Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

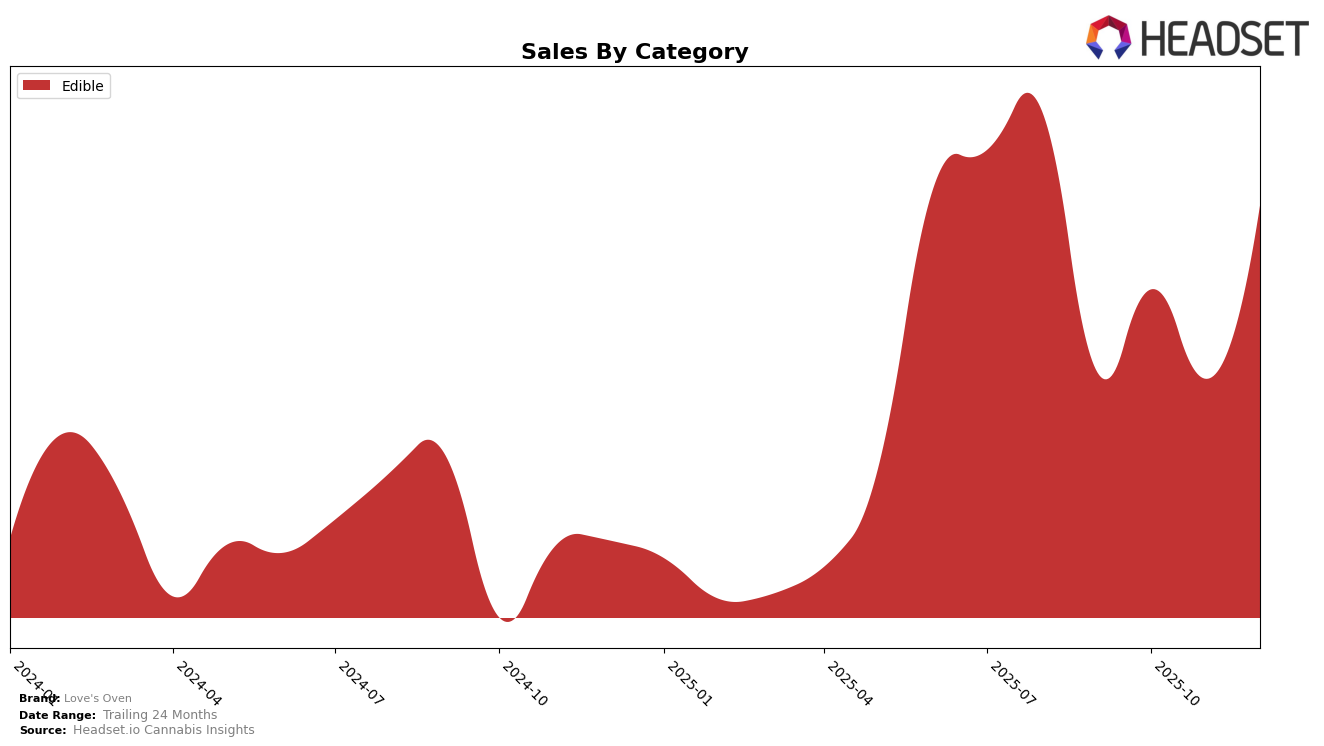

Love's Oven has shown a notable performance in the Edible category in Colorado over the last few months of 2025. The brand's ranking improved significantly from 32nd place in September to 24th place by December, indicating a positive trajectory. This upward movement suggests a growing consumer interest and potential increased market penetration within the state. Despite a slight dip in November, where the brand ranked 29th, the overall trend remains upward, demonstrating resilience and effective market strategies. The December sales figures reflect this growth, with a noticeable increase compared to previous months, highlighting a successful end to the year.

It's important to note that Love's Oven did not appear in the top 30 brands in any other states or provinces during this period, which could be seen as a limitation in their market reach. This absence in other markets might indicate an opportunity for expansion or a need to strengthen their presence outside of Colorado. The brand's focused performance in Colorado, however, suggests a strong foothold in their home state, which could serve as a solid foundation for future growth. Observing how Love's Oven navigates these dynamics in the coming months could provide further insights into their strategic direction and market adaptability.

Competitive Landscape

In the competitive landscape of the Colorado edible market, Love's Oven has demonstrated a positive trajectory in recent months. From September to December 2025, Love's Oven improved its rank from 32nd to 24th, showcasing a significant upward trend in market positioning. This advancement is particularly notable when compared to competitors like Freez-Its, which fluctuated between 29th and 26th place, and Billo, which experienced a slight decline from 24th to 25th. Meanwhile, Olio and Sinsere maintained stronger positions, with Olio moving from 27th to 23rd and Sinsere consistently holding ranks between 21st and 23rd. Despite these competitors' stable or improving standings, Love's Oven's significant increase in sales from October to December suggests a robust growth strategy that could further enhance its competitive edge in the coming months.

Notable Products

In December 2025, the top-performing product for Love's Oven was the Chocolate Solventless Chip Cookies 10-Pack (100mg), maintaining its first-place ranking with notable sales of 561 units. Indica Turtle Brownies (100mg) secured the second position, regaining its spot from September after a dip in October. Hybrid S'mores Brownies (100mg) ranked third, showing improvement from November when it was fourth. S'mores Brownies (100mg) climbed to fourth place in December, having not been ranked in October and November. The Hybrid Chocolate Chip Cookies (100mg) entered the rankings for the first time in December, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.