Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

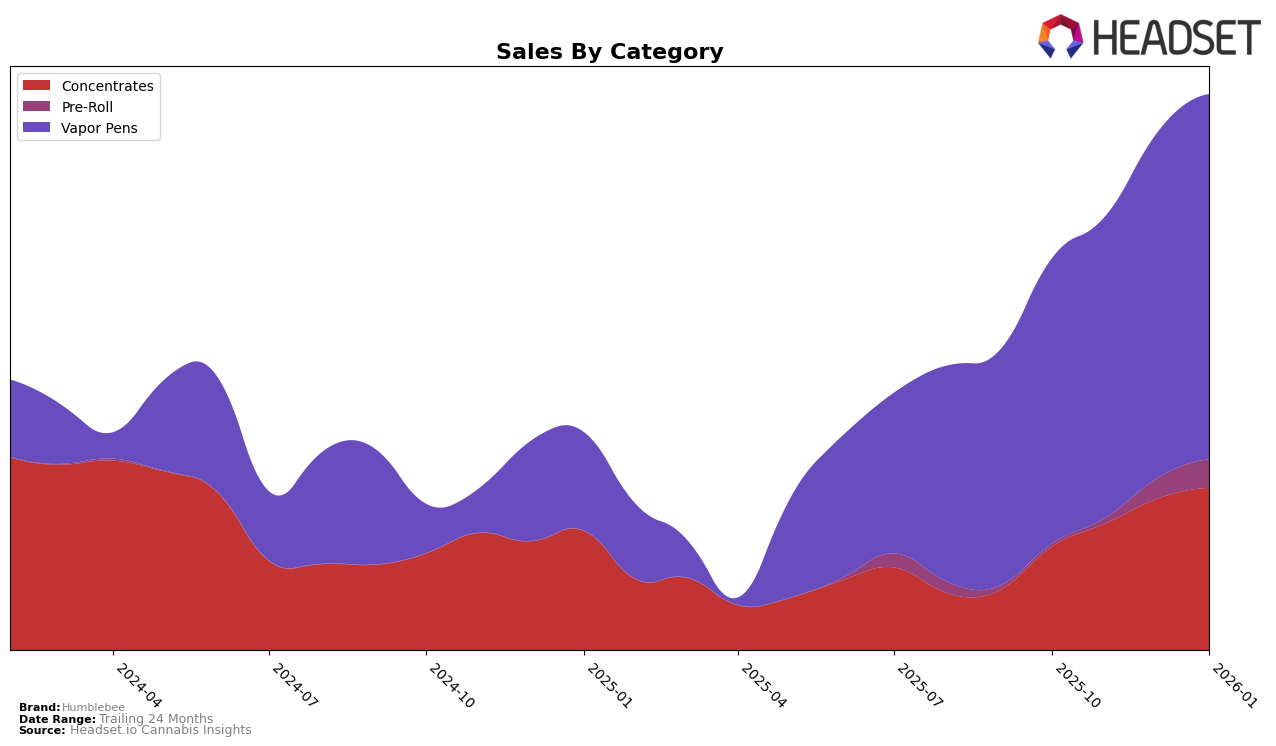

Humblebee has shown a notable upward trajectory in the Michigan concentrates category. Starting from a rank of 31 in October 2025, the brand climbed to the 15th position by January 2026. This consistent improvement suggests a strengthening foothold in the market, possibly driven by increasing consumer preference or strategic marketing efforts. The sales figures reflect this upward trend, with a steady increase from $120,642 in October 2025 to $189,670 in January 2026. Such a rise in rank and sales indicates a growing acceptance and popularity of Humblebee's concentrates among consumers in Michigan.

In contrast, Humblebee's performance in the vapor pens category within Michigan has been relatively stable, with minor fluctuations in rankings. The brand was ranked 28th in October 2025 and made a slight improvement to the 24th position by January 2026. Despite not breaking into the top 20, the sales figures for vapor pens have shown a positive trend, with sales increasing from $334,067 in October 2025 to $427,714 in January 2026. This suggests that while the brand's market position may not have shifted dramatically, consumer demand for its vapor pens is on the rise, hinting at potential for future growth in this category.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Humblebee has shown a promising upward trajectory in its rankings over recent months. Starting from the 28th position in October 2025, Humblebee improved to 24th by January 2026, indicating a positive trend in market presence. This improvement is notable when compared to competitors like Batch Extracts, which fell out of the top 20 by December 2025, and Legit Labs, which saw a decline from 23rd to 25th. Meanwhile, Redemption and Stickee maintained relatively stable positions, with Stickee slightly outperforming Humblebee by holding the 22nd rank in January 2026. Humblebee's sales have consistently increased, contrasting with the declining sales of Batch Extracts, suggesting a potential shift in consumer preference towards Humblebee's offerings. This positive momentum in both rank and sales positions Humblebee as a brand to watch in the Michigan vapor pen market.

Notable Products

In January 2026, Humblebee's top-performing product was the Tangerine Punch Live Resin Cartridge (1g) in the Vapor Pens category, leading the sales with 3966 units sold. Following closely, the Frosted Oranges Live Resin Cartridge (1g) secured the second spot, climbing up from its first-place position in December 2025. Both the Grape Dragon Kush Live Resin Cartridge (1g) and OG Kush Live Resin Cartridge (1g) shared the third rank, maintaining their positions consistently. The Sugar Bowl Live Resin Cartridge (1g) rounded out the top four, experiencing a slight drop in rank. These shifts indicate a competitive market for Humblebee's Vapor Pens, with slight fluctuations in consumer preferences over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.