Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

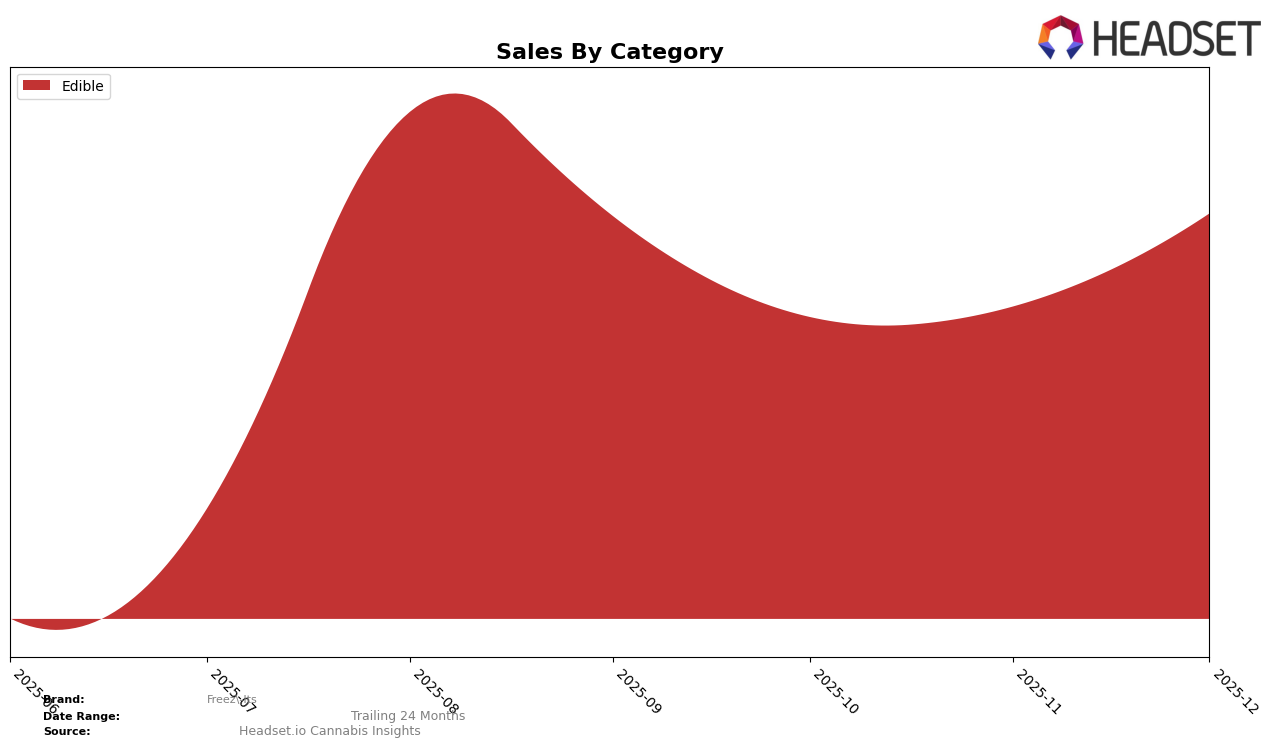

Freez-Its has shown a dynamic performance across various states and categories, with particularly interesting movements in the Edible category in Colorado. In September 2025, Freez-Its held the 29th position in the Edible category, but experienced a slight dip in October, falling to 31st. However, the brand quickly rebounded, climbing to the 28th position in November and further improving to 26th by December. This upward trend suggests a positive reception of their products, despite the initial setback in October. The fluctuations in ranking highlight the competitive nature of the Edible market in Colorado and Freez-Its' resilience and adaptability in maintaining a presence within the top 30 brands.

While Freez-Its has made notable progress in Colorado, it is important to recognize that their presence in other states and categories is not as prominent, as they did not appear in the top 30 rankings elsewhere. This absence could indicate potential areas for growth or challenges in penetrating other markets. The brand's ability to maintain and improve its position in Colorado's Edible category suggests potential strategies that could be applied to expand their footprint in other regions. Understanding the factors that contributed to their success in Colorado could provide valuable insights for Freez-Its as they aim to enhance their market presence across different states and product categories.

Competitive Landscape

In the competitive landscape of the edible cannabis category in Colorado, Freez-Its has experienced fluctuating rankings from September to December 2025, indicating a dynamic market presence. Notably, Freez-Its improved its rank from 31st in October to 26th in December, showcasing a positive trajectory despite a dip in sales in October. In contrast, Canyon and Mountain High Suckers have shown less stability, with Canyon not making it into the top 20 during this period and Mountain High Suckers maintaining a relatively consistent but lower rank. Meanwhile, Love's Oven has demonstrated a significant rise, climbing to 24th place by December, driven by a notable increase in sales. Billo remains a strong competitor, consistently ranking higher than Freez-Its, though its sales have seen a downward trend. This competitive analysis highlights the importance of strategic positioning and market adaptation for Freez-Its to capitalize on its recent upward momentum.

Notable Products

In December 2025, Rainbow Rocks Freeze Dried Treats 10-Pack (100mg) maintained its position as the top-performing product for Freez-Its, consistently ranking first with sales figures reaching 618 units. Cosmic Bursts Freeze Dried Treats 10-Pack (100mg) held steady at the second position, showing a notable increase in sales from previous months, now at 570 units. Spacecream Sandwich Freeze Dried Treats 10-Pack (100mg) ranked third, experiencing a decline in sales compared to earlier months. Astro Puffs Freeze Dried Treats 10-Pack (100mg) remained in fourth place, with sales dropping to 119 units, highlighting a consistent low performance. Overall, the rankings have shown stability, with the top three products maintaining their positions from November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.