Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

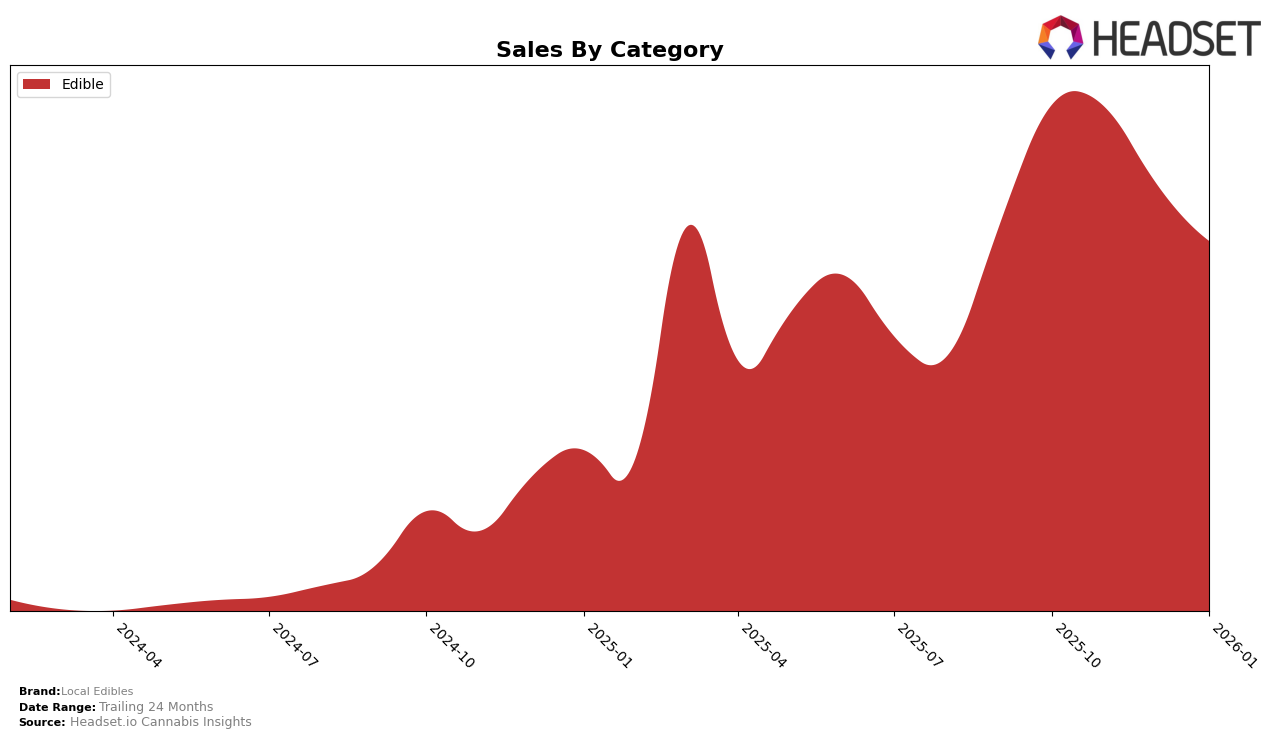

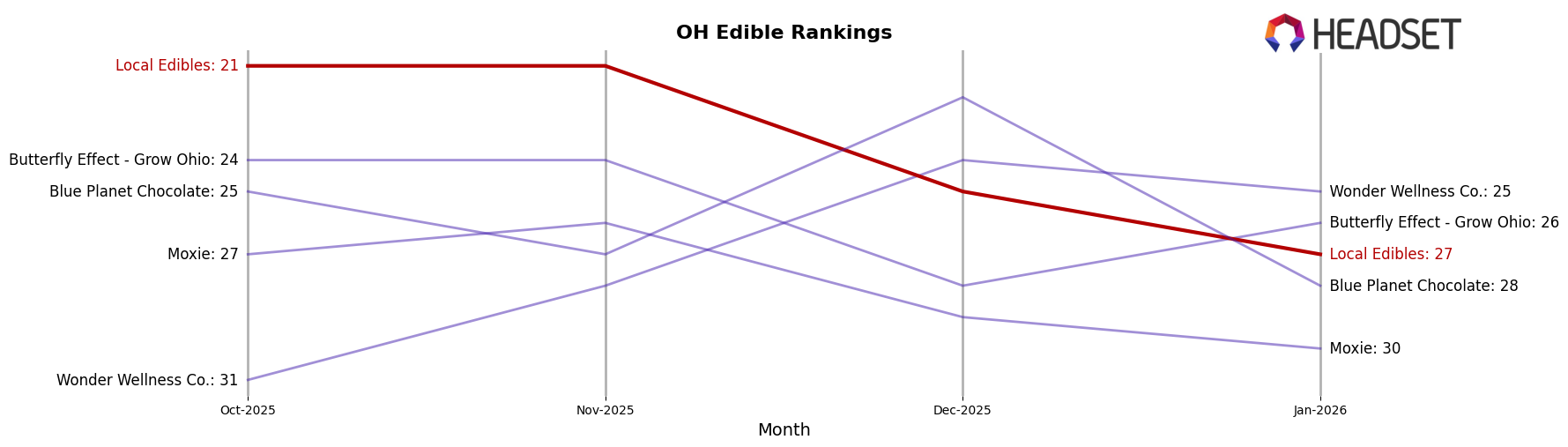

Local Edibles has shown varied performance across different states and categories over recent months. In Ohio, the brand has maintained a presence within the top 30 rankings for the Edible category, albeit with a slight downward trend. Starting at rank 21 in October 2025, Local Edibles held steady in November before slipping to rank 25 in December and further to 27 by January 2026. This gradual decline in rankings is indicative of competitive pressures or potential shifts in consumer preferences within the state. Despite these challenges, Local Edibles has managed to stay within the top 30, which suggests a resilience and continued relevance in the Ohio edibles market.

It is noteworthy that Local Edibles is not ranked in the top 30 for other states or categories, which could point to either limited market penetration or a strategic focus on specific regions and product lines. The brand's sales figures in Ohio mirror its ranking trajectory, with a noticeable decrease from October to January. This trend may reflect broader market dynamics or seasonal variations in consumer purchasing behavior. The absence of Local Edibles from the top 30 in other regions might be seen as a missed opportunity for expansion, but it also leaves room for potential growth if the brand decides to diversify its geographical reach or product offerings in the future.