Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

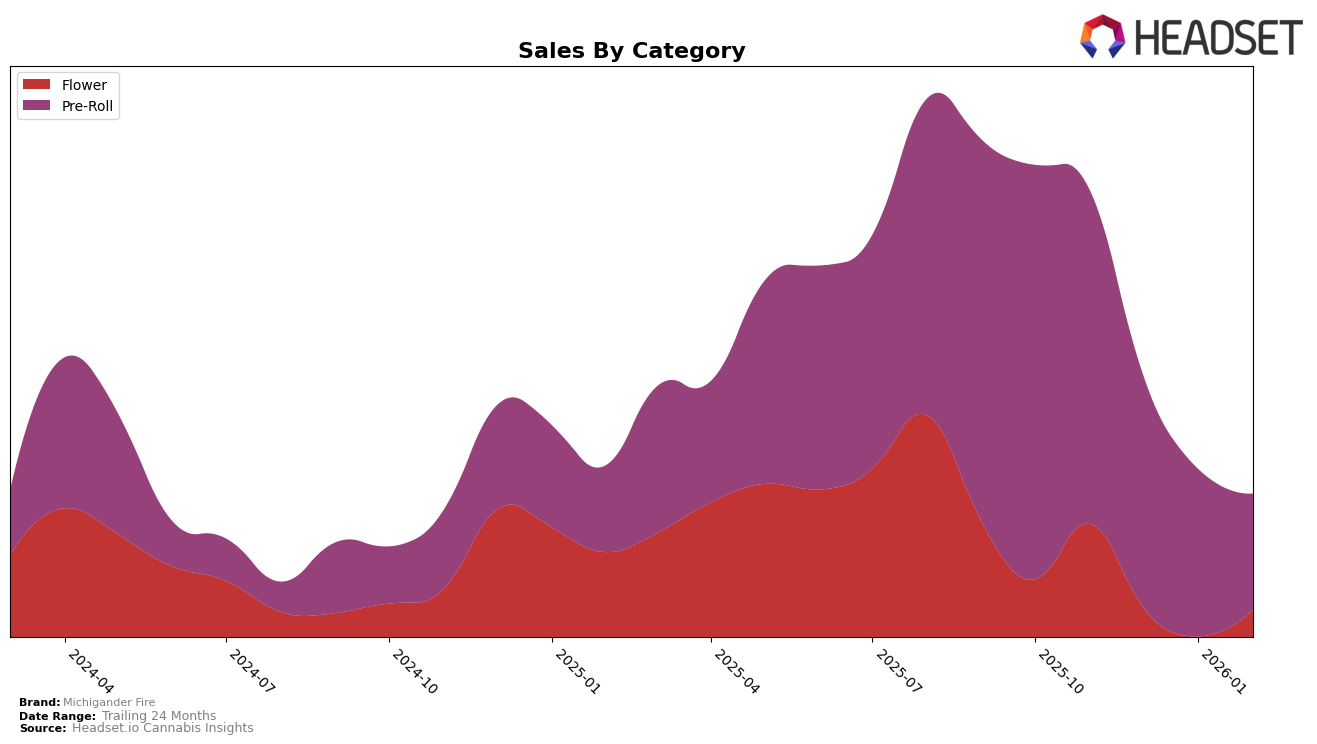

Michigander Fire's performance across different categories in Michigan reveals an interesting dynamic. In the Flower category, the brand was not ranked in the top 30 from November 2025 to January 2026, indicating a challenging market position. However, by February 2026, Michigander Fire managed to re-enter the rankings at the 100th spot. This suggests a slight recovery or strategic shift that might be worth exploring further. The brand's sales in this category also saw a decline from November 2025 to February 2026, reflecting potential market pressures or changes in consumer preferences.

