Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

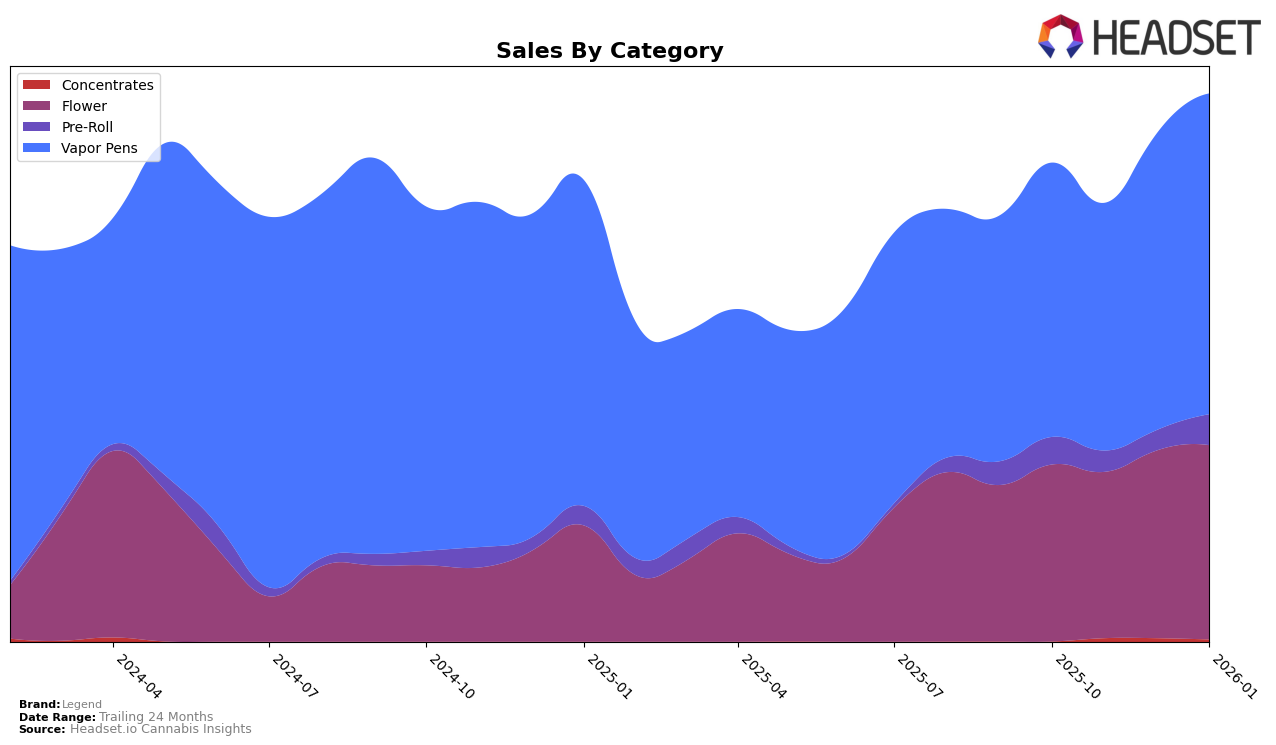

Legend's performance in the Maryland market has shown notable consistency and some positive trends across categories. In the Flower category, Legend maintained a stable presence, ranking at 20th place in both December 2025 and January 2026, despite a slight dip in November. This indicates a resilience in their Flower offerings, with January sales reaching $678,460, showcasing a recovery from the previous month's dip. In contrast, their Vapor Pens in Maryland displayed a more dynamic movement, climbing from 30th in October 2025 to 25th by December and January. The fluctuation in sales, with a peak in December, suggests a growing consumer interest in their vapor products.

In New Jersey, Legend's performance varied across different categories, with some standout achievements. The brand's Vapor Pens consistently held the 2nd rank from October 2025 to January 2026, underscoring their dominance in this category, with sales peaking at nearly $2.35 million in January. This consistency highlights a strong consumer preference for Legend's vapor products in New Jersey. Meanwhile, in the Flower category, Legend improved its ranking slightly from 19th in October to 17th in December, before settling at 18th in January, indicating a stable yet competitive position. The Pre-Roll category saw more volatility, with a notable rebound to 18th place in January after slipping to 27th in December, suggesting a successful recovery strategy or promotional effort during that period.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, Legend consistently holds the second rank from October 2025 to January 2026. Despite a slight dip in sales from October to November, Legend experienced a robust recovery with a significant increase in sales by January 2026. This resilience is noteworthy, especially when compared to the top competitor, Fernway, which maintains a firm grip on the first position with consistently higher sales figures. Meanwhile, Simply Herb and RYTHM hold steady in third and fourth positions, respectively, with Simply Herb showing a temporary spike in December. Legend's ability to sustain its rank amidst these competitors highlights its strong market presence and potential for further growth, suggesting a promising trajectory in the New Jersey vapor pen market.

Notable Products

In January 2026, the top-performing product from Legend was the Blueberry Muffin BDT Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank from the previous month with impressive sales of 4,199 units. The Sour Diesel Pre-Roll (1g) debuted strongly in the Pre-Roll category, securing the second position with significant sales figures. The Apple Fizz BDT Distillate Cartridge (1g) entered the rankings at third place in the Vapor Pens category. The Wild Cherry Distillate Cartridge (1g) climbed back to fourth position after being unranked in December 2025. Lastly, the Peach Ringz Natural Terpene Distillate Cartridge (1g) held steady at the fifth spot, showing consistent performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.