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Ohio, Local Edibles has experienced notable fluctuations in its ranking and sales over the past few months. From October 2025 to January 2026, Local Edibles' rank shifted from 21st to 27th, indicating a downward trend in their market position. This decline is juxtaposed against the performance of competitors like Wonder Wellness Co., which improved its rank from 31st to 25th, and Blue Planet Chocolate, which saw a significant jump to 22nd in December before dropping to 28th. Meanwhile, Butterfly Effect - Grow Ohio maintained a relatively stable position, hovering around the mid-20s. Despite Local Edibles' initial lead in sales, which were higher than its competitors in October and November, the brand saw a decrease in sales by January 2026, allowing competitors to close the gap. This dynamic suggests that Local Edibles may need to reassess its strategies to regain its competitive edge in the Ohio edible market.

Notable Products

In January 2026, the top-performing product from Local Edibles was the Sunshine Orange Live Liquid Diamond Gummies 10-Pack, which ascended to the number one rank with impressive sales of 413 units. This product showed a significant rise from its second-place rank in December 2025. Following closely, the Espresso Dark Chocolate Bar 10-Pack secured the second rank, maintaining its position from the previous month. The CBG/THC 1:1 Tropical Punch Gummies 10-Pack climbed to the third spot, indicating a growing popularity. Meanwhile, the Chocolate Covered Banana Bar 10-Pack and Caramel Pretzel Chocolate Rip Pack 5-Pack rounded out the top five, both entering the rankings for the first time in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.