Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

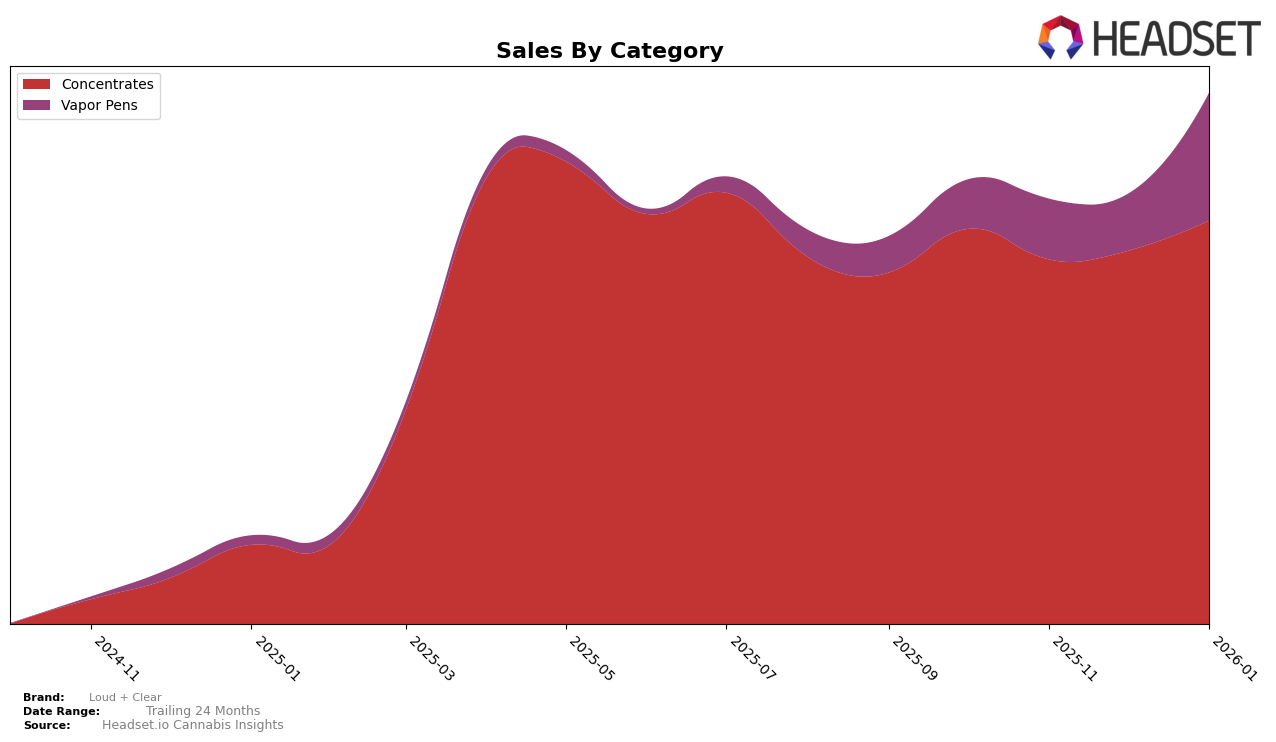

Loud + Clear has shown a consistent presence in the California concentrates market, maintaining a position within the top 20 brands. Despite some fluctuations, the brand improved its ranking from 16th in December 2025 to 14th by January 2026. This upward movement was accompanied by a notable increase in sales, rising from $239,321 in December to $258,760 in January, suggesting a strengthening foothold in the concentrates category. However, in the vapor pens category, Loud + Clear did not make it to the top 30 brands, which could indicate a potential area for growth or a strategic focus elsewhere.

While Loud + Clear's performance in California demonstrates resilience in the concentrates category, the absence from the top 30 in vapor pens highlights a stark contrast. This discrepancy suggests that while the brand is solidifying its position in one category, it may be facing challenges or prioritizing differently in another. The data implies that Loud + Clear might benefit from exploring opportunities to enhance its presence in the vapor pens market or further capitalizing on its strengths in concentrates to drive overall brand growth in California.

Competitive Landscape

In the competitive landscape of California's concentrates market, Loud + Clear has experienced fluctuations in its rank and sales, highlighting both challenges and opportunities. Over the four-month period from October 2025 to January 2026, Loud + Clear's rank shifted from 13th to 14th, indicating a slight decline in its competitive standing. Notably, Rosin Tech consistently outperformed Loud + Clear, maintaining higher rankings and sales, although it experienced a drop from 9th to 13th in January 2026. Meanwhile, Nasha Extracts showed a steady improvement, climbing from 14th to 12th, while Greenline also improved its position, peaking at 14th in December before settling at 15th in January. These movements suggest that while Loud + Clear remains a significant player, it faces stiff competition from brands like Rosin Tech and Nasha Extracts, which are gaining traction. To regain momentum, Loud + Clear might consider strategic initiatives to enhance its market presence and capture a larger share of the growing concentrates segment in California.

Notable Products

In January 2026, the top-performing product from Loud + Clear was Blueberry Diesel Live Resin Flavor Dab (2g) in the Concentrates category, maintaining its number one ranking consistently from October 2025 through January 2026, with sales reaching 1965 units. Sticky Mango Smoothie Liquid Diamonds Live Resin Cartridge (1g) from the Vapor Pens category saw a significant rise in popularity, moving from fourth place in December 2025 to second place in January 2026. Cherry Lemonade Live Resin Flavor Dab (2g) made a notable entry into the rankings, securing the third spot. Starfruit Sherbet Live Resin Flavor Dab (2g) dropped from second to third place over the months, showing a slight decrease in sales. Pineapple Cake Live Resin Flavor Dab (2g) re-entered the rankings in January 2026 at fourth place after being unranked in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.