Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

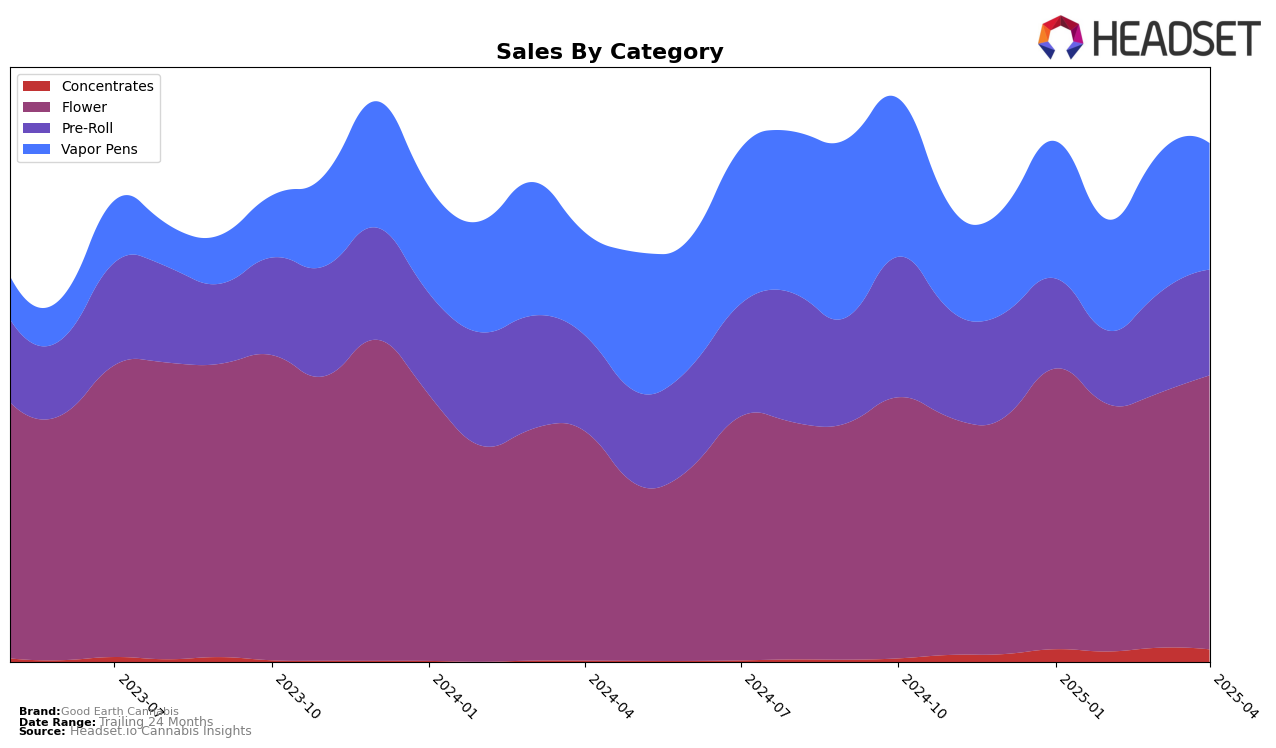

Good Earth Cannabis has shown a varied performance across different product categories in Washington. In the Flower category, the brand experienced a slight dip in March 2025, dropping out of the top 30 rankings, but managed to recover by April 2025, climbing back to the 26th position. This indicates a resilient market strategy that allowed them to regain traction. Notably, their Flower sales fluctuated, with a decrease in February followed by a recovery in subsequent months. In contrast, their Pre-Roll category performance has seen a steady improvement, moving from 47th in January to 40th by April, suggesting a growing consumer interest in this product line. This upward trend in Pre-Rolls could be a key area for Good Earth Cannabis to focus on for sustained growth.

The Vapor Pens category tells a different story, with Good Earth Cannabis maintaining a relatively stable presence, though consistently outside the top 30. The rankings hovered around the mid-40s throughout the first four months of 2025. Despite not breaking into the top 30, the brand's sales in this category showed some fluctuations, with a notable increase in March. This consistency, albeit outside the top tier, suggests a loyal customer base for their vapor products. The brand's ability to maintain and slightly improve its position in the Vapor Pens category could be seen as a positive sign, but there is room for strategic enhancements to push further into the competitive landscape.

Competitive Landscape

In the competitive landscape of the Washington flower market, Good Earth Cannabis has demonstrated a noteworthy upward trajectory in recent months. After starting the year ranked 29th in January 2025, Good Earth Cannabis improved its position to 26th by April 2025, showcasing resilience and growth amidst fluctuating market dynamics. This upward movement is particularly significant given the competitive pressure from brands like Smokey Point Productions (SPP), which saw a decline from 12th to 24th place over the same period, and Mini Budz, which also experienced a drop from 18th to 25th. Meanwhile, Snickle Fritz remained relatively stable, moving from 34th to 28th. Despite these shifts, Good Earth Cannabis's ability to climb the ranks suggests effective strategies in capturing market share, potentially driven by consumer preference or strategic marketing initiatives. This positive trend positions Good Earth Cannabis favorably for continued growth in the Washington flower market.

Notable Products

In April 2025, Purple Tangie (3.5g) emerged as the top-performing product for Good Earth Cannabis, achieving the number one rank with sales of 1499 units. Pineapples in Space Pre-Roll 2-Pack (1g) maintained its consistent performance by holding the second rank for the third consecutive month, showing a slight dip in sales to 1209 units. Pineapples In Space (3.5g) dropped to the third position after three months of leading the sales charts, indicating a decrease in its sales momentum. Wedding Cake (3.5g) held steady at fourth place, showing a gradual increase in sales compared to previous months. Super Cherry (3.5g), a new entrant, debuted at the fifth position, marking its presence in the top-selling products for the first time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.