Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

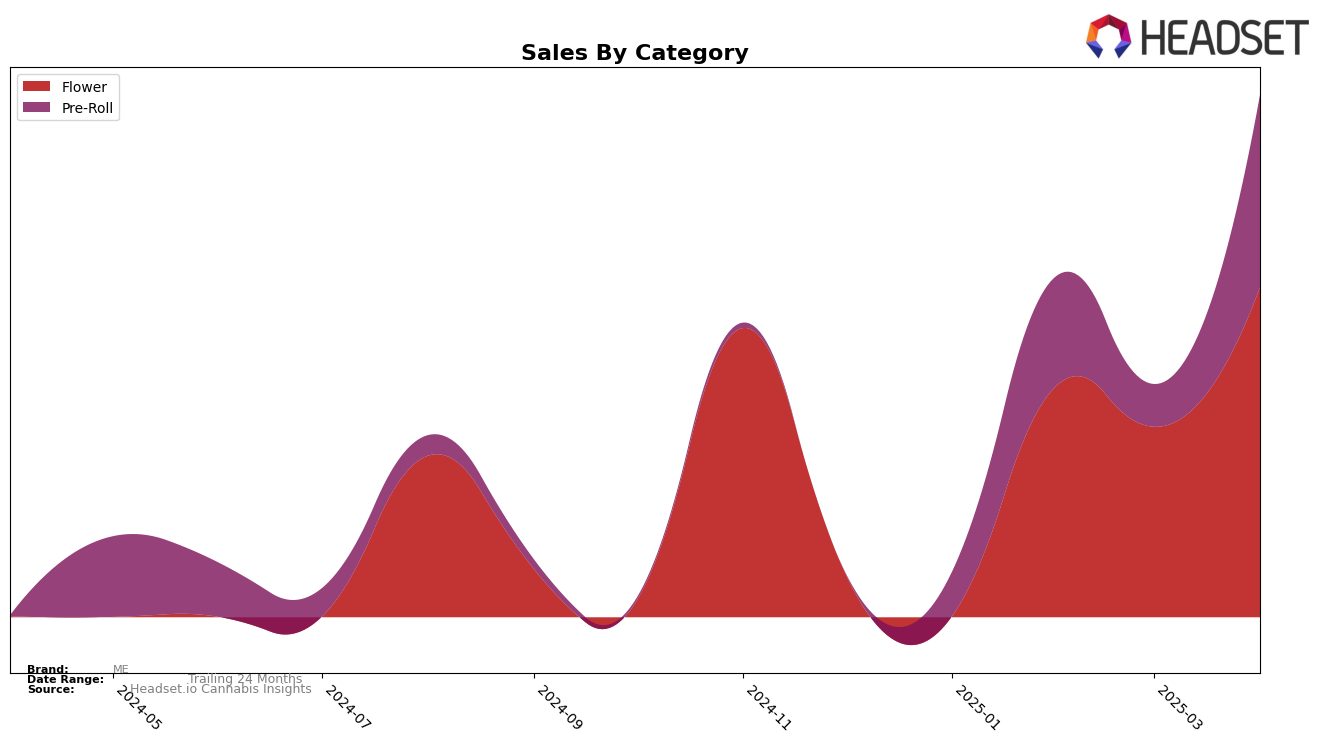

In the state of Nevada, the performance of the ME brand has shown varying trends across different categories. In the Flower category, ME did not rank in the top 30 in January 2025, but saw a significant improvement by March, reaching the 38th position. This upward movement suggests a growing presence in the Flower market, despite a dip in February. Meanwhile, the Pre-Roll category has been more volatile, with rankings fluctuating from 58th in January to 62nd in March, before climbing to 27th in April. The jump in April indicates a potential strategic shift or consumer preference change that has benefited the brand. These movements highlight ME's fluctuating but potentially promising position in Nevada's cannabis market.

Despite not making it to the top 30 in the Flower category initially, ME's sales trajectory in Nevada suggests a positive trend. The brand's Flower sales increased significantly from February to April, indicating a successful strategy or product reception. On the other hand, Pre-Roll sales saw a remarkable increase in April after a drop in March, aligning with its improved ranking. This pattern could reflect a successful promotional effort or an enhanced product offering that resonated well with consumers. The absence of ME in the top 30 rankings in January for the Flower category highlights the competitive nature of the market, but their subsequent rise demonstrates their potential to capture more market share in the future.

Competitive Landscape

In the Nevada flower category, ME has shown a dynamic shift in its competitive standing over the first four months of 2025. Initially absent from the top 20 in January, ME entered the rankings at 51st in February, dropped to 61st in March, and then made a significant leap to 38th in April. This upward trajectory in April suggests a positive change in consumer perception or strategy that could be capitalized on for future growth. In comparison, Hippies experienced a notable rise from 46th in February to 18th in March, before settling at 31st in April, indicating a volatile but strong performance. Meanwhile, Kynd Cannabis Company saw a decline from 24th in January to 41st in April, suggesting potential challenges in maintaining its market position. ME's ability to improve its rank amidst these fluctuations highlights its potential to capture a larger market share if it continues to leverage the factors contributing to its recent success.

Notable Products

In April 2025, the top-performing product for ME was the Headband Pre-Roll (1g) in the Pre-Roll category, which climbed to the number one spot with sales reaching 2201 units. Following closely, Orange Beltz Pre-Roll (1g) secured the second position, maintaining its strong performance from previous months, with a notable increase in sales to 2142 units. Mimosa Pie Pre-Roll (1g) also showed a significant rise, moving up to third place with sales of 2118 units. The Headband (3.5g) in the Flower category saw an improvement, reaching the fourth position, despite not being ranked in March. Berry Bombs Pre-Roll (1g) entered the rankings for the first time at fifth place, demonstrating emerging popularity in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.