Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

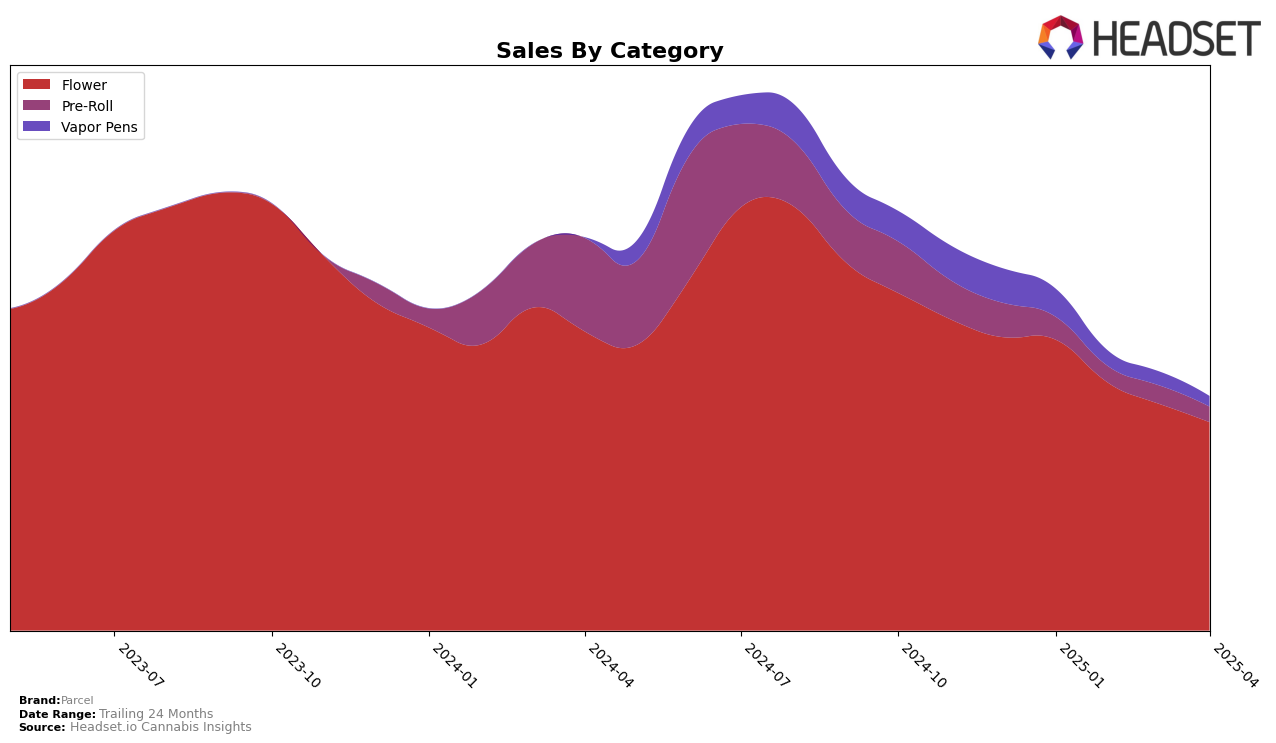

Parcel's performance across various categories and regions reveals a mixed but insightful picture. In British Columbia, the brand has shown consistent presence in the Flower category, maintaining a rank within the top 20, specifically ranging from 14th to 17th over the first four months of 2025. This steady ranking suggests a solid foothold in the Flower market within the province. In contrast, Parcel's performance in the Pre-Roll category in the same province is less stable, with a notable absence from the top 30 ranks in February and April, indicating potential challenges or fluctuations in market demand or distribution effectiveness in this category.

In Ontario, Parcel's presence in the Flower category has seen a downward trend, with its rank slipping from 28th in January to 38th by April. This decline might signal increasing competition or shifting consumer preferences. Meanwhile, in the Vapor Pens category, Parcel's ranking has consistently fallen, from 48th in January to 74th by April. This trend may point to a need for strategic adjustments to regain market share. Interestingly, in Alberta, Parcel's absence from the top 30 in the Flower category throughout the months analyzed suggests a significant opportunity for growth or a need for strategic reevaluation in that market.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, Parcel has experienced notable fluctuations in its market position from January to April 2025. Initially ranked 14th in January, Parcel saw a slight dip to 15th in February, further declining to 17th in March before recovering slightly to 16th in April. This trend indicates a challenging market environment, with competitors like Jonny Chronic consistently maintaining a stronger position, ranking 12th in February and 14th in both March and April. Meanwhile, 1964 Supply Co experienced a downward trend, dropping from 8th in January to 17th in April, which may suggest an opportunity for Parcel to capitalize on the shifting dynamics. Additionally, Grasslands showed a stable performance, maintaining a rank between 14th and 15th throughout the period, reflecting a resilient market presence. Parcel's sales figures have shown a consistent decline over these months, highlighting the need for strategic adjustments to regain competitive ground in this evolving market.

Notable Products

In April 2025, Sweet Notes (14g) reclaimed the top spot in Parcel's product lineup, with sales reaching 6354 units. Sweet Notes (3.5g), which previously held the number one position in February and March, moved to second place this month. Citrus Notes Milled (7g) maintained its consistent performance, remaining steady at the third rank across the months. Grape Cream Cake (14g) climbed to fourth place, showing a notable increase from its debut in March. Sweet Notes Milled (7g) re-entered the rankings, taking the fifth position, highlighting a resurgence in consumer interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.