Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

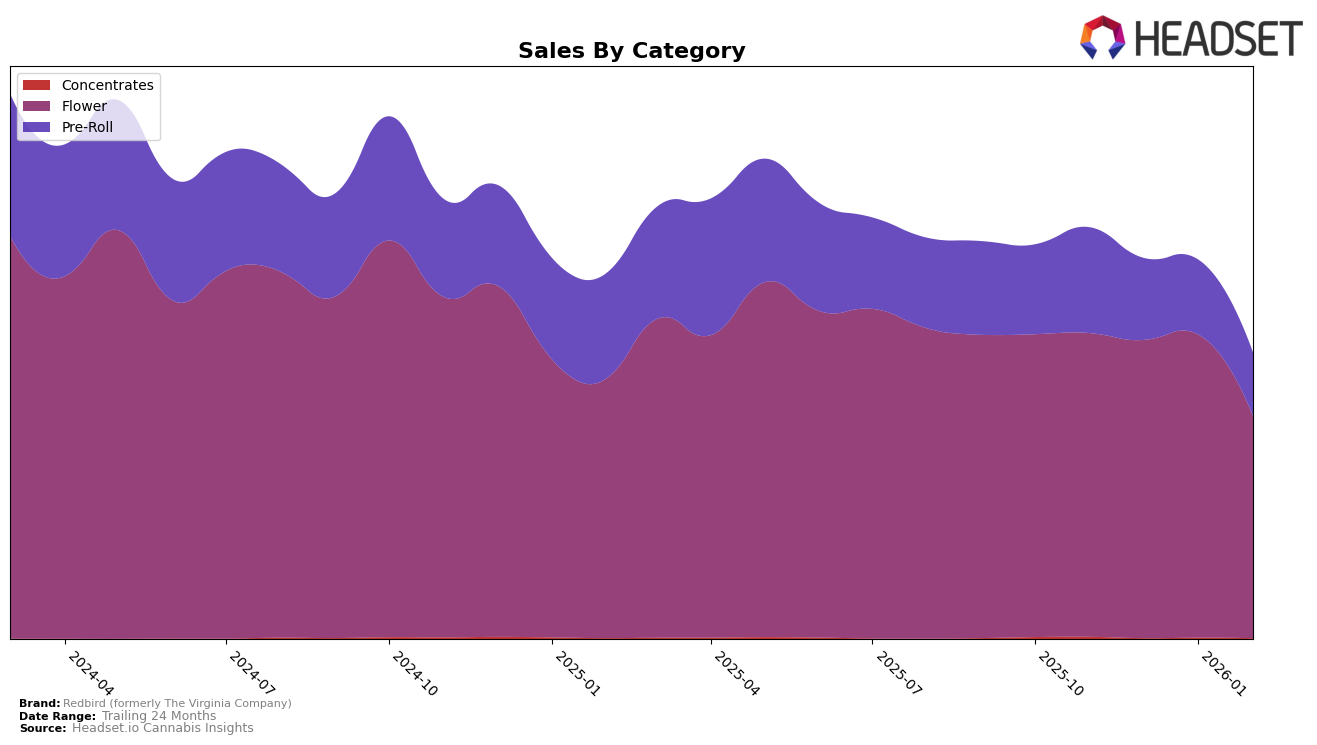

Redbird, previously known as The Virginia Company, has shown notable performance fluctuations across different product categories and states. In the Washington market, their Flower category has consistently maintained a strong presence, with rankings moving from 5th place in November and December 2025 to 4th in January 2026. However, February 2026 saw a decline to 10th place, indicating potential challenges or increased competition. Despite this dip, the brand's Flower sales remained robust, though there was a noticeable drop in sales volume in February. Such movements suggest a dynamic market environment where Redbird's Flower products have generally performed well, but they face occasional hurdles that impact their ranking.

In contrast, Redbird's performance in the Pre-Roll category in Washington has been less stable, with their rankings fluctuating widely. Starting at 19th place in November 2025, the brand slipped to 25th in December and slightly improved to 24th in January 2026, before dropping to 28th in February. This downward trend highlights the competitive nature of the Pre-Roll segment, where Redbird struggles to maintain a consistent top-tier position. The absence of a top 30 ranking in some months could indicate either a strategic shift away from this category or the need for a more aggressive market approach to regain traction. These insights emphasize the importance of adaptive strategies in maintaining brand strength across various product lines and geographical markets.

Competitive Landscape

In the competitive landscape of the Washington flower category, Redbird (formerly The Virginia Company) has experienced notable fluctuations in its market position over recent months. Despite maintaining a strong start with a consistent 5th place rank in November and December 2025, Redbird climbed to 4th place in January 2026, showcasing its potential for upward momentum. However, by February 2026, the brand experienced a significant drop to 10th place, indicating potential challenges in sustaining its growth. This shift is particularly notable when compared to competitors such as Torus, which improved its rank from 11th in November 2025 to 8th in February 2026, and Viking Cannabis, which consistently hovered around the 7th to 9th positions. Meanwhile, Artizen Cannabis remained relatively stable, despite a slight dip in rank. These dynamics suggest that while Redbird has demonstrated the ability to ascend in rank, maintaining that position amidst strong competition remains a challenge, potentially impacting its sales trajectory in the long term.

Notable Products

In February 2026, Chocolate Bars (3.5g) emerged as the top-performing product for Redbird (formerly The Virginia Company), leading the sales with a notable rank improvement from third place in January 2026. Raspberry Dosido (3.5g) secured the second position, maintaining a consistent presence in the top ranks, although its sales figure slightly decreased to 902 units. Ice Cream Cake (3.5g) also demonstrated strong performance, climbing to the third rank from being unranked in January. Acai Gelato (3.5g) and Collison Kush (3.5g) rounded out the top five, marking their first appearance in the rankings. This shift indicates a dynamic change in consumer preferences within the Flower category for Redbird.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.