Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

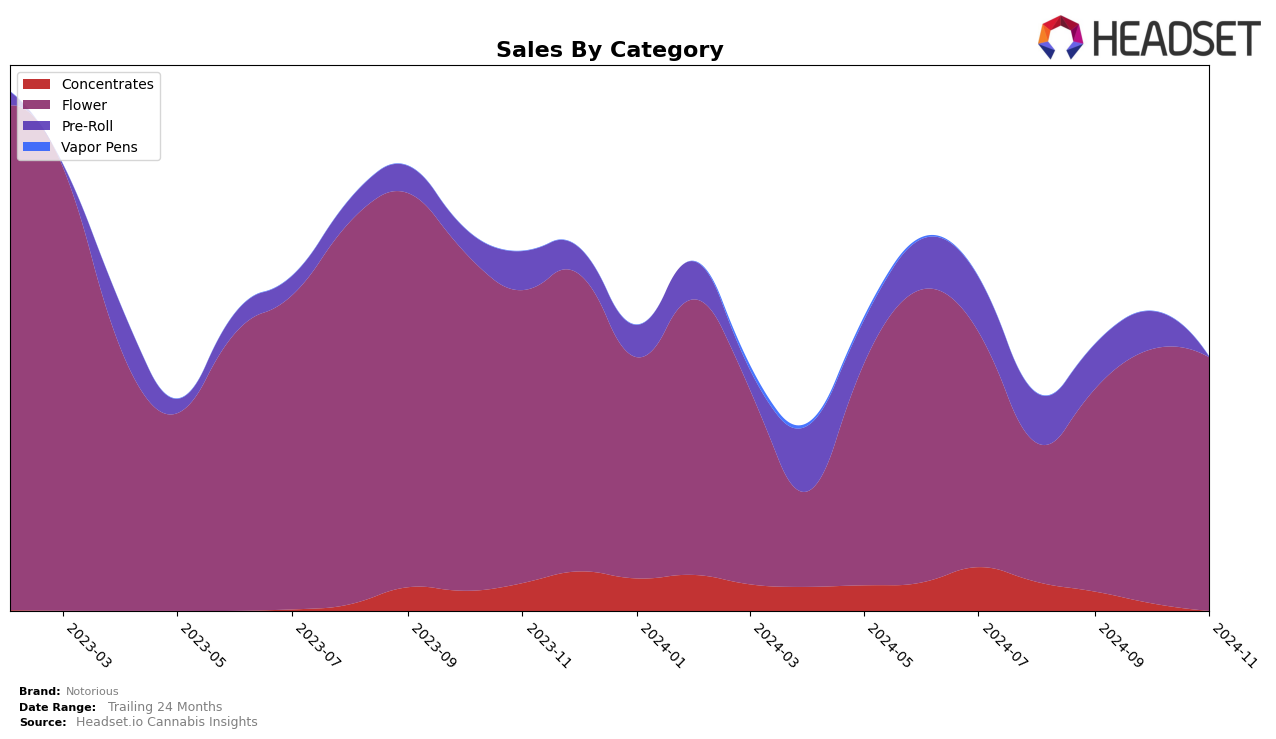

In the state of Missouri, Notorious is experiencing varied performance across different cannabis categories. For the Concentrates category, the brand has seen a downward trend, starting at rank 29 in August 2024 and slipping out of the top 30 by November 2024. This suggests a decline in market presence or increased competition within this category. Conversely, in the Flower category, Notorious has shown significant improvement, climbing from rank 40 in August to securing the 30th position by November. This upward trajectory indicates a strengthening foothold in the Flower market, potentially driven by increased consumer preference or effective product positioning.

Notorious's performance in the Pre-Roll category in Missouri also highlights some challenges, as the brand was ranked 34th in August but did not maintain a top 30 position by November 2024. This drop could point to a need for strategic adjustments to regain market share. Despite these fluctuations, it's noteworthy that Notorious's Flower sales have remained robust, with sales figures peaking in October before slightly declining in November. These trends suggest that while Notorious is making headway in certain areas, particularly in Flower, there are opportunities for growth and improvement in other categories such as Concentrates and Pre-Rolls.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Notorious has shown a notable upward trend in rankings, moving from 40th place in August 2024 to a consistent 30th place by October and November 2024. This improvement is indicative of a positive trajectory in sales performance, as evidenced by a steady increase from August to October, with sales stabilizing in November. In contrast, CAMP Cannabis experienced fluctuations, peaking at 21st place in both August and October but dropping to 28th in November, suggesting potential volatility in their market position. Meanwhile, The Solid made a significant leap from 38th in October to 29th in November, surpassing Notorious in rank, which could pose a competitive challenge. Additionally, Royal Cannabis (WA) and The Standard remained outside the top 20, indicating that while they are competitors, they currently do not pose a direct threat to Notorious' upward momentum in the Missouri flower market.

Notable Products

In November 2024, Triple Burger (3.5g) emerged as the top-performing product for Notorious, climbing from the second position in September to secure the first place with sales reaching 3,078 units. Black Maple (3.5g) also showed significant improvement, advancing from the fourth rank in August to second place in November, with sales figures of 2,706 units. Melted Strawberries (3.5g) debuted strongly at the third position, while Grape Topanga Z (3.5g) entered the rankings at fourth place. Scooby Snax (3.5g) maintained its fifth position from October to November, despite fluctuating rankings in previous months. Overall, November saw notable shifts in product rankings, with new entries and improved performances among the top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.