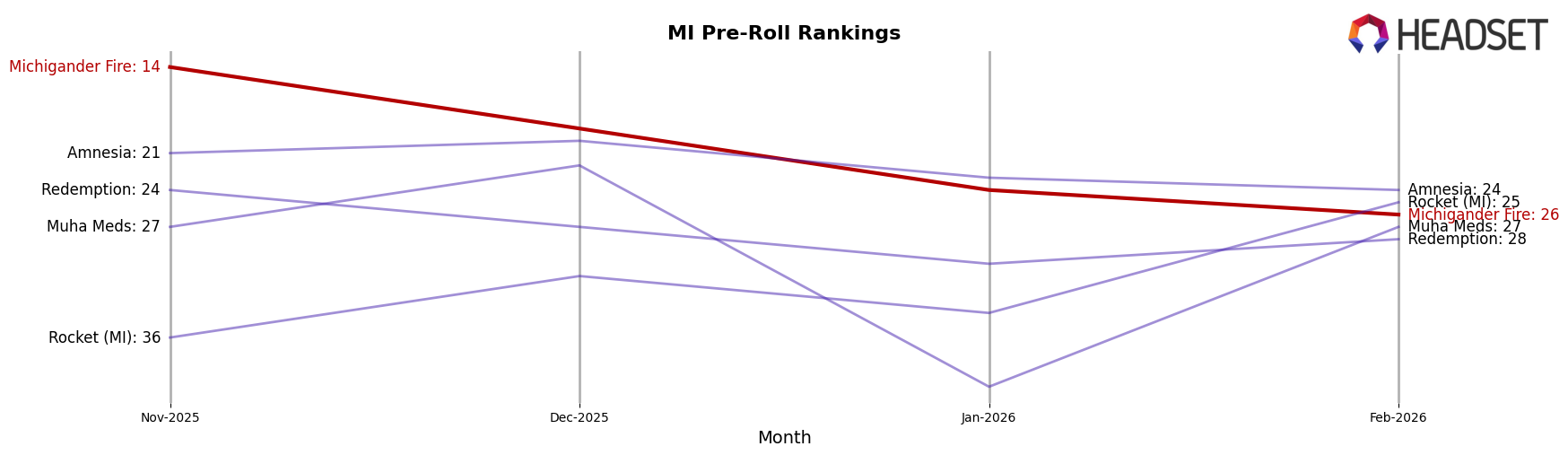

In contrast, Michigander Fire's performance in the Pre-Roll category shows a more consistent presence in the rankings. Starting from a strong 14th position in November 2025, the brand experienced a gradual decline, reaching the 26th spot by February 2026. Despite this downward trend, maintaining a position within the top 30 indicates a relatively stable demand for their Pre-Roll products. The sales figures for Pre-Rolls also demonstrate a downward trajectory, which might suggest increasing competition or shifting consumer trends. This category's performance could provide insights into the brand's overall strategy and market adaptation in Michigan.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll category, Michigander Fire has experienced a notable shift in its market position, moving from a rank of 14 in November 2025 to 26 by February 2026. This decline in rank is accompanied by a decrease in sales, reflecting a broader trend of diminishing market presence. In contrast, brands like Redemption and Amnesia have maintained relatively stable rankings, with Redemption hovering around the mid-20s and Amnesia consistently outperforming Michigander Fire by February 2026. Meanwhile, Muha Meds has shown volatility, dropping to rank 40 in January 2026 but rebounding to 27 by February. The competitive dynamics suggest that Michigander Fire faces challenges in retaining its market share amidst fluctuating consumer preferences and the resilience of its competitors in the Michigan pre-roll market.

Notable Products

In February 2026, the top-performing product for Michigander Fire was the London Cherry Gelato Pre-Roll, which maintained its leading position from December 2025, with a notable sales figure of 1719 units. The Crunch Berries Pre-Roll climbed to second place, showing a resurgence from its absence in December and January, with sales reaching 1419 units. Zupa Pre-Roll, previously ranked first in January, slipped to third position with sales of 1395 units. Flint Tropics Pre-Roll held steady in fourth place, while Pink Belts Pre-Roll re-entered the rankings at fifth, despite not being ranked in the preceding months. This shift in rankings highlights a dynamic market where consumer preferences appear to fluctuate, especially as seen with the varying performance of Zupa Pre-Roll and Crunch Berries Pre-Roll over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.