Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

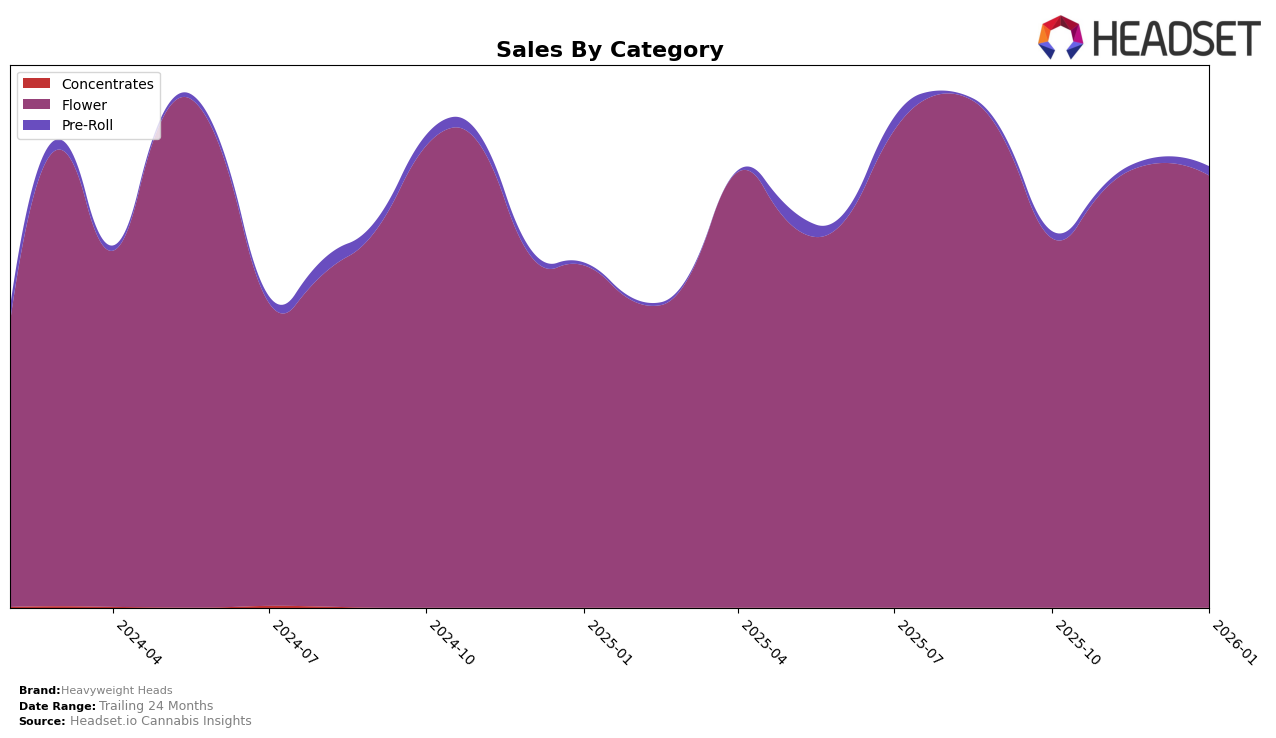

Heavyweight Heads has demonstrated notable performance within the Michigan cannabis market, specifically within the Flower category. Over the four-month period from October 2025 to January 2026, the brand climbed from the 30th position to the 20th, showing a consistent upward trajectory. This improvement is reflected in their sales figures, which peaked in December 2025. The brand's ability to secure a place within the top 30 consistently in Michigan's Flower category indicates a strong market presence and growing consumer preference. However, the slight dip in sales from December to January suggests a potential seasonal fluctuation or increased competition that may need to be addressed.

In contrast, the performance of Heavyweight Heads in New Jersey reveals a more challenging landscape. While the brand did not secure a top 30 position in the Flower category initially, it showed significant improvement, moving up to the 47th position by January 2026. This upward movement, particularly the jump in January, suggests a growing recognition and acceptance among New Jersey consumers. Additionally, the brand's entry into the Pre-Roll category in January 2026, debuting at the 71st position, marks a new strategic expansion. Despite not being in the top 30, this entry could signal potential for growth and diversification in New Jersey's competitive market.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Heavyweight Heads has demonstrated a notable upward trajectory in its rankings over the past few months, moving from 30th place in October 2025 to 20th by January 2026. This improvement in rank indicates a strengthening market position, especially when compared to competitors like Glacier Cannabis, which saw a significant jump from 50th to 19th place in January 2026, suggesting a resurgence in their sales. Meanwhile, Zones experienced a gradual decline, dropping from 15th to 18th, which could reflect a potential opportunity for Heavyweight Heads to capture more market share. Tru Smoke maintained a relatively stable position, slightly fluctuating between 19th and 21st, while Guerilla Grown experienced a more volatile ranking, dropping from 16th to 22nd. These shifts highlight Heavyweight Heads' potential to capitalize on the changing dynamics within the Michigan flower market, as it continues to climb the ranks and solidify its presence among the top competitors.

Notable Products

In January 2026, Orangutan (3.5g) emerged as the top-performing product for Heavyweight Heads, climbing from a previous third place in October 2025 to the first position with sales reaching 1837 units. Sunfuel (3.5g) followed closely in second place, a new entry in the rankings with notable sales of 1630 units. My Detroit Players (Bulk) secured the third position, marking its debut in the rankings with 1495 units sold. Sunshine (Bulk) took the fourth spot, another new entry, while Sun Fuel (Bulk), which was ranked first in December 2025, dropped to fifth place in January 2026. This shift highlights a dynamic change in consumer preference towards smaller package sizes and new product entries in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.