Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

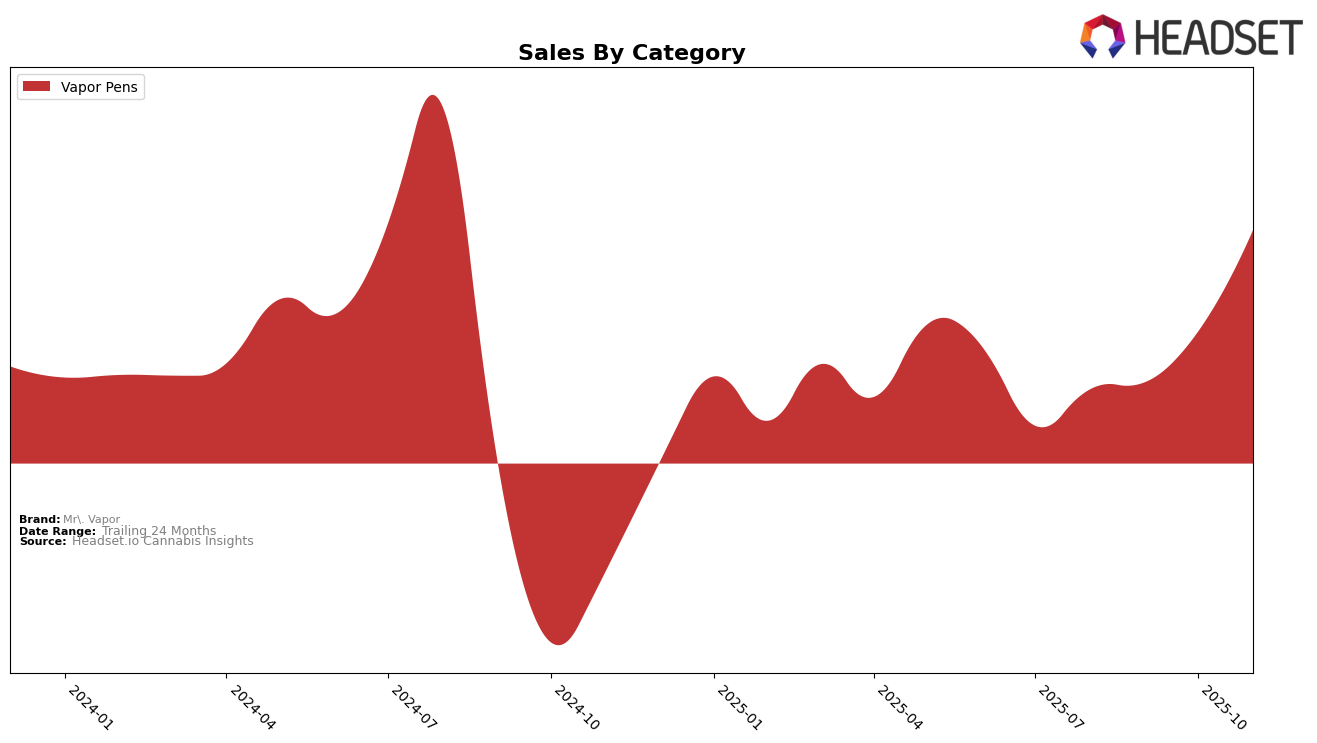

Mr. Vapor has shown a significant upward trajectory in the vapor pens category within Michigan. Starting from a rank of 75 in August 2025, the brand made a remarkable leap to the 30th position by November 2025. This steady climb over a span of four months underscores a strong market presence and growing consumer preference within the state. The brand's sales figures reflect this positive trend, with a substantial increase from August to November, demonstrating an effective market strategy and possibly an expanding customer base in Michigan.

However, it's important to note that Mr. Vapor's performance outside of Michigan is not captured in the top 30 rankings for other states or provinces. This absence could indicate a lack of market penetration or competitive challenges in those regions, suggesting areas for potential growth or reevaluation of market strategies. Understanding the dynamics in other states could provide further insights into regional preferences and the competitive landscape that Mr. Vapor faces. Exploring such data can be instrumental for stakeholders looking to capitalize on emerging opportunities or address existing market challenges.

