Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

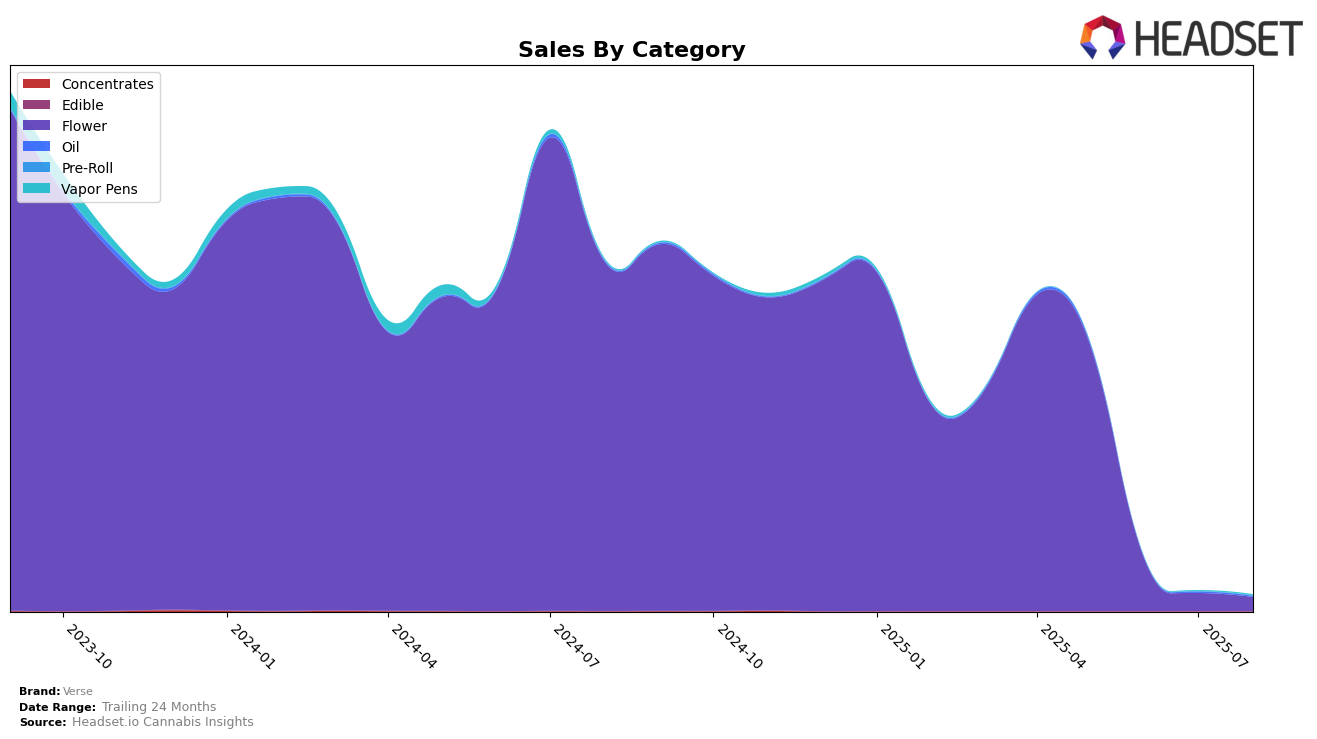

In the cannabis market, Verse has shown varied performance across different categories and regions. In the Alberta market, Verse's presence in the Flower category has not been strong enough to place it within the top 30 brands, indicating potential challenges in gaining market traction or facing stiff competition. Meanwhile, in Ontario, Verse also did not secure a top 30 position in the Flower category, suggesting a similar competitive landscape or a need for strategic adjustments to improve brand visibility and sales performance in this category.

Analyzing sales trends, it's noteworthy that Verse's sales figures in Ontario were significantly higher than in Alberta, with Ontario recording sales of 141,770 CAD in May 2025 compared to Alberta's 33,789 CAD. This discrepancy points to a larger consumer base or stronger brand affinity in Ontario, despite the lack of top 30 rankings. Such data highlights the importance of regional strategies tailored to market dynamics and consumer preferences. The absence of ranking data for June through August 2025 further emphasizes the need for Verse to reassess its market positioning and competitive strategies to enhance its presence in these provinces.

