Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

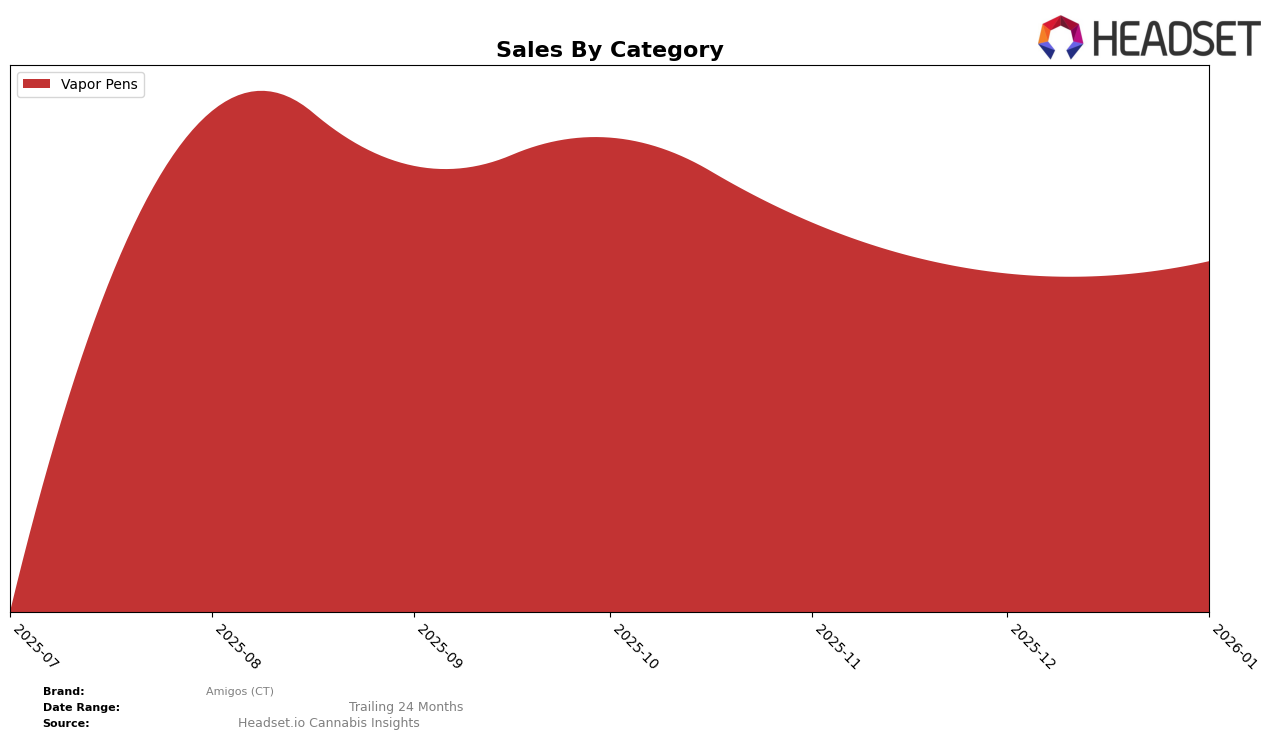

Amigos (CT) has demonstrated a consistent performance in the Vapor Pens category within the state of Connecticut. Over the past few months, the brand has maintained a steady position, ranking fifth from October 2025 through January 2026. This consistency in ranking suggests a stable consumer base and a reliable market presence despite a noticeable decline in sales figures from October to December 2025. The sales figures dropped from $586,044 in October to $418,598 in December, before seeing a slight recovery in January 2026. This rebound could indicate a potential strategy adjustment or seasonal factors affecting consumer purchasing behavior.

While Amigos (CT) has managed to secure a top-five spot in Connecticut's Vapor Pens category, it is important to note that the brand does not appear in the top 30 rankings for any other state or category. This limitation could be seen as a challenge for Amigos (CT) to expand its market reach beyond Connecticut or diversify its product offerings to appeal to a broader audience. The absence of rankings in other states suggests that Amigos (CT) may need to explore new strategies to enhance its competitive edge and market penetration. However, the brand's stronghold in Connecticut provides a solid foundation for potential growth and expansion efforts.

Competitive Landscape

In the competitive landscape of vapor pens in Connecticut, Amigos (CT) consistently holds the 5th rank from October 2025 to January 2026, indicating a stable position amidst fluctuating market dynamics. Notably, CTPharma maintains a dominant presence, although it experienced a slight drop from 2nd to 3rd place in January 2026, which may suggest opportunities for Amigos (CT) to capitalize on shifting consumer preferences. Meanwhile, Lighthouse Cannabis Company consistently ranks 4th, showcasing a strong hold just above Amigos (CT). Interestingly, Rodeo Cannabis Co. and Brix Cannabis (CT) demonstrate more volatility, with Rodeo Cannabis Co. maintaining a 6th position in January 2026, while Brix Cannabis (CT) improved its rank to 7th, potentially signaling increased competition. Despite these dynamics, Amigos (CT) shows resilience in sales, with a notable rebound in January 2026, suggesting effective strategies to maintain its market share in a competitive environment.

Notable Products

In January 2026, OG Kush Live Resin Disposable (1g) emerged as the top-performing product for Amigos (CT), ascending from the fifth position in October 2025 to claim the number one spot, with sales reaching 1272 units. Lemon Skunk Live Resin Disposable (1g) maintained a strong performance, holding steady in second place with a slight increase in sales from December 2025. Cherry Kiss Live Resin Disposable (1g) saw a drop from first place in December 2025 to third in January 2026, indicating a shift in consumer preference. Orange Sherbet Live Resin Disposable (1g) consistently held the fourth position over the months, showing stable demand. Mystic Mintz Live Resin Disposable (1g) experienced a notable decline, falling from first in November 2025 to fifth in January 2026, suggesting a decrease in popularity or availability.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.