Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

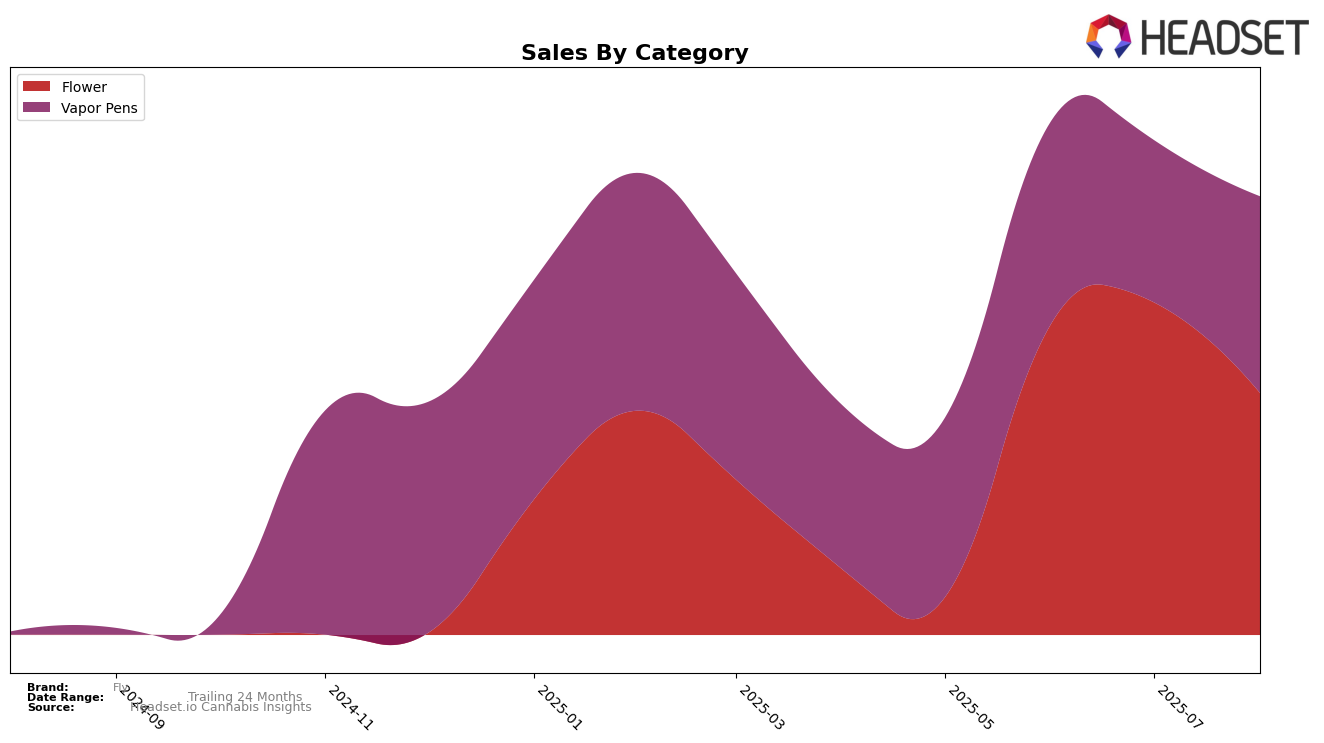

In the state of Michigan, Fly's performance in the Flower category has seen some fluctuations over the summer months. Notably, Fly did not make it to the top 30 brands in May, which could be a concern for stakeholders. However, the brand showed some recovery by securing the 44th rank in June and improving slightly to the 39th position in July, before dropping again to 63rd in August. This inconsistent performance might suggest challenges in maintaining a steady market presence in the Flower category, possibly due to increased competition or shifts in consumer preferences.

In contrast, Fly's presence in the Vapor Pens category in Michigan has been relatively more stable. Starting at the 23rd position in May, Fly managed to hold its position around the top 30, ranking 21st in June, 31st in July, and improving to 26th in August. This indicates a more resilient demand or effective marketing strategies in the Vapor Pens category compared to Flower. The brand's ability to remain consistently within the top 30 suggests a stronger foothold and possibly a more loyal customer base in this segment.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Fly has experienced notable fluctuations in its rank and sales over the summer of 2025. Fly achieved its highest rank in July 2025 at 39th, but by August, it had dropped to 63rd, indicating a significant decline in its market position. This volatility contrasts with competitors like Peninsula Cannabis, which maintained a relatively stable presence, ranking between 47th and 60th over the same period. Meanwhile, Rkive Cannabis and Giving Tree Gardens showed sporadic appearances in the top 100, with Rkive Cannabis re-entering at 74th in August after missing the top 20 in June and July. Bamn also demonstrated upward momentum, climbing from 75th in July to 61st in August. Fly's sales mirrored its ranking trends, peaking in July before a downturn in August, suggesting the brand may need to reassess its strategies to regain its competitive edge in the Michigan market.

Notable Products

In August 2025, Fly's top-performing product was the Cereal Milk Distillate Cartridge (1g) in the Vapor Pens category, reclaiming its number one position with sales reaching 8,946 units. The Forbidden Fruit Distillate Cartridge (1g) showed a significant jump to the second position, having not been ranked in June, with notable sales of 7,642 units. Gelato Distillate Cartridge (1g) maintained a steady presence, ranking third, consistent with its performance from July. Cherry Zkittles Distillate Cartridge (1g) held its ground in fourth place, continuing its gradual rise since May. The Cookies & Chem (3.5g) flower product entered the rankings at fifth, indicating a strong debut in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.