Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

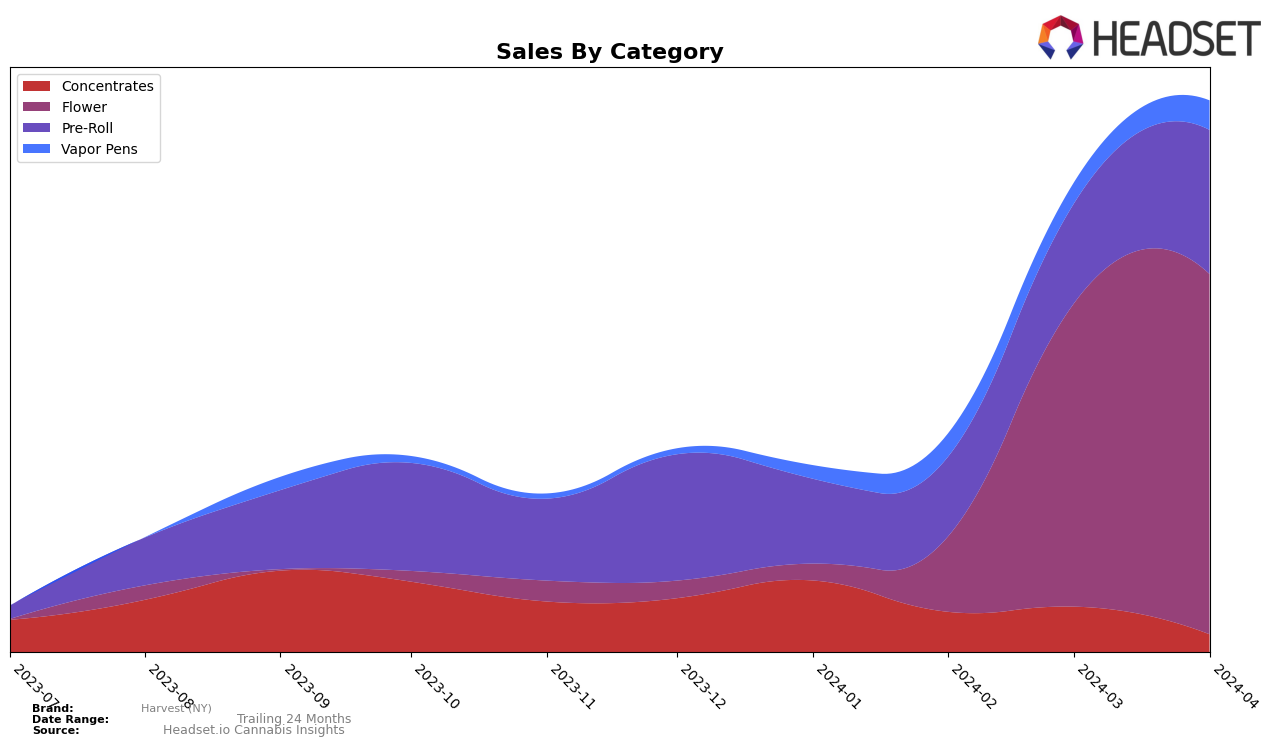

In the competitive cannabis market of New York, Harvest (NY) has shown a notable presence in both the Flower and Pre-Roll categories, albeit with room for growth. For the Flower category, their ranking remained static at 54th place in both March and April 2024, indicating a stable but not leading position within this segment. This stability is mirrored in their sales figures, which saw a rise from 32,264 in March to 38,268 in April, suggesting a growing consumer base or increased purchase frequency among existing customers. However, the absence of ranking data for January and February implies that Harvest (NY) was not among the top 30 brands during those months, highlighting a significant improvement in their market performance starting in March.

Similarly, in the Pre-Roll category, Harvest (NY) maintained a consistent rank at 57th place during March and April 2024. This consistency, much like in the Flower category, suggests a steady demand for their Pre-Rolls among New York consumers. The sales trajectory for Pre-Rolls also reflects positive momentum, with sales increasing from 10,595 in March to 15,284 in April. This growth trajectory, while promising, also underscores the potential for Harvest (NY) to further capitalize on market opportunities and climb higher in the rankings. The lack of top 30 rankings in the initial months of the year across both categories indicates a later surge in performance, marking an area for potential strategic focus to maintain and enhance their market presence in New York.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Harvest (NY) has shown a notable entry and positioning within the market. Despite not being ranked in the top 20 brands for January and February of 2024, Harvest (NY) made a significant entrance in March, securing the 54th rank, and maintained this position into April. This is a remarkable achievement considering the brand's recent entry into the rankings. Competitors such as Flower by Edie Parker and urbanXtracts have shown fluctuating ranks but remained within the top 50, indicating a more established presence in the market. Specifically, urbanXtracts has demonstrated a consistent performance, moving from the 37th rank in January to the 47th in April, with sales trends generally increasing. In contrast, FLWR CITY and Bison Botanics have experienced more significant rank volatility and overall lower sales compared to urbanXtracts. Harvest (NY)'s entry and subsequent performance suggest a growing brand presence and potential challenge to its competitors, signaling an interesting dynamic to watch in the evolving New York Flower market.

Notable Products

In April 2024, Harvest (NY) saw Skywalker OG (3.5g) from the Flower category leading the sales charts, marking a consistent top position since March with 573 units sold. Following closely, Wedding Cake Pre-Roll (1g) and Strawberry Cough Pre-Roll (1g) from the Pre-Roll category secured the second and third spots, respectively, showcasing their enduring popularity. The Blue Dream Pre-Roll (1g) made a notable entry to the fourth rank, indicating a rising preference among consumers. Peyote Cookies Pre-Roll (1g) rounded out the top five, maintaining a steady presence in the rankings despite fluctuating sales figures. These rankings highlight a diverse consumer interest within Harvest (NY)'s product range, with a particular emphasis on Pre-Rolls, which dominated the top sales positions in April 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.