Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

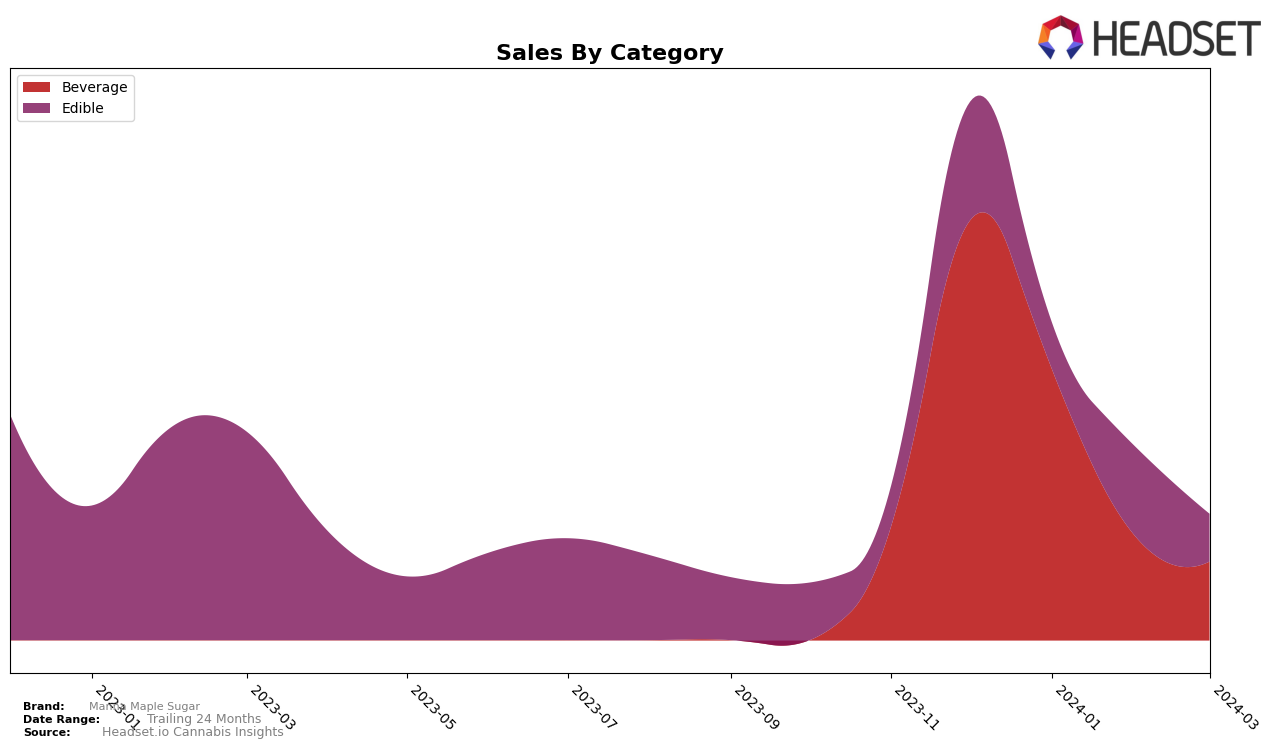

In the competitive landscape of Alberta, Manna Maple Sugar has shown a fluctuating yet insightful performance across different categories. In the Beverage category, the brand maintained a presence within the top 30, albeit with a slight decline from a rank of 20 in December 2023 to 25 in March 2024. This downward trend, mirrored in their sales figures which dropped from 10744 in December 2023 to 2011 in March 2024, suggests challenges in maintaining their market position amidst stiff competition. On the other hand, their performance in the Edible category tells a slightly different story. Despite starting at a rank of 40 in December 2023 and experiencing a dip to 44 by March 2024, the brand exhibited a notable improvement in February 2024, moving up to rank 37. This indicates a potential resilience and ability to recover, even if their standing in the top 30 is precarious and their sales figures show a general decline.

Meanwhile, in British Columbia, Manna Maple Sugar's journey within the Edible category offers a glimpse into the brand's market dynamics outside Alberta. Notably, the brand was absent from the top 30 rankings in January 2024, which could be seen as a significant setback. However, a rebound to rank 31 in February 2024 showcases a noteworthy recovery, even though specific sales figures for December 2023 and March 2024 are missing. This absence in data points for two months makes it challenging to fully assess the brand's performance trend over the period. Nevertheless, the available information hints at a brand that experiences fluctuations in its market standings but has the capability to regain its footing, at least temporarily, in a highly competitive landscape.

Competitive Landscape

In the competitive landscape of the beverage category in Alberta, Manna Maple Sugar has experienced fluctuating ranks over the recent months, indicating a challenging market position amidst its competitors. Initially ranked 20th in December 2023, it saw a slight improvement in January 2024 moving up to 22nd, before dropping to 26th in February and then slightly recovering to 25th in March 2024. This trajectory suggests a struggle to maintain a consistent market position, contrasting with competitors like D'Gree, which, despite a significant drop from 11th to 24th, managed to stay ahead in the rankings. Other notable competitors include Emprise Canada, Little Victory, and Favours, each showing varying degrees of rank and sales performance but generally maintaining a more stable position than Manna Maple Sugar. The fluctuating ranks and sales of Manna Maple Sugar relative to its competitors highlight the brand's volatility in a competitive market, underscoring the need for strategic adjustments to enhance its market standing.

Notable Products

In Mar-2024, Manna Maple Sugar's top-performing product was the Milk Chocolate & Maple Hot Chocolate Bomb (10mg) from the Beverage category, maintaining its number one rank since Dec-2023 with 142 sales in March. Following closely, the CBD/THC 5:1 Maple Sugar Sachet 2-Pack (50mg CBD, 10mg THC) in the Edible category rose to the second rank in March from its previous fourth position in February, showcasing significant interest. The CBN/CBD/THC 4:2:1 Maple Sugar Sachet 4-pack (40mg CBN, 20mg CBD, 10mg THC) also in the Edible category, moved up to the third rank in March from its third position in February, indicating stable demand. The Maple Sugar Sachet (10mg), another Edible, dropped to fourth place in March from its second position in February, suggesting a shift in consumer preference. Notably, the rankings reflect a growing consumer interest in diverse cannabis-infused edible products, with Edibles dominating the top ranks after the leading Beverage item.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.