Competitive Landscape

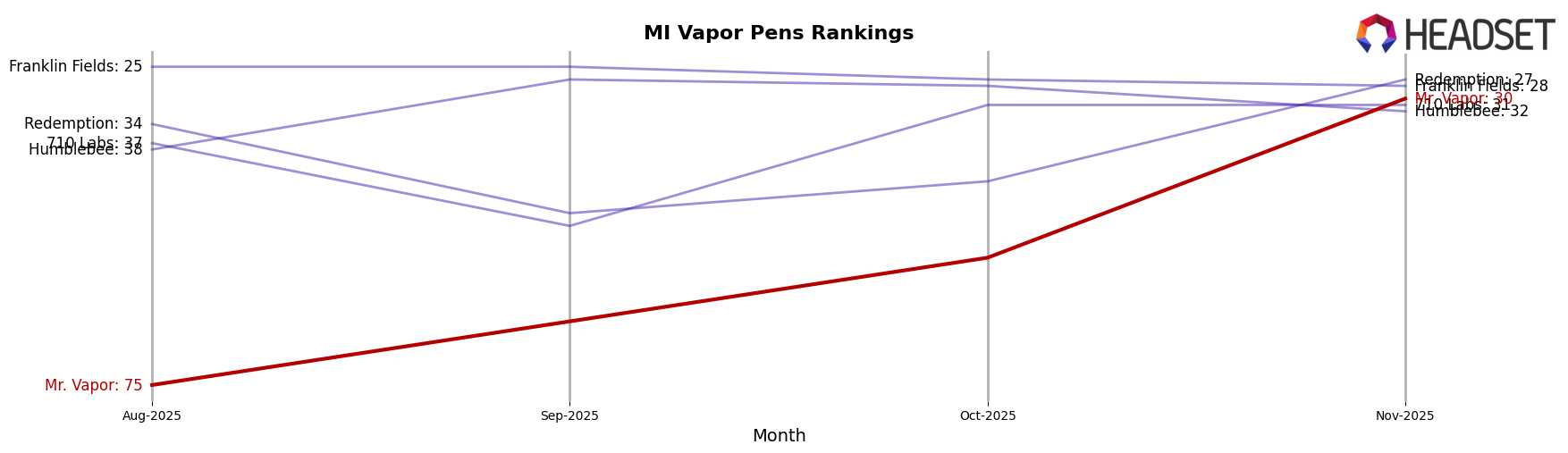

In the competitive landscape of the vapor pens category in Michigan, Mr. Vapor has shown a remarkable upward trajectory in its rankings over the past few months. Starting from a rank of 75 in August 2025, Mr. Vapor has climbed to the 30th position by November 2025, indicating a significant improvement in market presence and consumer acceptance. This upward movement is notable when compared to competitors like 710 Labs, which maintained a relatively stable rank around the 31st position, and Redemption, which improved from the 43rd to the 27th position in the same timeframe. Meanwhile, Humblebee experienced fluctuations, ending at the 32nd position in November. The consistent rise in Mr. Vapor's rank suggests a growing consumer preference and potentially effective marketing strategies, positioning it as a formidable competitor in the Michigan vapor pens market.

Notable Products

In November 2025, Blue Razz Distillate Cartridge (1g) reclaimed the top spot among Mr. Vapor's products with notable sales of 5713 units. Apple Runtz Distillate Cartridge (1g) climbed to the second position, showing a consistent upward trend from its fourth place in August. Tasty Rainbow Distillate Cartridge (1g) slipped to third, despite maintaining high sales figures. Bubble Yum Distillate Cartridge (1g) held steady in fourth place for consecutive months, while Bombsicle Distillate Cartridge (1g) re-entered the top five after being unranked in October. Overall, the Vapor Pens category demonstrated strong performance with minor shifts in product rankings, indicating stable consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.