Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

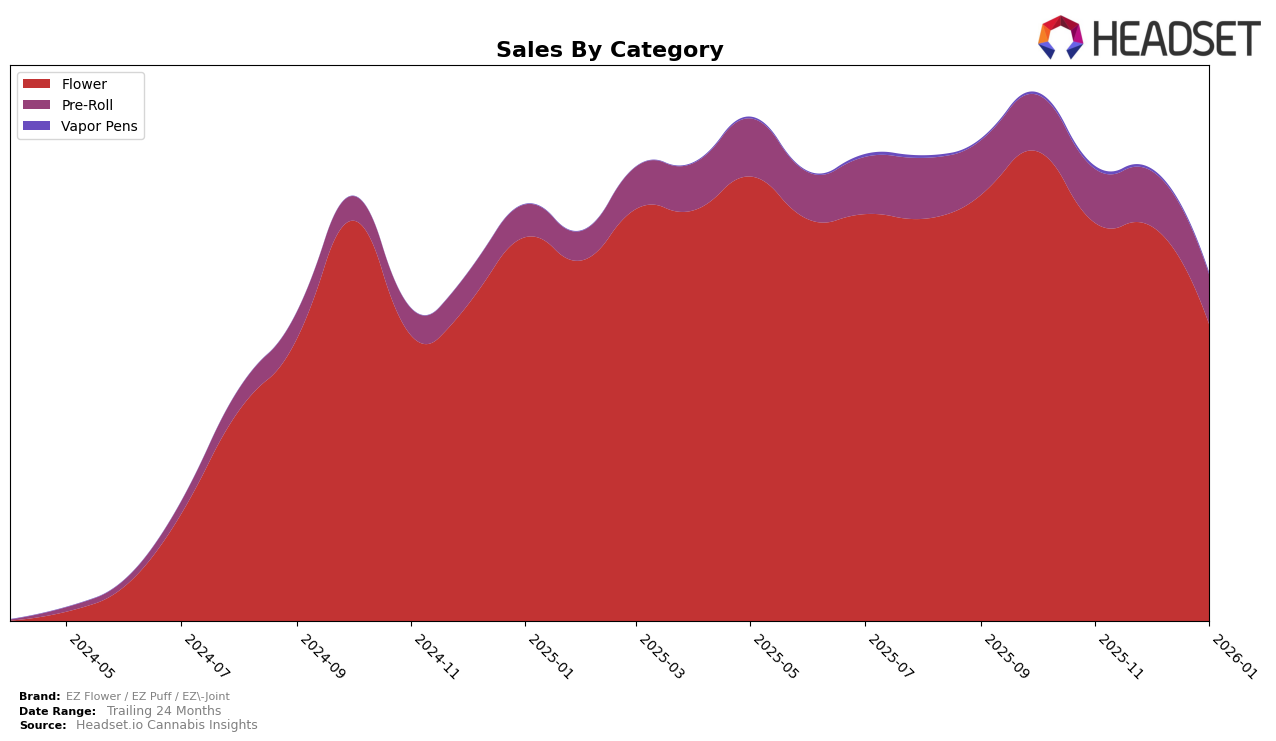

In the Washington market, EZ Flower / EZ Puff / EZ-Joint has demonstrated notable consistency in the Flower category, maintaining a solid ranking of 4th place from October through December 2025. However, a dip to 7th place in January 2026 suggests a potential shift in consumer preferences or increased competition. Despite this decline, the brand's Flower sales remained relatively robust, although there was a marked decrease from October to January. This trend might indicate seasonal fluctuations or strategic changes within the brand that could be impacting its market position.

In contrast, the brand's performance in the Pre-Roll category within Washington has been less prominent, with rankings hovering around 39th to 42nd place during the same period. This consistent lower-tier ranking suggests that while EZ Flower / EZ Puff / EZ-Joint has a strong foothold in the Flower category, it faces challenges in gaining similar traction with Pre-Rolls. The sales figures reflect a slight decline over the months, which could be indicative of broader market trends or a need for the brand to innovate or reposition its offerings in this category. Understanding these dynamics could be crucial for stakeholders looking to optimize their product strategies across different segments.

Competitive Landscape

In the competitive landscape of the Washington flower category, EZ Flower / EZ Puff / EZ-Joint has experienced a notable shift in its market position from October 2025 to January 2026. Initially holding a strong 4th place, the brand saw a decline to 7th by January 2026, indicating a potential challenge in maintaining its competitive edge. This change in rank is significant when compared to competitors like Lifted Cannabis Co, which consistently held a top position, moving from 6th to 5th place over the same period. Meanwhile, Sweetwater Farms and Viking Cannabis have shown upward momentum, with Sweetwater Farms climbing from 14th to 6th and Viking Cannabis maintaining a strong presence within the top 10. The sales figures for EZ Flower / EZ Puff / EZ-Joint also reflect this downward trend, with a notable decrease from October to January, contrasting with the sales growth seen by Sweetwater Farms. This competitive analysis suggests that while EZ Flower / EZ Puff / EZ-Joint was once a frontrunner, it faces increasing pressure from rising brands in the Washington flower market.

Notable Products

In January 2026, EZ Flower / EZ Puff / EZ-Joint's top-performing product was Georgia Pie (3.5g) in the Flower category, maintaining its number one rank from December 2025, despite a decrease in sales to 1476 units. Cookie Kush (3.5g) emerged as a strong contender, debuting at the second position with notable sales figures. Northern Lights Infused Pre-Roll (1g) climbed to third place, improving from its fifth-place rank in November 2025. Durban Cookies (3.5g) secured the fourth spot, while Wedding Cake Infused Pre-Roll (1g) rounded out the top five. This mix of Flower and Pre-Roll products highlights a shift in consumer preferences towards a variety of cannabis consumption methods.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.