Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

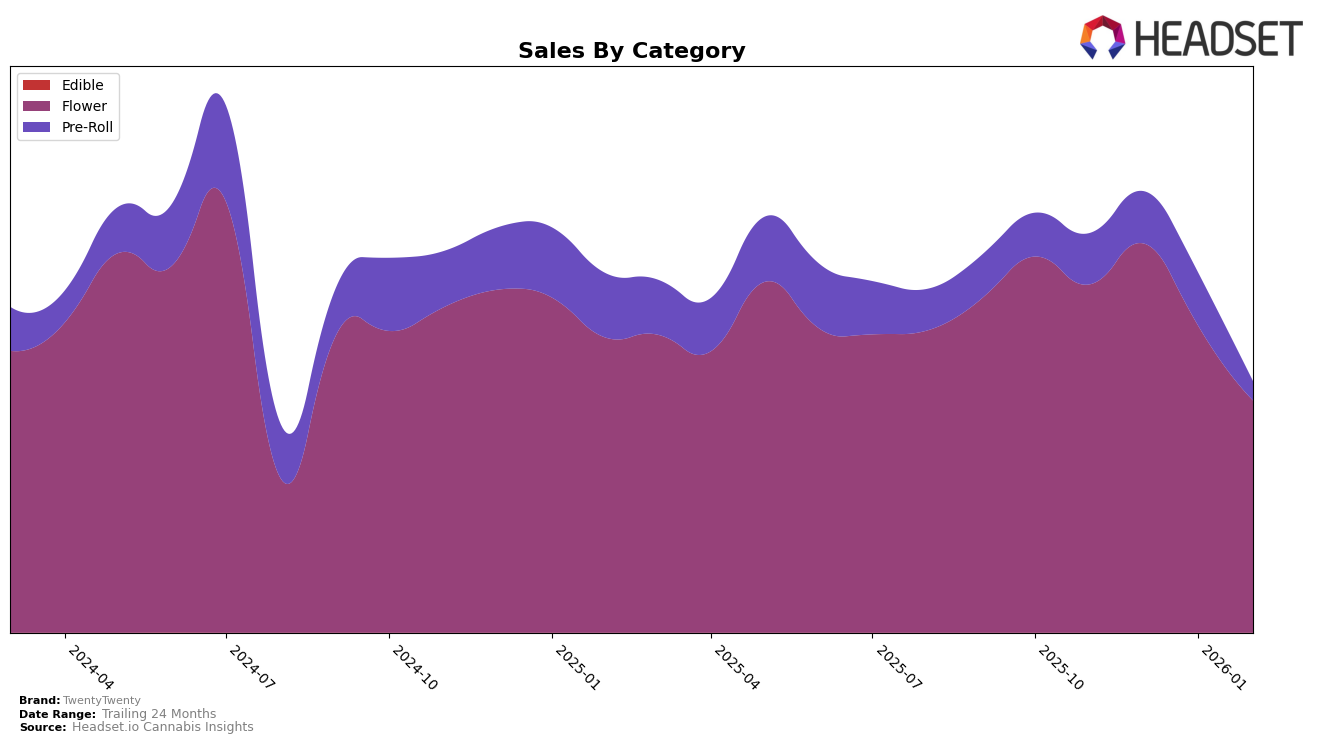

In the state of Illinois, TwentyTwenty has experienced a decline in their rankings across both the Flower and Pre-Roll categories. Specifically, in the Flower category, they dropped from the 29th position in November 2025 to the 50th position by February 2026. This downward trend is mirrored in the Pre-Roll category, where they were not even ranked in the top 30 by February 2026, having fallen from the 36th position in November 2025. The declining sales figures in Illinois, particularly for Flower, which saw a significant drop from $432,271 in November to $152,147 by February, highlight the challenges TwentyTwenty is facing in maintaining its market position in this state.

Conversely, in Missouri, TwentyTwenty has shown more stability, particularly in the Flower category, where they maintained a relatively stable ranking, hovering around the 15th to 16th positions from November 2025 through February 2026. Despite a decrease in sales from $1,026,074 in November to $818,443 in February, they managed to maintain their rank, indicating a steady demand relative to their competitors. However, in the Pre-Roll category, TwentyTwenty experienced a significant drop in ranking from 28th in November to 45th by February 2026, along with a notable decline in sales, suggesting a need for strategic adjustments to regain competitiveness in this segment within Missouri.

Competitive Landscape

In the competitive landscape of the Missouri Flower category, TwentyTwenty has experienced some fluctuations in rank and sales over the recent months. As of February 2026, TwentyTwenty is ranked 16th, a slight decline from its 14th position in December 2025. This shift is notable as competitors like Proper Cannabis and Nugz (MO) have maintained higher rankings, with Proper Cannabis holding the 14th spot and Nugz (MO) at 15th in February 2026. Despite TwentyTwenty's sales peaking in December 2025, they have since decreased, aligning with its drop in rank. Meanwhile, Packs Cannabis (MO) has shown resilience, staying close to TwentyTwenty in rank, while Vertical (MO) has made significant strides, climbing from 36th in November 2025 to 18th by February 2026. These dynamics suggest that while TwentyTwenty remains a key player, it faces stiff competition and must strategize to regain its earlier momentum in the Missouri market.

Notable Products

In February 2026, the top-performing product for TwentyTwenty was Deep Fried Runtz (3.5g), which climbed to the number one position with sales of 2873 units. Hash Burger (3.5g) followed closely, securing the second spot, having maintained a strong presence in the top three since November 2025. Heir Heads (3.5g) made its debut in the rankings, achieving a notable third place. Applescotti (3.5g) also entered the rankings for the first time, capturing the fourth position. Deep Fried Runtz Shake (7g), which led in December 2025, fell to fifth place, indicating a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.