Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

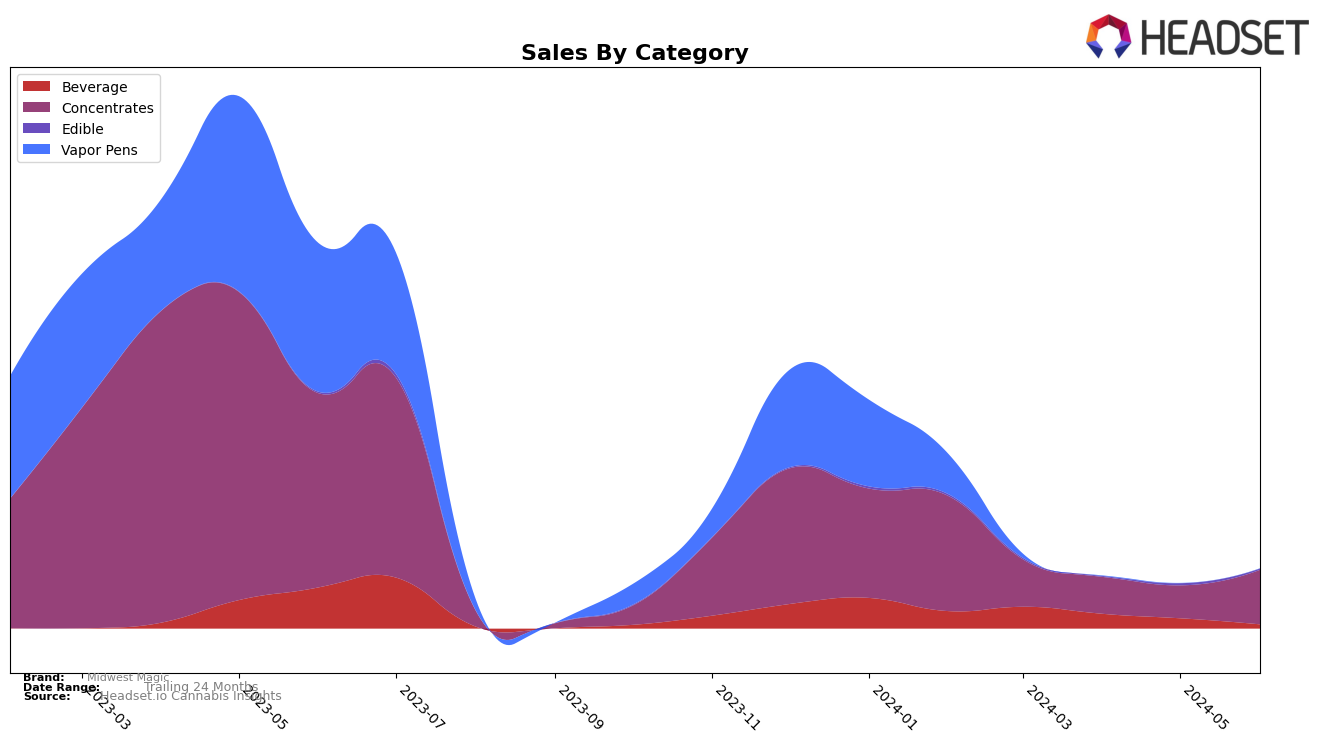

Midwest Magic has shown notable performance in the Missouri market, particularly in the Beverage category. In March 2024, the brand achieved a commendable 9th place ranking, indicating a strong presence in this segment. However, it is worth noting that Midwest Magic did not maintain its top 30 status in the subsequent months, which could be seen as a potential area of concern. This drop from visibility in the rankings might suggest a need for strategic adjustments or increased marketing efforts to regain its foothold in the Beverage category.

In the Concentrates category, Midwest Magic's performance in Missouri shows a different trend. The brand consistently hovered around the 30th rank, with a slight improvement in June 2024, moving from 35th in May to 32nd. This upward movement, coupled with a notable increase in sales from $21,059 in May to $34,951 in June, indicates a positive trend and potential growth in this segment. The fluctuations in ranking and sales highlight the dynamic nature of the market and the need for continuous adaptation to maintain and improve brand positioning.

Competitive Landscape

In the Missouri concentrates market, Midwest Magic has demonstrated a fluctuating but generally stable performance over the past few months. While the brand ranked 33rd in March 2024, it saw a slight dip to 36th in April before climbing back up to 32nd by June. This indicates a resilient recovery, especially considering the competitive landscape. Notably, Notorious has consistently outperformed Midwest Magic, maintaining a top 30 position throughout the same period, which suggests a stronger market presence and potentially higher customer loyalty. On the other hand, Vertical (MO) experienced a significant drop from 21st in March to 35th in June, which could indicate potential market opportunities for Midwest Magic to capitalize on. Additionally, Lush Labs entered the rankings in April at 40th and has been gradually improving, posing a potential emerging threat. Overall, Midwest Magic's ability to rebound in rank and increase sales in June suggests a positive trend, but the brand must remain vigilant of both established competitors and new entrants to sustain its growth.

Notable Products

In June 2024, the top-performing product for Midwest Magic was Kush Cake Cured Sugar Sauce (1g) in the Concentrates category, which saw a significant spike in sales to 1067 units, climbing from third place in March 2024. Super Boof Crumble (1g) also performed well, securing the second spot with 538 units sold, up from fifth place in March 2024. Tropicana Cherry Diamonds & Sauce (1g) debuted in third place with 530 units sold. Lemon Lime Full Spectrum Mixer (150mg) in the Beverage category ranked fourth, maintaining a consistent presence in the top five from its third-place ranking in April 2024. White Runtz Diamonds and Sauce (1g) rounded out the top five with 335 units sold, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.