Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

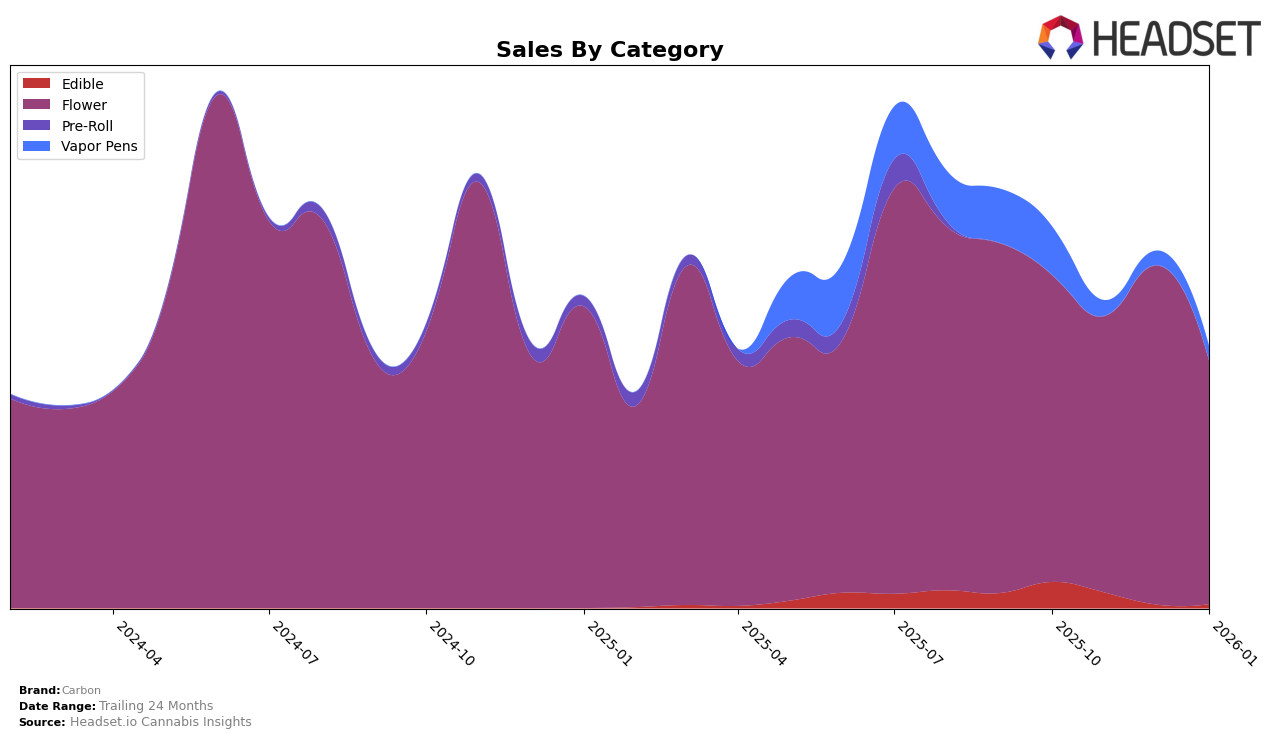

Carbon's performance across different categories in Michigan has shown some intriguing trends over the past few months. In the Flower category, Carbon has had a fluctuating but generally positive presence, with a notable improvement from a rank of 24 in November 2025 to 18 in December 2025, before dropping to 26 in January 2026. This suggests a competitive positioning that saw a significant peak during December. However, the Edible category tells a different story, with Carbon not making it into the top 30 rankings from October 2025 onwards, which might indicate challenges in market penetration or consumer preferences in this segment.

In the Vapor Pens category, Carbon's performance has been less stable, with rankings dropping from 53 in October 2025 to 93 in November 2025, and then hovering around the low 90s through December and January. This indicates a potential struggle in maintaining their market share within this category. Despite these challenges, it's worth noting that the Flower category remains a stronghold for Carbon, as evidenced by their consistent presence in the top 30, which could be a strategic focus area for the brand in Michigan. The sales figures reflect these trends, with Flower sales peaking in December, highlighting consumer preference and brand strength in this category during the holiday season.

Competitive Landscape

In the Michigan flower category, Carbon experienced fluctuations in its market position, with its rank shifting from 21st in October 2025 to 26th by January 2026. This decline in rank could be attributed to the competitive landscape, where brands like Everyday Cannabis (MI) and Glorious Cannabis Co. consistently outperformed Carbon, maintaining higher ranks and sales figures. Notably, Everyday Cannabis (MI) held a strong position, ranking as high as 8th in December 2025, while Glorious Cannabis Co. also maintained a top 10 presence until January 2026. Meanwhile, Light Sky Farms and Six Labs showed varied performance, with Light Sky Farms achieving a peak rank of 25th in December 2025. Carbon's sales trajectory mirrored its rank changes, peaking in December 2025 before declining in January 2026, suggesting a need for strategic adjustments to regain competitive standing in this dynamic market.

Notable Products

In January 2026, Carbon's top-performing product was Pablo's Revenge Bulk in the Flower category, climbing to the number one spot with notable sales of 6,830 units. GMO Sherb 3.5g also made a strong entry, securing the second position, while Chemdawg 3.5g followed closely in third place. Trop Cherry 3.5g saw a slight dip, moving from fourth to third, indicating a competitive shift in the Flower category. Clementine Distillate Cartridge 1g maintained a steady presence, ranking fourth in the Vapor Pens category. Compared to previous months, Pablo's Revenge Bulk improved from second place in December 2025, showcasing a significant upward trend in sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.