Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

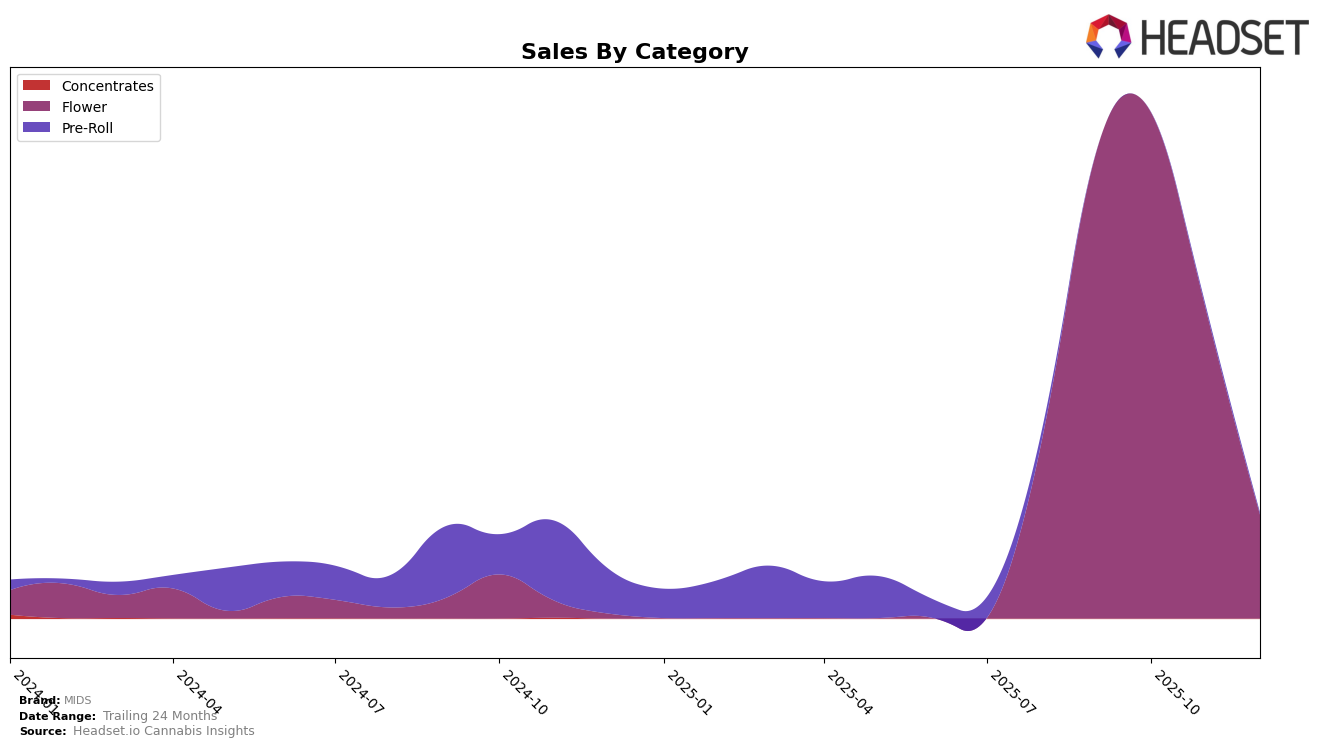

In the competitive landscape of cannabis brands, MIDS has experienced notable fluctuations in its performance across different categories and states. In Saskatchewan, the brand's presence in the Flower category has seen a significant decline over the months from September to December 2025. MIDS started strong with a rank of 2 in September, but by December, it dropped to the 29th position, indicating a substantial decrease in market traction. This downward trend is further highlighted by the sales figures, which show a marked reduction from over 287,000 in September to just over 63,000 by December. Such a drop suggests challenges in maintaining consumer interest or perhaps increased competition in the Flower category within the province.

While the Saskatchewan market shows a declining trajectory for MIDS, it is important to note that the brand's performance in other categories or states might tell a different story. The absence of MIDS from the top 30 rankings in any other state or category during these months could be interpreted as a need for strategic realignment or expansion efforts. The data suggests that while MIDS had a strong start, sustaining that momentum has proven difficult, particularly in the Flower category in Saskatchewan. This performance could prompt the brand to reconsider its approach to market penetration and product offerings to regain its standing in the competitive cannabis industry.

Competitive Landscape

In the competitive landscape of the Flower category in Saskatchewan, MIDS has experienced significant fluctuations in its rank from September to December 2025, indicating a dynamic market presence. Initially holding a strong position at rank 2 in September, MIDS saw a decline to rank 29 by December. This drop in rank is mirrored by a decrease in sales, which plummeted from a high in October to a much lower figure by December. In contrast, EastCann showed a notable improvement, moving from rank 24 in September to 14 in November, before settling at 27 in December, with sales peaking in November. Meanwhile, JC Green Cannabis Company and Freedom Cannabis both experienced fluctuations, with JC Green Cannabis Company dropping out of the top 20 by December and Freedom Cannabis showing a positive trend by climbing to rank 29 in November. These shifts highlight a competitive environment where MIDS must strategize to regain its earlier market dominance amidst rising competitors.

Notable Products

In December 2025, the top-performing product for MIDS was Animal Cookies (28g) in the Flower category, climbing to the number one spot with sales of 566 units. Animal Cookies (3.5g) also saw a significant rise, reaching the second position, up from fourth in November. Animal Cookies (7g) secured the third rank, showing a consistent upward trend. Winter Berry Pre-Roll 7-Pack (3.5g) entered the top rankings at fourth place, indicating a growing interest in pre-rolls. Notably, Indica Blend (28g), which had consistently held the top rank in previous months, dropped to fifth place with a dramatic decrease in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.