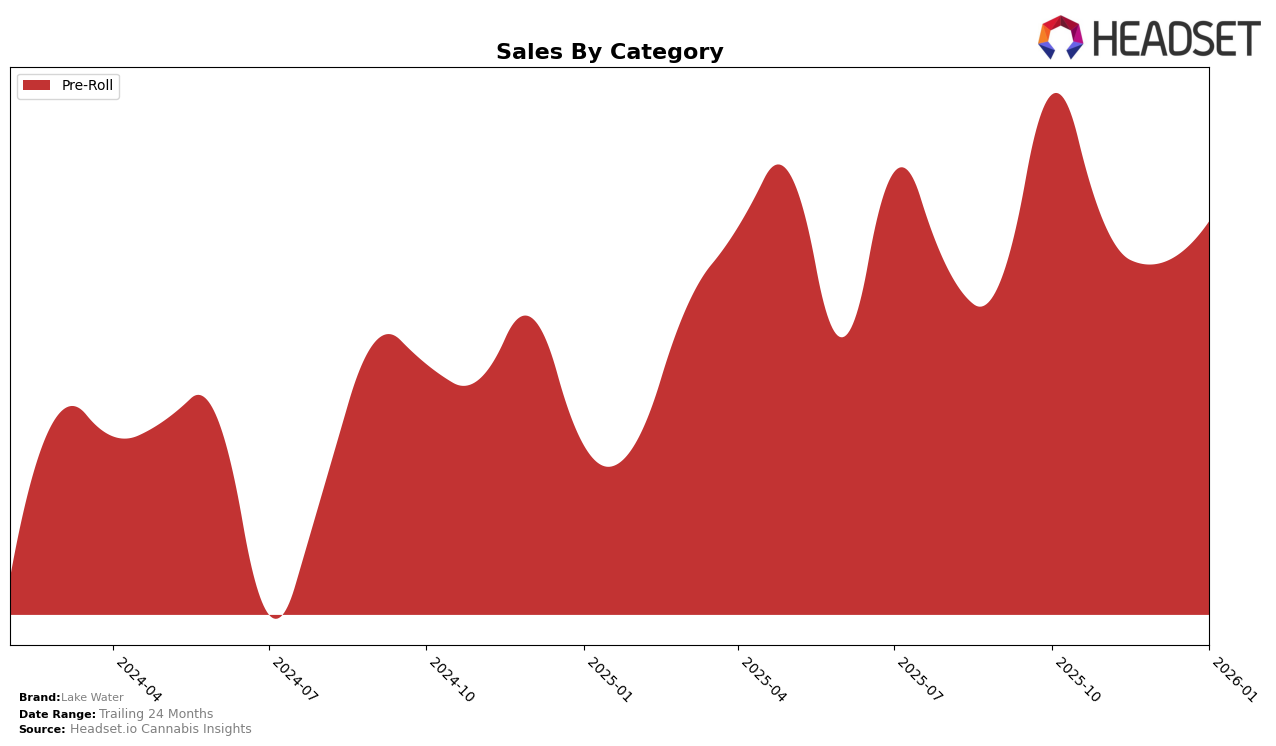

Lake Water has shown varied performance across different categories and states over recent months. In the Pre-Roll category in Missouri, the brand has experienced some fluctuations in its rankings. Starting from October 2025, Lake Water was ranked 26th, but by December, it had slipped to 31st, indicating a downward trend. However, in January 2026, the brand managed to climb back to the 30th position. This slight recovery in Missouri might suggest some strategic adjustments or market responses that helped regain a foothold, though the brand still faces challenges in maintaining a stronger presence in the top rankings.

Despite these ranking fluctuations, Lake Water's sales figures in Missouri have shown some resilience. While there was a notable decline from October to December 2025, with sales decreasing from $165,254 to $126,636, January 2026 saw an uptick to $136,448. This increase could be indicative of a seasonal trend or a successful promotional effort. However, the brand's inability to consistently stay within the top 30 in December highlights potential areas for improvement. Understanding the dynamics behind these movements could offer deeper insights into Lake Water's market strategy and consumer reception in Missouri's competitive cannabis landscape.

Competitive Landscape

In the competitive landscape of the Missouri pre-roll category, Lake Water has experienced a fluctuating position in the rankings, indicating a dynamic market presence. As of January 2026, Lake Water holds the 30th rank, showing a slight improvement from its 31st position in December 2025. Despite this, Lake Water faces stiff competition from brands like Sundro Cannabis, which consistently ranks higher, albeit with a downward trend from 23rd in October 2025 to 31st in January 2026. Meanwhile, Teal Cannabis and Kusch have shown more stable or improving ranks, with Teal Cannabis climbing from 39th in October 2025 to 32nd in January 2026. Despite Lake Water's sales dip in December 2025, its January 2026 sales indicate a recovery, suggesting potential for upward momentum if strategic adjustments are made to counteract the competitive pressures from these brands.

Notable Products

In January 2026, Lake Water's top-performing product was the Lake Water Pre-Roll (1g), maintaining its number one rank for the fourth consecutive month with sales of 18,882 units. The Lake Water Trim Pre-Roll (1g) also held steady at the second position, showing a slight increase in sales compared to previous months. The Lake Water Pre-Roll 5-Pack (5g) remained consistent in third place, while the Hybrid Blend Pre-Roll (1g) continued to rank fourth. Notably, all products retained their rankings from the prior three months, indicating stable consumer preferences for Lake Water's pre-roll offerings. This consistency in rankings suggests a strong brand loyalty and market presence for Lake Water's pre-roll products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.