Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

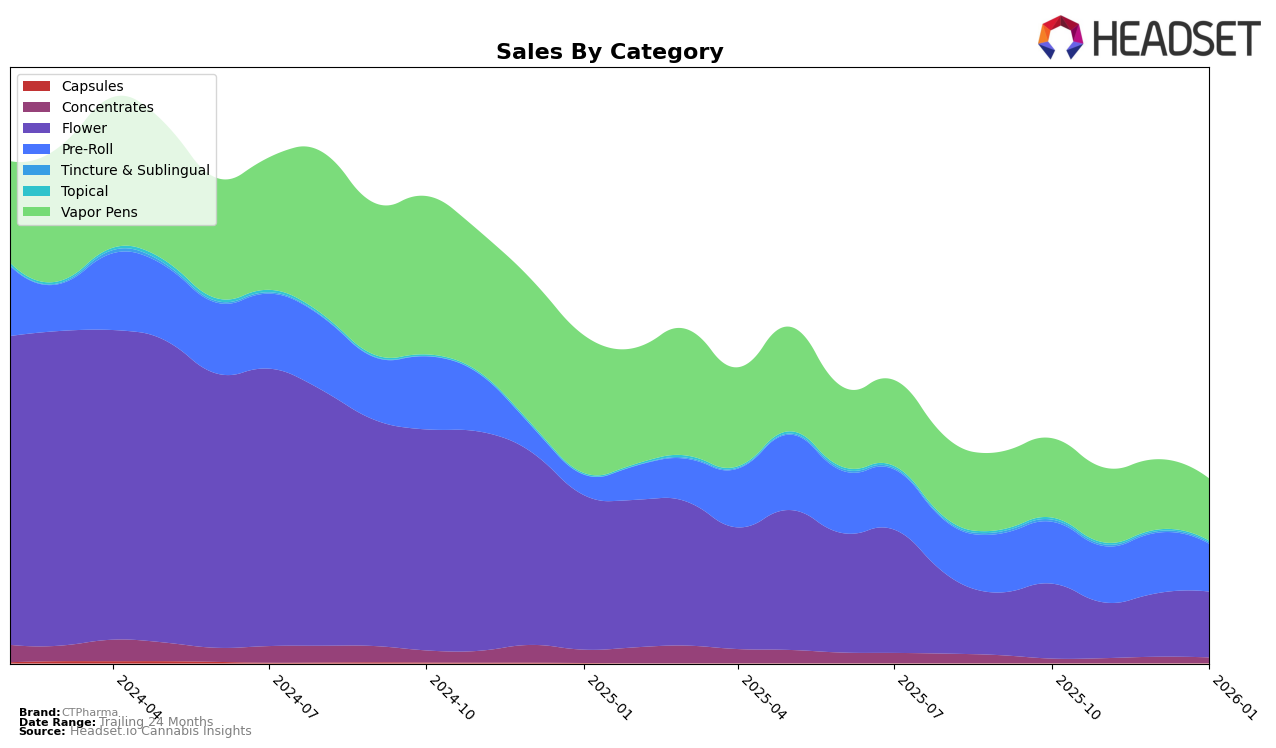

CTPharma has demonstrated a strong performance across several categories in Connecticut. In the concentrates category, CTPharma has consistently maintained its position as a top contender, ranking first in three out of the four months from October 2025 to January 2026. This indicates a solid hold on consumer preferences in this category. Meanwhile, in the flower category, CTPharma experienced some fluctuations, moving from second to fifth place in November 2025, but quickly rebounded to third and then back to second by January 2026. This suggests a resilient brand presence that can recover swiftly from short-term dips.

In the pre-roll category, CTPharma has shown remarkable stability, consistently holding the number one position throughout the observed months, which highlights its dominance in this segment. However, in the vapor pens category, there was a slight decline from second to third place in January 2026, indicating a potential area for improvement or increased competition. Notably, CTPharma's absence from the top 30 in any category or state would be concerning, but this is not the case here, as their presence is strong across all major categories in Connecticut.

Competitive Landscape

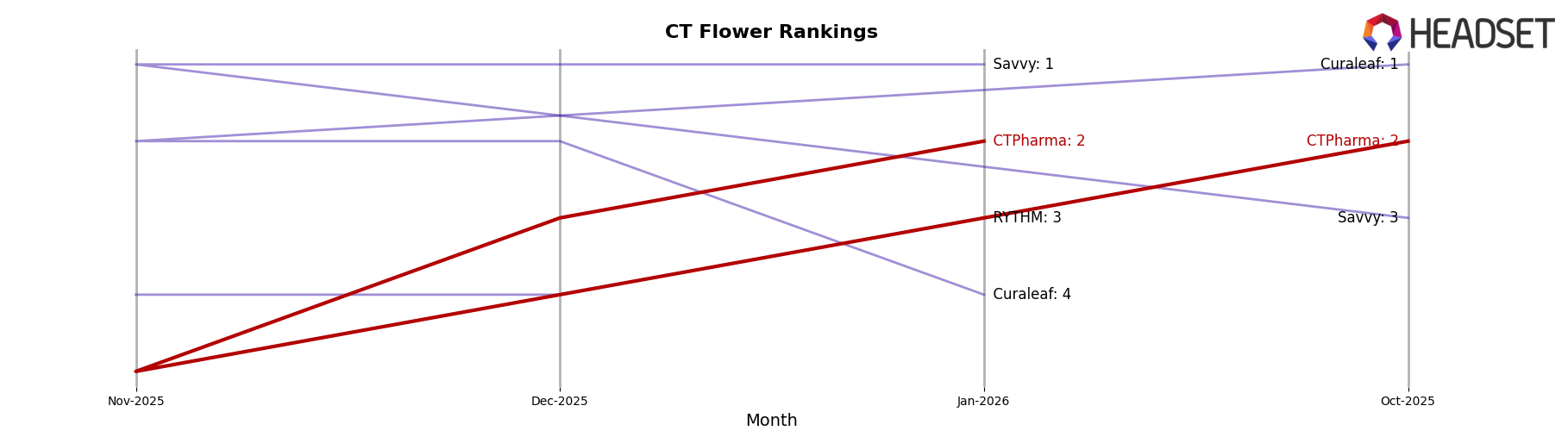

In the Connecticut flower category, CTPharma has experienced notable fluctuations in its ranking and sales over the past few months. Starting in October 2025, CTPharma held a strong position at rank 2, but saw a dip to rank 5 in November, before recovering to rank 3 in December and climbing back to rank 2 in January 2026. This volatility in rank can be attributed to the competitive landscape, where brands like Savvy consistently maintained the top position from November to January, and Curaleaf experienced a decline from rank 1 in October to rank 4 by January. Meanwhile, RYTHM showed a steady improvement, moving from rank 4 to rank 3 by January. Despite these challenges, CTPharma's sales have shown resilience, particularly in January 2026, where they surpassed the November dip, indicating a positive trend in consumer demand and brand loyalty.

Notable Products

In January 2026, CTPharma's top-performing product was Snow Drift (3.5g) in the Flower category, securing the first position with sales of 4047. Full Tank (3.5g), another Flower product, followed closely in second place. The Dos Mendos THCa Infused Shorties Pre-Roll 5-Pack (2g) ranked third, dropping from its top position in December 2025. Kush Scout Shorties Pre-Roll 5-Pack (2g) maintained its rank at fourth place. Ghost White (3.5g) in the Flower category held steady at fifth place, consistent with its rank from December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.