Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

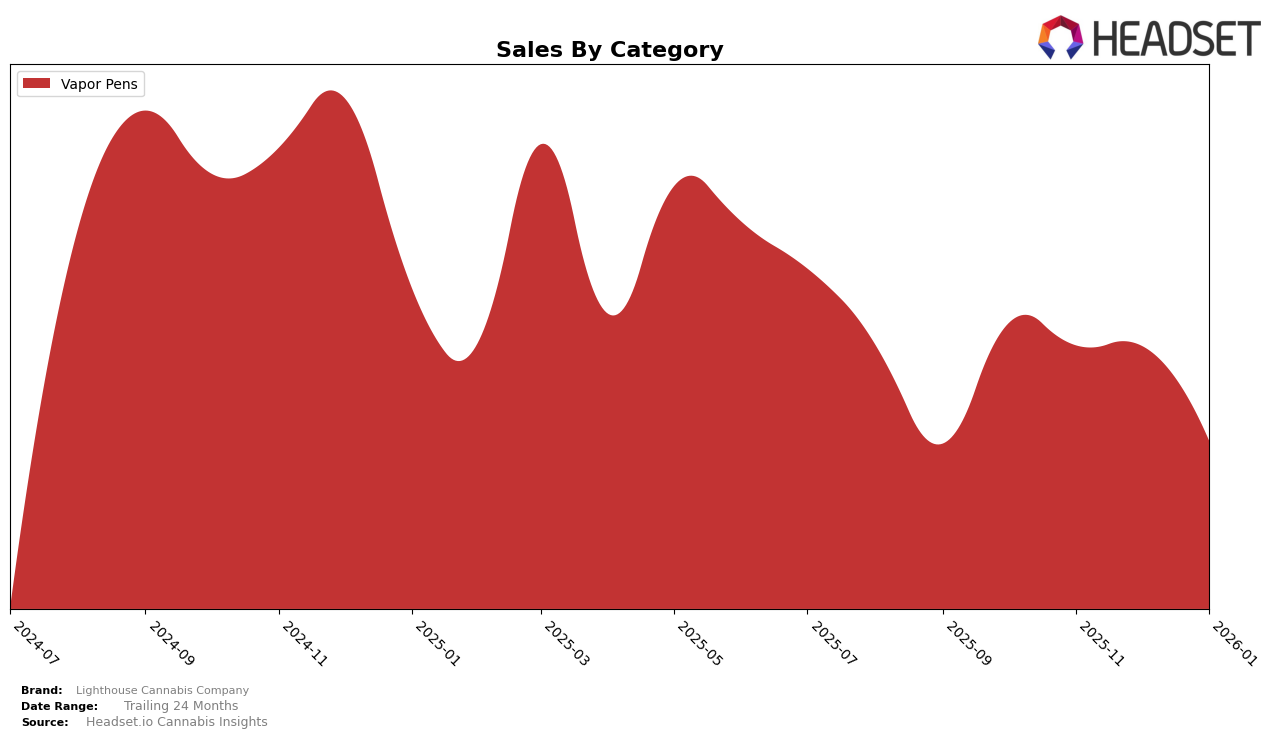

Lighthouse Cannabis Company has shown a consistent performance in the Vapor Pens category in Connecticut. Over the months from October 2025 to January 2026, the brand has maintained a steady presence in the top ranks, fluctuating slightly between the third and fourth positions. This consistency suggests a strong foothold in the market, although there was a noticeable decline in sales from October to January, with January sales reaching approximately $607,610. This downward trend in sales might indicate either a seasonal dip or increased competition in the market, which could be worth monitoring for future performance insights.

While Lighthouse Cannabis Company has maintained its ranking within the top four in Connecticut's Vapor Pens category, the absence of its ranking in other states or categories could be seen as a limitation in its market reach. Not appearing in the top 30 brands in other markets suggests there might be opportunities for growth or expansion that have yet to be tapped. This could also indicate a strategic focus on maintaining and strengthening their position in Connecticut, potentially at the expense of broader market penetration. Such insights could be valuable for stakeholders looking to understand the brand's strategic priorities and market dynamics.

Competitive Landscape

In the Connecticut Vapor Pens category, Lighthouse Cannabis Company has experienced a relatively stable performance in recent months, maintaining a consistent rank of 4th place from October 2025 to January 2026. This stability is noteworthy, especially in a competitive landscape where brands like Select and CTPharma have shown fluctuations, with Select improving its rank from 4th to 2nd, while CTPharma dropped from 2nd to 3rd. Despite a slight decline in sales from November to January, Lighthouse Cannabis Company has managed to hold its position, indicating a loyal customer base and effective brand strategies. Meanwhile, Rodeo Cannabis Co. and Amigos (CT) have remained in the lower ranks, suggesting that Lighthouse's competitive edge is strong against these brands. This analysis highlights the importance of maintaining consistent brand performance amidst market shifts, which can be crucial for sustaining sales and market position.

Notable Products

In January 2026, the top-performing product for Lighthouse Cannabis Company was Laughing Buddha Live Resin Microbar Rechargeable (1g), leading the rankings in the Vapor Pens category with sales of 1326 units. Following closely, Sour Diesel Live Resin Cartridge (1g) moved up to the second position from fourth in December, with a notable increase in sales to 1285 units. Wedding Cake Live Resin Cartridge (1g) secured the third spot, maintaining a strong presence in the top rankings since its debut in December. Horchata Live Resin Disposable (1g) slipped slightly to fourth place, despite consistent sales figures. Rounding out the top five, Granddaddy Purple Live Resin Stick Disposable (1g) made its first appearance in the rankings, indicating a positive reception in this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.