Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

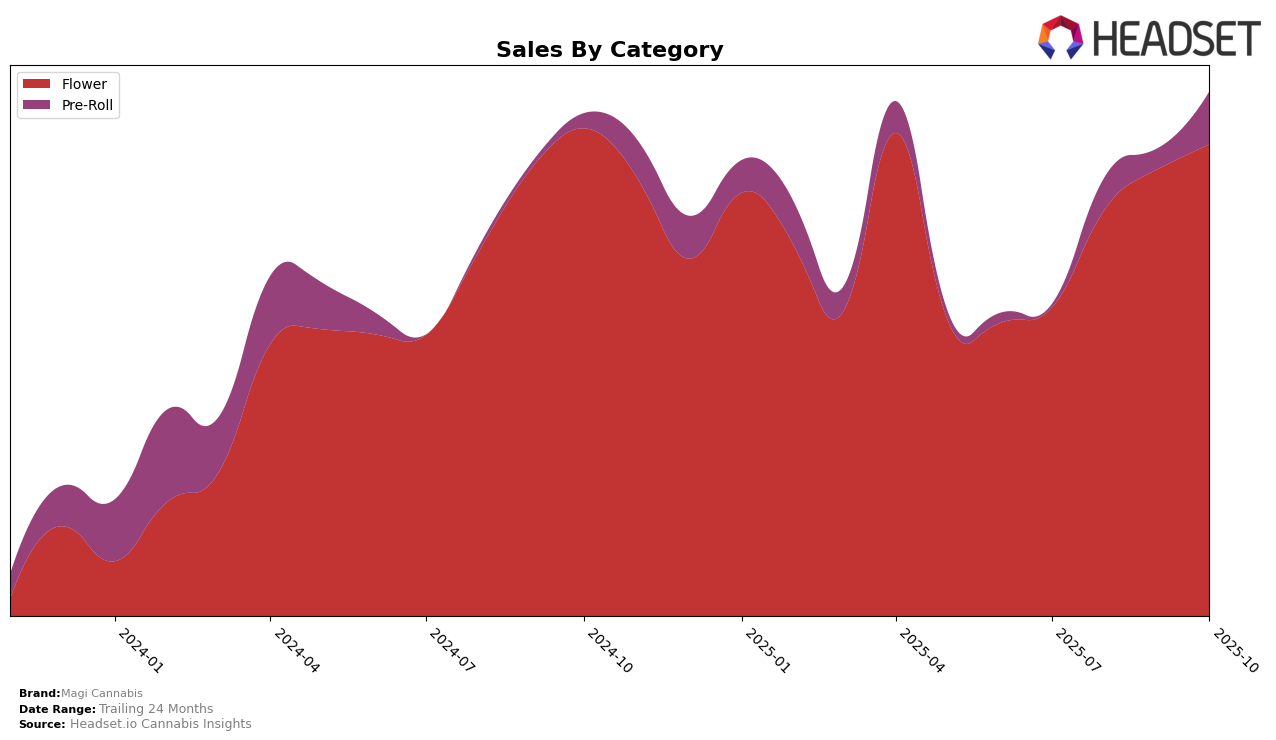

In the British Columbia market, Magi Cannabis has shown a steady presence in the Flower category. Over the past few months, the brand has seen fluctuations in its rankings, moving from 28th position in July to 27th in October. Despite the slight dip in October, it's important to note the overall upward trend in sales, with October sales figures reaching $294,560, indicating a growing consumer interest. However, the brand's absence from the top 30 rankings in the Pre-Roll category in July and September suggests challenges in gaining a foothold in that segment, despite a notable re-entry at 86th position in October.

The performance of Magi Cannabis across different categories in British Columbia highlights a mixed yet intriguing narrative. While the Flower category shows a consistent presence, the Pre-Roll category's sporadic rankings point to potential volatility or strategic shifts. The brand's ability to climb back into the rankings in October for Pre-Rolls suggests possible improvements or changes in market strategy. This mixed performance across categories underscores the dynamic nature of the cannabis market in British Columbia and highlights areas where Magi Cannabis could focus its efforts to enhance its market presence further.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, Magi Cannabis has shown a steady improvement in its market position, moving from the 28th rank in July 2025 to 27th in October 2025. This upward trajectory in rank is complemented by a consistent increase in sales, indicating a positive reception from consumers. In contrast, Tweed experienced a decline, dropping out of the top 20 by October 2025, which may suggest a shift in consumer preferences or competitive pressures. Meanwhile, Sitka Weedworks and Fort 20 Farms have made notable jumps into the top 30 by October, with Sitka Weedworks showing a remarkable leap from 84th to 29th, and Fort 20 Farms from 96th to 28th, potentially challenging Magi Cannabis's position. Choklit Park also surged to 25th place, highlighting a dynamic and competitive market environment. These shifts underscore the importance for Magi Cannabis to continue its strategic efforts to maintain and enhance its market share amidst rising competition.

Notable Products

In October 2025, the top-performing product for Magi Cannabis was the Block Party Variety Pack Pre-Roll 20-Pack (10g), maintaining its number one rank for four consecutive months, with sales reaching 1280 units. Salty Pink (3.5g) emerged as the second-ranked product for October, showing a significant entry into the rankings. Pine Tar (3.5g) secured the third position, also marking its first appearance in the rankings. Timmy OG Shark (7g) held the fourth spot, consistent with its previous ranking in July, and saw a steady increase in sales since September. Salt Spring Love Haze (14g) remained in the fifth position for the third consecutive month, reflecting stable performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.