Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

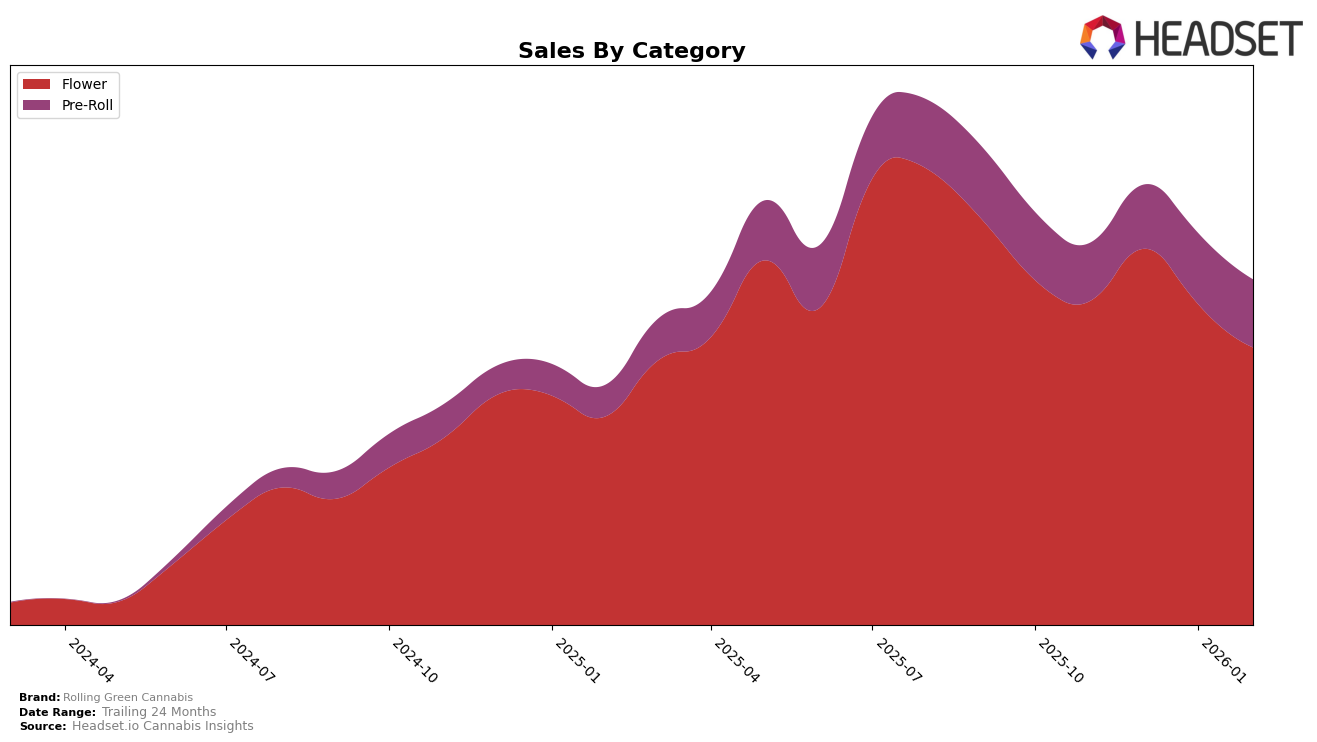

Rolling Green Cannabis has shown varied performance across different categories and states, with notable movements in New York. In the Flower category, the brand maintained a strong presence, starting at rank 4 in November 2025 and slightly dropping to rank 7 by February 2026. This indicates a consistent demand, albeit with some competitive pressures affecting their standing. The sales figures for this category in New York peaked in December 2025, suggesting a seasonal or promotional boost, but saw a decline in early 2026. Such fluctuations might reflect broader market trends or strategic shifts within the brand's marketing or distribution efforts.

In contrast, the Pre-Roll category in New York has seen a positive trajectory for Rolling Green Cannabis. Starting at rank 18 in November 2025, the brand improved its position to rank 13 by February 2026. This upward movement, accompanied by a steady increase in sales from November to January, indicates growing consumer interest and possibly successful product launches or marketing campaigns. The lack of top-30 rankings in other states or provinces might suggest opportunities for expansion or highlight challenges in those markets. The performance in New York serves as a benchmark for potential growth strategies in similar markets.

Competitive Landscape

In the competitive landscape of the New York flower category, Rolling Green Cannabis has experienced notable fluctuations in its market position from November 2025 to February 2026. Initially ranked 4th in November 2025, Rolling Green Cannabis climbed to 3rd place in December before dropping to 7th in both January and February 2026. This decline in rank coincided with a decrease in sales from January to February, suggesting potential challenges in maintaining market share. Meanwhile, Revert Cannabis New York consistently held a strong position, maintaining a top 5 rank throughout the period, which may have contributed to the competitive pressure faced by Rolling Green Cannabis. Additionally, Smoakland showed a significant upward trend, advancing from 18th to 8th place, which indicates a growing threat to Rolling Green Cannabis's market share. These dynamics highlight the competitive intensity in the New York flower market and the need for Rolling Green Cannabis to strategize effectively to regain its earlier standing.

Notable Products

In February 2026, the top-performing product for Rolling Green Cannabis was Black Cherry Runtz Pre-Roll (1g), maintaining its first-place rank for four consecutive months with sales reaching 8,065 units. Trainwreck Pre-Roll (1g) climbed from fourth place in January to second place in February, showing a significant increase in popularity. Lemon Cherry Gelato Pre-Roll (1g) dropped from second to third place, while Blue Dream Pre-Roll (1g) consistently held the fourth position. Northern Lights Pre-Roll (1g) remained steady at fifth place, showing growth from its initial entry in January. These shifts indicate dynamic changes in consumer preferences within the pre-roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.