Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

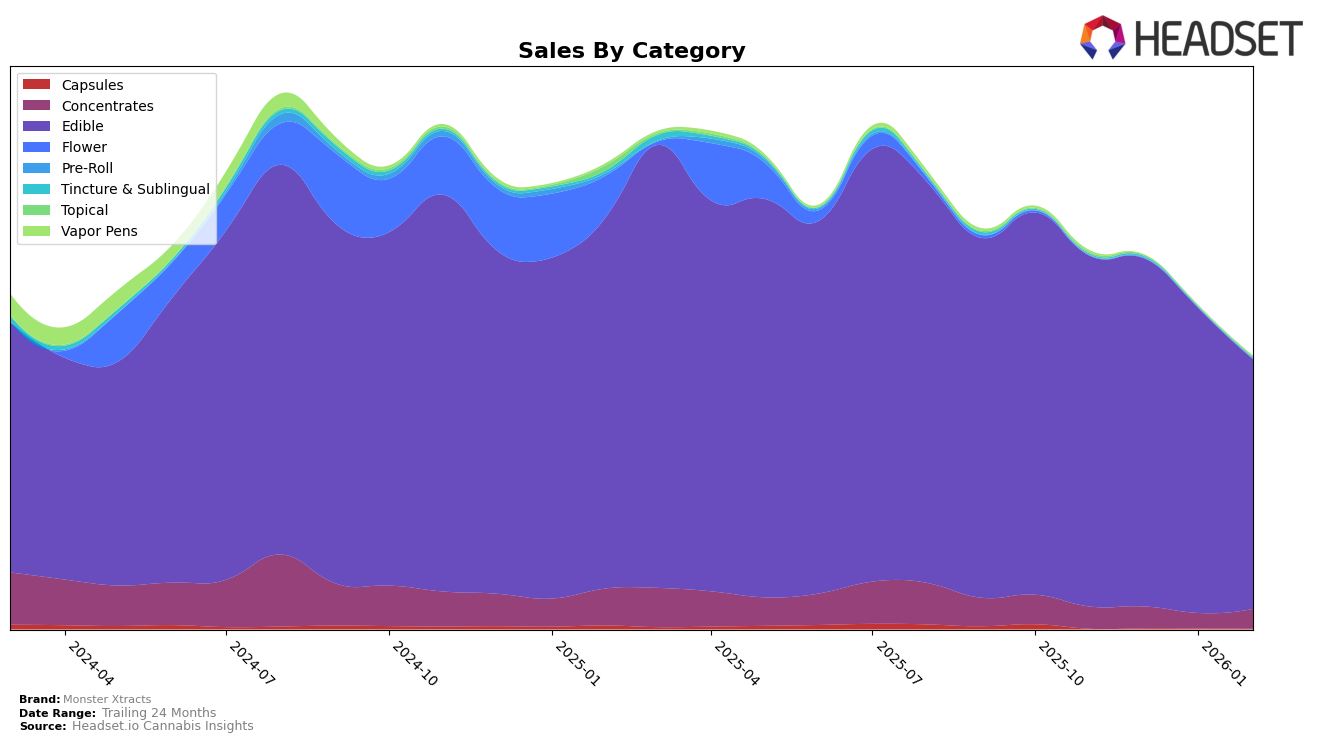

Monster Xtracts has demonstrated varied performance across different product categories and states. In the Michigan market, the brand's presence in the concentrates category has been somewhat inconsistent. While it did not feature in the top 30 brands for the past several months, it showed a slight improvement in February 2026, moving up to the 63rd position from 74th in January. This indicates a positive, albeit modest, recovery in their market positioning within this category. The sales figures, although not disclosed in detail, suggest a fluctuating trend with a noticeable dip in January, followed by a rebound in February.

In contrast, Monster Xtracts has maintained a relatively strong and stable presence in the edibles category in Michigan. The brand consistently ranked within the top 10, displaying a slight oscillation between the 6th and 7th positions over the past few months. This stability is indicative of a solid foothold in the edibles market, despite a gradual decline in sales from November to February. Such performance suggests that while the brand is facing challenges in maintaining its sales volume, its market presence remains resilient, particularly in the edibles sector.

Competitive Landscape

In the competitive landscape of the Michigan edible cannabis market, Monster Xtracts has experienced fluctuations in its ranking, holding positions between 6th and 7th from November 2025 to February 2026. Despite a consistent presence in the top 10, Monster Xtracts faces stiff competition from brands like True North Collective, which briefly surpassed Monster Xtracts in December 2025, and NOBO, which made a significant leap to 6th place in February 2026. Meanwhile, Camino consistently maintained a higher rank at 5th place throughout the period. Although Monster Xtracts' sales have shown a downward trend, especially notable in February 2026, the brand remains competitive, indicating potential for strategic growth initiatives to reclaim higher rankings and increase sales in the future.

Notable Products

In February 2026, the top-performing product from Monster Xtracts was the Hybrid Cherry Bomb Single Blaster Naut Gummy (200mg), maintaining its first-place rank from January 2026 with a sales figure of 10,171. The Indica Blue Razz Bang! Single Blaster Naut Gummy (200mg) climbed to the second position, having consistently improved its rank over the past months. Monster Medibles - Blue Raspberry Gummies 10-Pack (200mg) dropped to the third position, despite being the top ranker in November and December 2025. The Tropical Thunder Blaster Naut Gummy (200mg) maintained its fourth position from January to February 2026. Lastly, Monster Medibles - Jungle Fruit Gummies 10-Pack (200mg) entered the rankings in February 2026 at the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.