Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

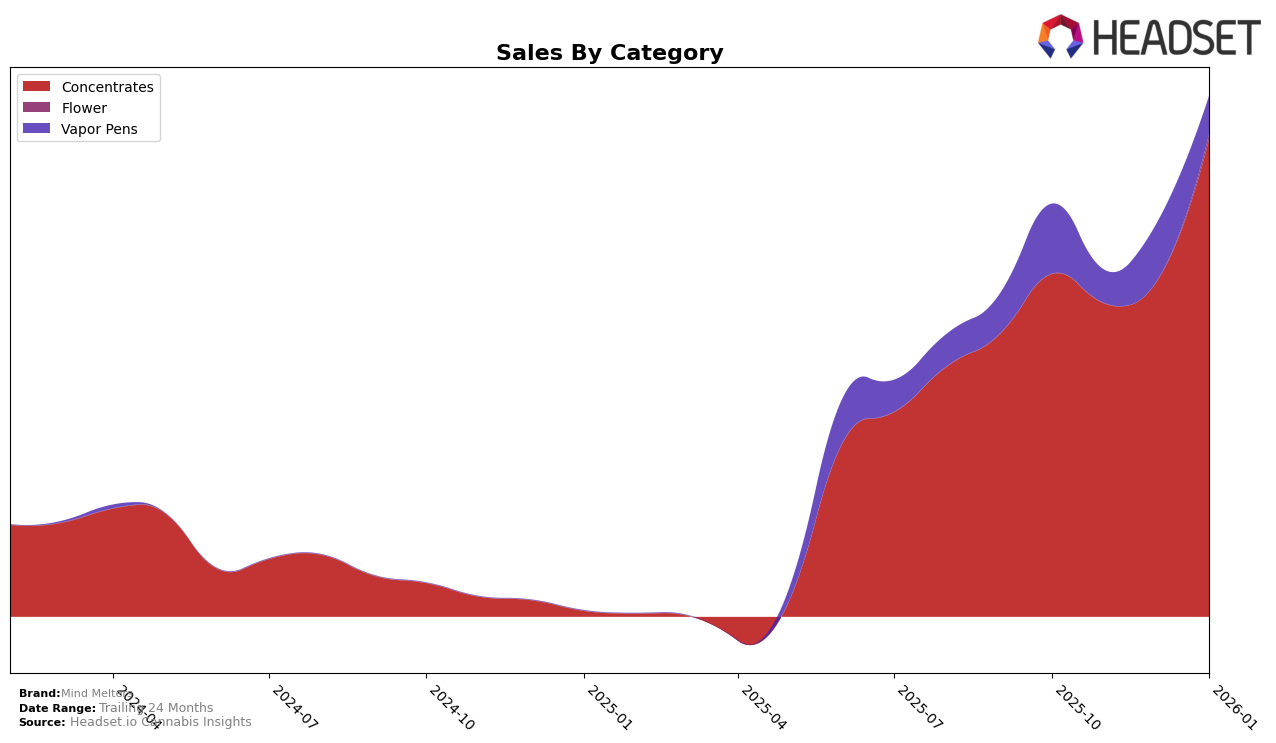

Mind Melters has shown a fluctuating performance in the New York concentrates market over the past few months. In October 2025, they were ranked 26th, but by November, they slipped to 29th. This downward trend continued into December when they fell out of the top 30. However, January 2026 marked a significant recovery for the brand, as they climbed back to the 26th position. This rebound coincided with a noticeable increase in sales, suggesting a successful strategy or product launch that resonated well with consumers. The ability to recover and regain a position within the top 30 highlights Mind Melters' resilience and potential to maintain a competitive edge in the market.

While Mind Melters managed to secure a spot in the top 30 in New York for most months, their absence from the December ranking indicates challenges that may have affected their market presence. This absence could point to increased competition or internal factors impacting their performance. The sales figures for January 2026, however, show a substantial improvement, suggesting that the brand successfully addressed these challenges. The fluctuating rankings underscore the dynamic nature of the concentrates market in New York and highlight the importance for brands like Mind Melters to continuously adapt to consumer preferences and market conditions.

Competitive Landscape

In the New York concentrates market, Mind Melters has experienced fluctuating rankings over the past few months, indicating a competitive landscape. While Mind Melters ranked 26th in October 2025 and January 2026, it dropped to 29th and 31st in November and December 2025, respectively. This volatility contrasts with competitors like Pines/ A Walk In The Pines, which maintained a stronger presence with a peak rank of 18th in November 2025, and Waferz, which showed a consistent upward trend from 34th in November to 27th in January 2026. Additionally, Head & Heal and Hepworth both demonstrated significant improvements, with Head & Heal climbing from 41st in November to 24th by January 2026. Despite the challenges, Mind Melters' sales saw a notable increase in January 2026, suggesting a potential recovery and an opportunity to regain higher rankings if the trend continues.

```

Notable Products

In January 2026, Gelonade Cold Cure Live Rosin (1g) emerged as the top-performing product for Mind Melters, maintaining its leading position with a notable sales figure of 115 units. Lemon Cherry Gelato Cold Cure Live Rosin (1g) climbed to the second position, showing a substantial increase from its fourth position in November 2025. Mendo Crumble Cold Cure Live Rosin (1g) secured the third spot, dropping from its first-place ranking in December 2025. Green Crack Live Rosin (1g) re-entered the rankings at fourth place after being absent in December 2025. Kiwi Kush x Lemon Cherry Gelato Cold Cure Live Rosin (1g) made its debut at fifth place, indicating a new addition to Mind Melters' top products lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.