Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

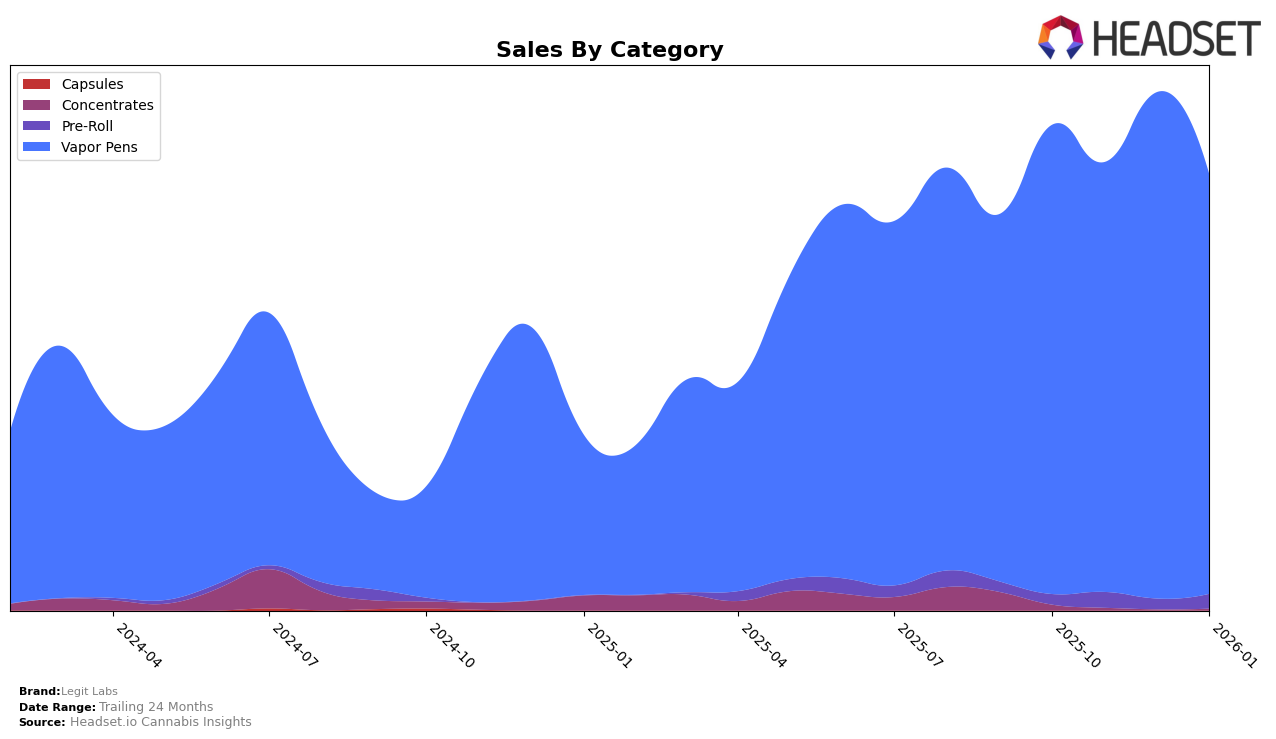

Legit Labs has shown a consistent presence in the Vapor Pens category in Michigan. Over the past few months, their ranking has fluctuated slightly, moving from 23rd in October 2025 to 25th by January 2026. Despite this minor decline in rank, it is notable that Legit Labs has maintained a position within the top 30, indicating a stable foothold in this competitive category. The sales figures reflect a similar pattern, with a peak in December 2025 followed by a slight dip in January 2026. This suggests that while there is some variability in monthly performance, Legit Labs continues to be a relevant player in Michigan's Vapor Pens market.

The data does not indicate Legit Labs' presence in the top 30 brands for other states or categories, which could be a point of concern or an area for potential growth. The absence from top rankings in other regions or product categories may highlight opportunities for Legit Labs to expand its market reach or diversify its product offerings. However, their consistent performance in Michigan's Vapor Pens category suggests a strong brand loyalty or product appeal that could be leveraged in new markets. Understanding the factors driving their success in Michigan could provide insights for strategic expansion or improvement in other areas.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Legit Labs has experienced fluctuating rankings from October 2025 to January 2026, indicating a dynamic market presence. While Legit Labs maintained a relatively stable position, ranking between 23rd and 25th, it faced competition from brands like Batch Extracts, which saw a decline from 18th to 26th, and Redemption, which improved its rank from 30th to 23rd. Notably, Humblebee showed a positive trend, advancing from 28th to 24th, while Party Favors made significant strides, climbing from 42nd to 28th. Despite these shifts, Legit Labs' sales peaked in December 2025, suggesting a strong market response during that period, although the subsequent decline in January 2026 indicates potential challenges in sustaining momentum. Understanding these trends can provide valuable insights for strategic positioning and growth opportunities within the Michigan vapor pen market.

Notable Products

In January 2026, Legit Labs saw the Caramel Apple Gelato Cured Resin Cartridge (1g) top the sales rankings, securing the first position with a notable sales figure of 1665 units. The Mac #1 Live Resin Cartridge (1g) followed closely in second place, while the Lemon Cherry Gelato Live Resin Cartridge (1g) took the third spot. The Peach Pie Live Resin Cartridge (1g) maintained its fourth position from December 2025, showing consistent performance. The White Runtz x Snowman Live Resin Post-Less Disposable (1g) rounded out the top five, marking its debut in the rankings this month. These rankings indicate a strong preference for vapor pens among consumers, with some products rising in popularity over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.