Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

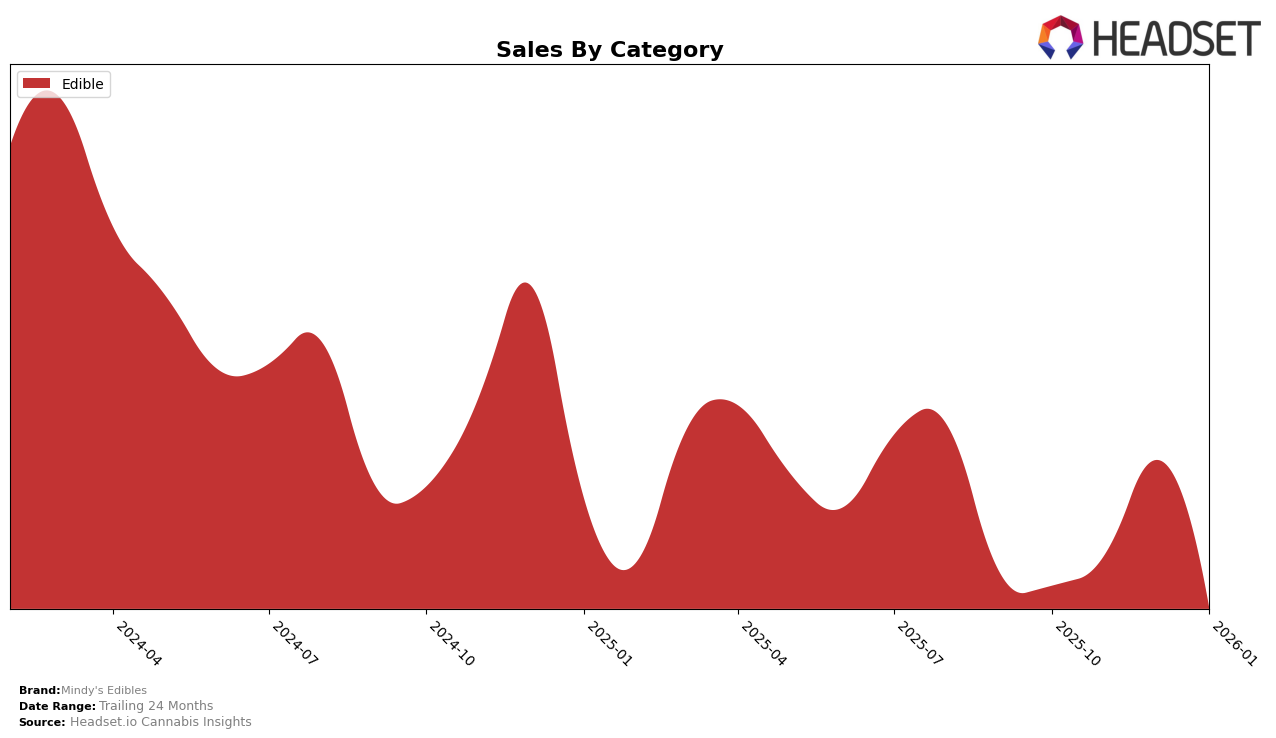

Mindy's Edibles has shown varied performance across different states and categories, reflecting both strengths and areas of potential growth. In Illinois, the brand consistently maintained a presence in the top 15 for the Edible category from October 2025 to January 2026, with rankings fluctuating slightly but remaining stable. Notably, their sales in Illinois peaked in December 2025, indicating a strong holiday season performance. However, their ranking dropped back to 15th in January 2026, suggesting a potential challenge in sustaining post-holiday momentum. This consistent presence in the top rankings highlights a solid market position in Illinois, though there is room for improvement in maintaining higher rankings throughout the year.

In contrast, Mindy's Edibles experienced a slight decline in their rankings in Massachusetts, where they started at 12th place in October and November 2025 but fell to 14th by December and January. This downward trend in rankings, coupled with a decrease in sales from November to January, suggests a need for strategic adjustments to regain a stronger foothold in the Massachusetts market. Despite these challenges, the brand's ability to remain within the top 15 indicates a resilient presence, although not appearing in the top 10 may be seen as a missed opportunity for greater market influence in the state.

Competitive Landscape

In the competitive landscape of the Illinois edible cannabis market, Mindy's Edibles experienced notable fluctuations in its rank over the past few months. Starting in October 2025, Mindy's Edibles held the 15th position, improved to 13th in November and December, but then slipped back to 15th by January 2026. This indicates a dynamic competitive environment where Mindy's Edibles is vying for a stable position amidst strong competitors. For instance, Hijinx consistently improved its rank from 16th in October to 14th by January, showing a steady upward trend that could pose a challenge to Mindy's Edibles. Meanwhile, Betty's Eddies maintained a higher rank than Mindy's Edibles, despite a slight dip in December, suggesting robust sales performance. Additionally, Nature's Grace and Wellness and Good Tide remained in the lower ranks, indicating that while they are competitors, they currently pose less of a threat to Mindy's Edibles' market position. These dynamics highlight the need for Mindy's Edibles to strategize effectively to maintain and improve its market share in this competitive landscape.

Notable Products

In January 2026, the top-performing product from Mindy's Edibles was the CBD/THC 1:1 Lush Black Cherry Gummies 20-Pack, maintaining its consistent rank of 1 since October 2025, despite a slight decrease in sales to 9,583 units. The Glazed Clementine Orange Gummies 20-Pack held steady at the second position, mirroring its rank from previous months. Freshly Picked Berries Gummies 20-Pack (100mg) also retained its third-place ranking, although its sales figures showed a decline. The Freshly Picked Berries Gummies 20-Pack (50mg) stayed at fourth place, consistent with its ranking since November 2025. Notably, the Cool Keylime Kiwi Gummies 20-Pack reappeared in the rankings at position five, after not being ranked in November and December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.