Competitive Landscape

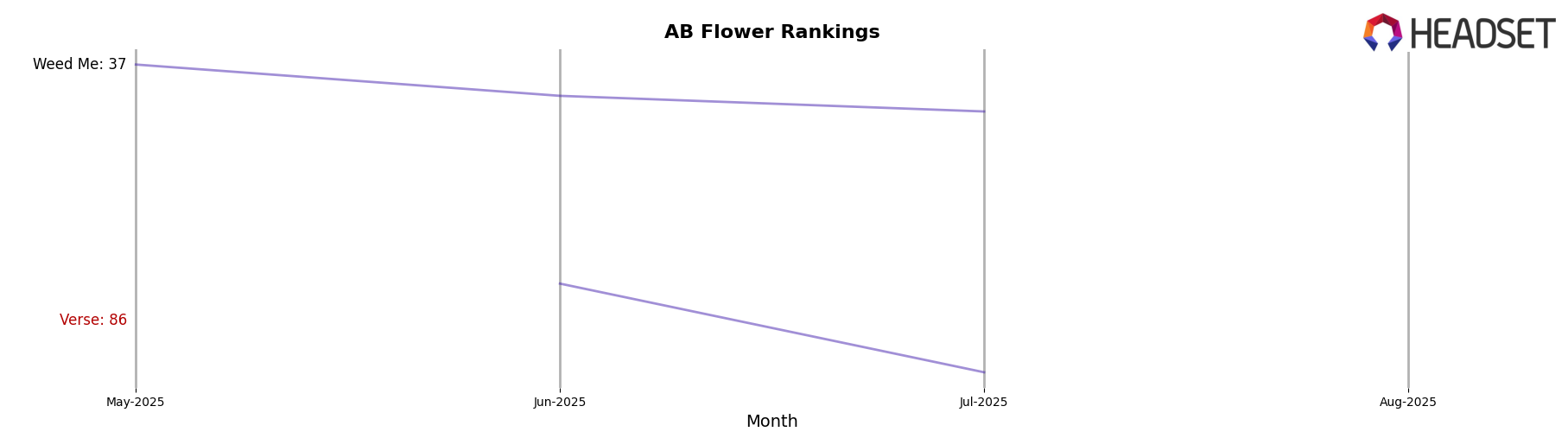

In the competitive landscape of the flower category in Alberta, Verse has experienced notable fluctuations in its market presence. In May 2025, Verse was ranked 86th, but it did not appear in the top 20 for the subsequent months, indicating a potential decline in its competitive standing. This contrasts with brands like Weed Me, which consistently maintained a higher rank, although it also faced a downward trend from 37th in May to being absent from the top 20 by August. Meanwhile, Stigma Grow and Dab Bods re-entered the rankings in August at 87th and 50th respectively, suggesting a resurgence in their market activity. Western Cannabis showed a decline from 79th in June to 96th in July, further illustrating the dynamic shifts within this market. These movements highlight the competitive pressures Verse faces, emphasizing the need for strategic adjustments to regain and sustain a stronger market position.

Notable Products

In August 2025, the top-performing product for Verse was BC God Bud (28g) in the Flower category, maintaining its number one rank for four consecutive months, despite a decline in sales to 77 units. CBD Drops (20ml) in the Oil category also held steady at the second rank throughout this period, with a modest sales figure of 21 units in August. Notably, the Originals - Tropic Lemon Distillate Cartridge (0.3g) emerged as a strong contender in the Vapor Pens category, securing the second rank in August. This product was not ranked in previous months, indicating a significant rise in popularity. Similarly, the Originals - Tropic Lemon Distillate Cartridge (1g) entered the rankings in July at third place, showcasing a growing interest in Verse's vapor pen offerings.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.