Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

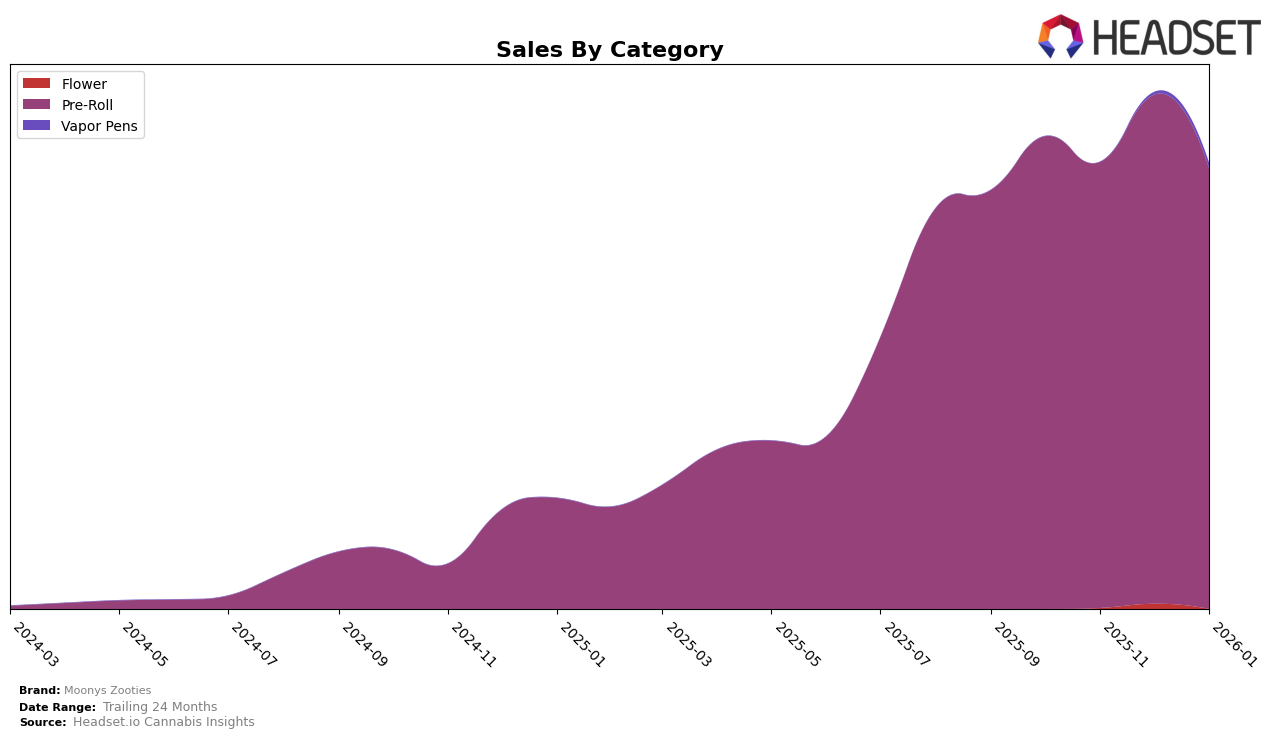

Moonys Zooties has demonstrated a consistent presence in the Pre-Roll category in New York over the last few months. The brand held a steady rank of 13 from November to December 2025, although it slightly dropped to 15 in January 2026. Despite this minor decline, the brand's ability to maintain a position within the top 15 over four consecutive months indicates a stable demand in the region. Interestingly, there was a noticeable sales increase in December 2025, suggesting a possible seasonal boost or successful marketing campaign, which might have contributed to maintaining their rank during that period.

While Moonys Zooties has shown resilience in New York, it's worth noting that they did not appear in the top 30 brands in other states or provinces during the same period. This absence could be interpreted as a potential area for growth or an indication of regional preferences that differ from New York's market. The lack of presence in other regions might suggest the brand is either focusing its efforts on specific markets or facing challenges in expanding its reach. Understanding these dynamics could help in strategizing future market entries or strengthening their position in existing ones.

Competitive Landscape

In the competitive landscape of the New York Pre-Roll category, Moonys Zooties has shown resilience and adaptability amidst fluctuating market dynamics. Over the period from October 2025 to January 2026, Moonys Zooties maintained a relatively stable ranking, peaking at 13th in November 2025 before slightly dropping to 15th by January 2026. This performance is noteworthy considering the competitive pressure from brands like PUFF, which saw a decline from 13th to 16th, and Rolling Green Cannabis, which improved its position from 15th to 14th. Meanwhile, Goodlyfe Farms demonstrated a significant upward trajectory, climbing from 34th to 13th, suggesting a potential threat to Moonys Zooties' market share. Despite these shifts, Moonys Zooties' sales figures remained robust, indicating a strong brand loyalty and consumer preference that could be leveraged for future growth in a highly competitive market.

Notable Products

In January 2026, the top-performing product from Moonys Zooties was the Tropic Cooler Pre-Roll 2-Pack (1g) in the Pre-Roll category, which claimed the number one rank with notable sales of 7043 units. The Zonuts Pre-Roll 2-Pack (1g) maintained its position at rank two, despite a consistent presence in the top two since October 2025. The Gorilla Glue Pre-Roll 2-Pack (1g) dropped to third place after previously holding the top position in December 2025. The Tropical Cooler Pre-Roll (0.5g) secured the fourth rank, maintaining its previous position from October. White Widow Pre-Roll (0.5g) entered the rankings at the fifth position, showcasing its growing popularity in the new year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.