Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

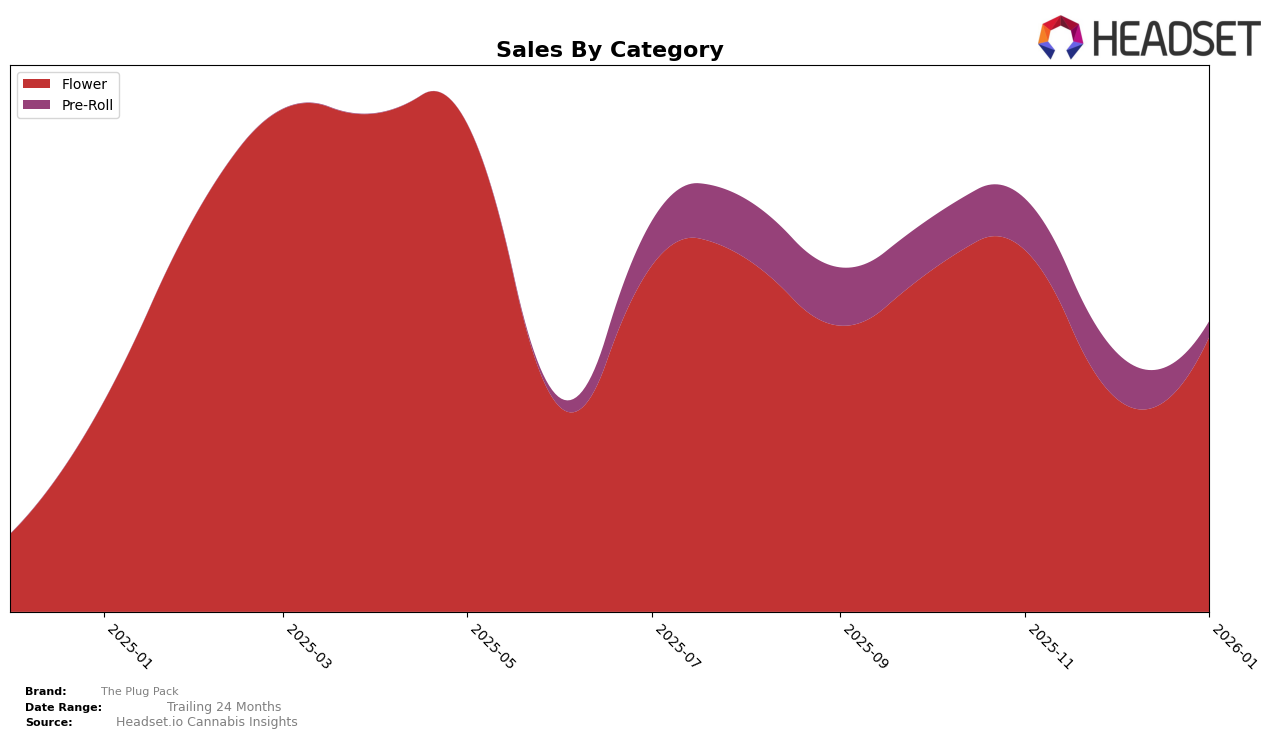

The Plug Pack has shown varying performance across different categories and states, with notable movements in the New York market. In the Flower category, The Plug Pack maintained a consistent presence in the top 20, with a slight dip in December 2025 to rank 18th before climbing back to 17th in January 2026. This fluctuation in rankings is indicative of the competitive nature of the Flower category in New York, where The Plug Pack has managed to sustain its market position despite a drop in sales from November to December 2025. The brand's resilience in maintaining a top 20 position highlights its potential for growth and adaptation in a dynamic market environment.

Conversely, The Plug Pack's performance in the Pre-Roll category in New York has been less favorable, with a steady decline in rankings from October 2025, where it was positioned outside the top 30, to a significant drop to 91st place by January 2026. This downward trend is accompanied by a sharp decrease in sales over the same period, suggesting challenges in maintaining competitiveness within this category. The absence from the top 30 rankings in consecutive months could be indicative of broader market pressures or shifts in consumer preferences. Understanding these dynamics is crucial for stakeholders looking to navigate the evolving landscape of the cannabis industry in New York.

Competitive Landscape

In the competitive landscape of the Flower category in New York, The Plug Pack has experienced notable fluctuations in its market position, which have implications for its sales trajectory. From October 2025 to January 2026, The Plug Pack's rank shifted from 12th to 17th, indicating a decline in its competitive standing. This change is particularly significant when compared to competitors like LivWell, which also saw a decline but maintained a higher sales volume, and Electraleaf, which showed a consistent rank around the 15th position with increasing sales. Meanwhile, RIPPED and Mini Mart demonstrated remarkable improvements in rank, with RIPPED jumping from 48th to 19th and Mini Mart from 62nd to 16th, indicating aggressive market penetration. These shifts suggest that while The Plug Pack's sales saw a recovery in January 2026, the brand faces stiff competition and must strategize to regain its earlier momentum and improve its rank in the New York Flower market.

Notable Products

In January 2026, Bomb Pop (28g) maintained its position as the top-selling product for The Plug Pack, with sales reaching 3117 units. Cherry Pie (28g) experienced a notable rise, moving from third place in December 2025 to second place, indicating a significant increase in popularity. Tequila Sunrise (28g) climbed back into the top three after being unranked in December 2025, showcasing a resurgence in demand. Chopped Cheese (28g) dropped from second place in December 2025 to fourth in January 2026, reflecting a decrease in sales momentum. PB & J (28g) consistently ranked fifth over the past four months, maintaining steady sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.