Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

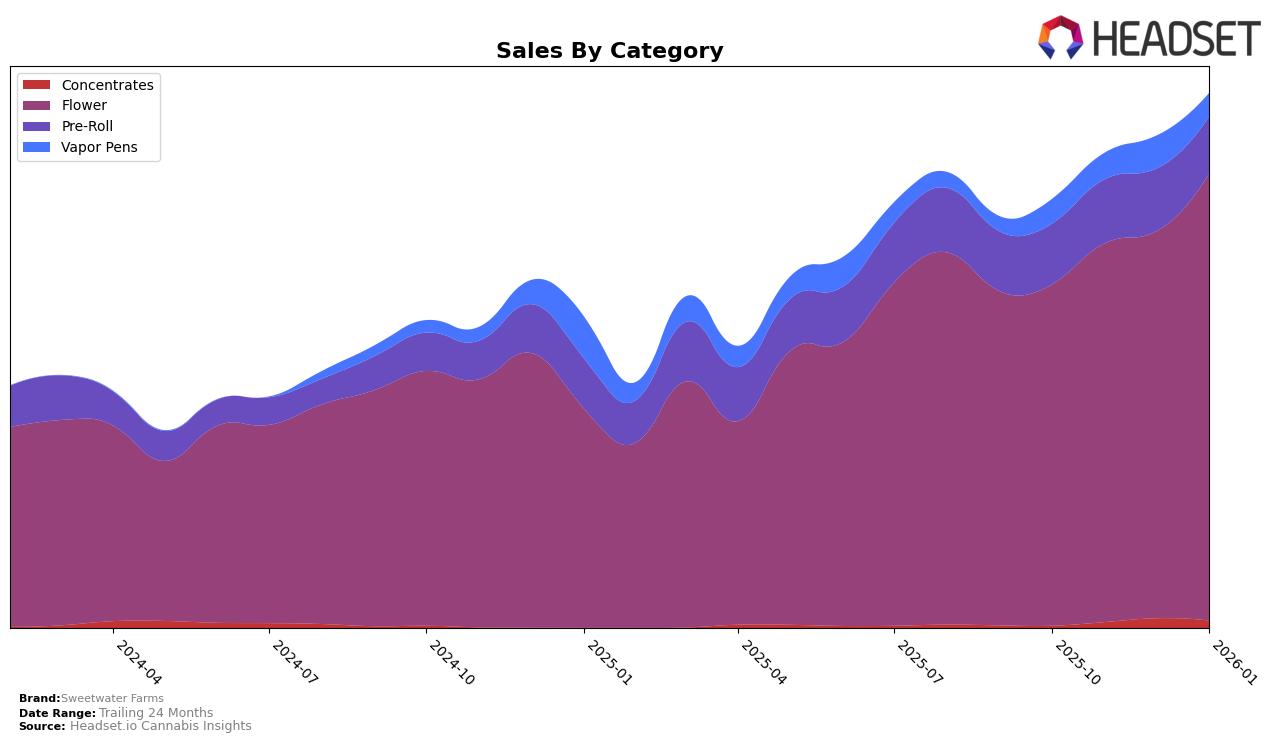

Sweetwater Farms has shown a notable upward trajectory in the Washington flower category over the past few months. Starting from a rank of 14 in October 2025, the brand climbed to the 6th position by January 2026. This consistent improvement in ranking is accompanied by a significant increase in sales, indicating a strengthening market presence in the flower category. However, in the pre-roll category, Sweetwater Farms has not yet managed to break into the top 30, which could suggest potential growth opportunities or areas needing strategic focus.

In the vapor pens category, Sweetwater Farms was not ranked in the top 30 until December 2025, when it entered at the 90th position. Although this entry indicates a presence in the market, the lack of ranking in previous months suggests that Sweetwater Farms is still establishing itself in this category within Washington. The brand's performance in the flower category, however, highlights its strength and competitive edge, which could potentially be leveraged to improve standings in other product categories like pre-rolls and vapor pens.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Sweetwater Farms has demonstrated a notable upward trajectory in rankings from October 2025 to January 2026. Starting at 14th place in October, Sweetwater Farms climbed to 6th by January, indicating a significant improvement in market position. This rise is particularly impressive when compared to competitors such as Viking Cannabis, which fluctuated between 7th and 10th place during the same period. Meanwhile, Redbird (formerly The Virginia Company) and Lifted Cannabis Co maintained relatively stable positions, with Redbird consistently ranking in the top 5 and Lifted Cannabis Co showing slight variability but remaining in the top 7. Despite EZ Flower / EZ Puff / EZ-Joint experiencing a decline from 4th to 7th, Sweetwater Farms' sales growth trajectory suggests a strong competitive edge, potentially driven by strategic marketing or product differentiation, as it continues to close the gap with higher-ranked brands.

Notable Products

In January 2026, Sweetwater Farms' top-performing product was Alaskan Thunder Fuck (3.5g) in the Flower category, maintaining its number one position from November 2025 and showing a significant sales increase to 1790 units. Laughing Gas (3.5g) emerged as a strong contender, securing the second rank with notable sales of 1541 units, despite not being ranked in the previous months. Black Maple (3.5g) entered the rankings at third place, indicating a successful launch or promotion. Huckleberry Pie (3.5g) dropped from its previous top position in October 2025 to fourth place, although it showed a recovery from its rank in November and December 2025. Lastly, Sin City Sugar Pre-Roll 2-Pack (1g) debuted in the fifth position, marking its entry into the top rankings for the first time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.