Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

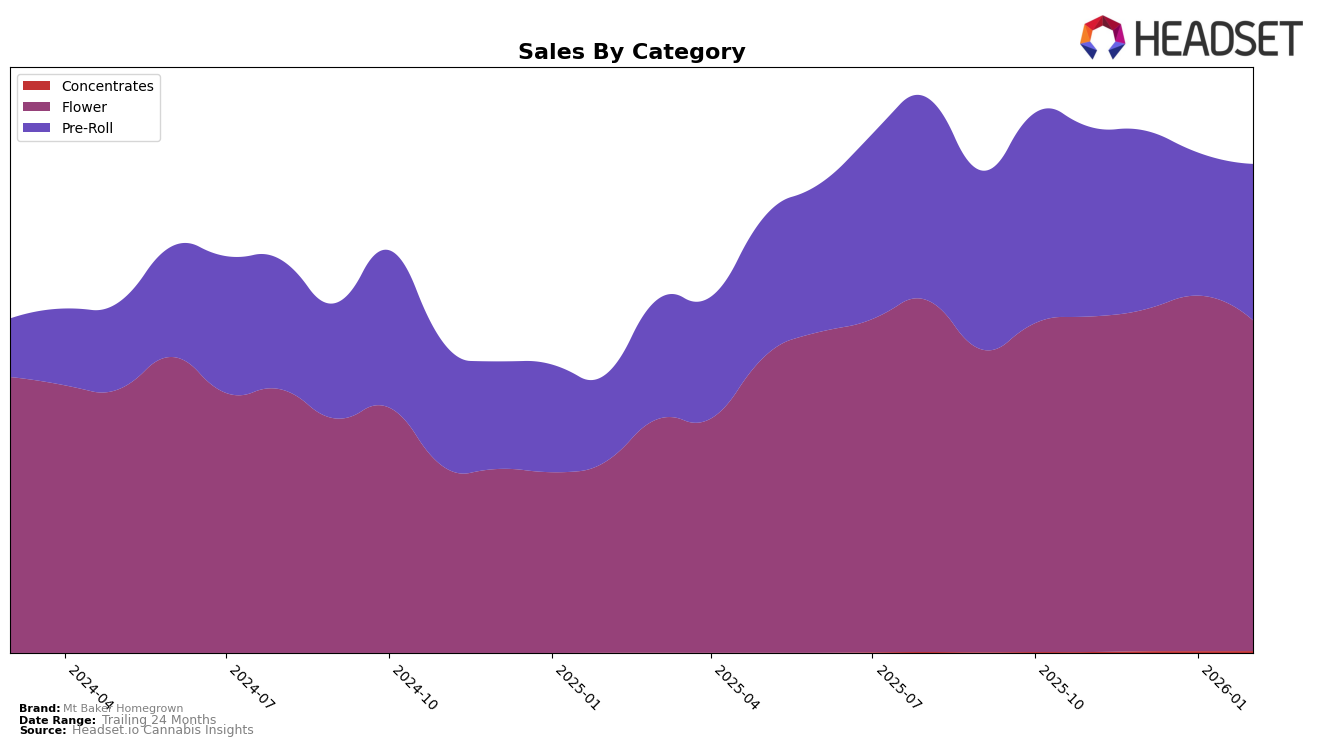

In the state of Washington, Mt Baker Homegrown has demonstrated a consistent performance in the Flower category. Over the observed months, the brand maintained a solid presence in the top 30, with a slight dip from rank 22 in November 2025 to rank 23 in December 2025, before climbing back to rank 20 in both January and February 2026. This stability in ranking is underscored by a notable increase in sales from December to January, before experiencing a slight decline in February. This pattern indicates a robust market presence with potential for growth, particularly in maintaining top 20 positions consistently.

Conversely, Mt Baker Homegrown's performance in the Pre-Roll category in Washington presents a more varied trajectory. The brand's rank declined from 24 in November 2025 to 29 in December, and notably, it fell out of the top 30 in January 2026, indicating a challenging period. However, by February 2026, the brand made a recovery to rank 26, which suggests efforts to regain market share. Despite these fluctuations, the sales trend shows a decrease from November to January, followed by a slight recovery in February, hinting at potential strategic adjustments that could be explored further.

Competitive Landscape

In the competitive landscape of the Washington Flower category, Mt Baker Homegrown has demonstrated a consistent presence, maintaining a rank within the top 20 from November 2025 to February 2026. Despite a slight dip in December 2025, where it ranked 23rd, Mt Baker Homegrown rebounded to secure the 20th position by January and February 2026. This stability is noteworthy when compared to competitors like SubX, which fluctuated more significantly, peaking at 16th in December before dropping to 21st by February. Meanwhile, Ooowee showed a positive trend, climbing from 30th in December to 19th in February, surpassing Mt Baker Homegrown in the final month. Momma Chan Farms consistently outperformed Mt Baker Homegrown, although it experienced a notable decline from 8th in December to 18th by February. These dynamics suggest that while Mt Baker Homegrown maintains a steady market position, it faces competitive pressure from brands that are either rising or maintaining stronger sales trajectories.

Notable Products

In February 2026, Mt Baker Homegrown's top-performing product was Gelato 33 Pre-Roll 10-Pack (5g) in the Pre-Roll category, maintaining its number one rank consistently from previous months with sales of 1,371 units. Garlic Grapes Pre-Roll 10-Pack (5g) held the second position, showing stability in its ranking since January 2026. Lemon Cherry Gelato Pre-Roll 10-Pack (5g) made a notable entry into the rankings, securing the third position for the first time. Terpgasm Pre-Roll 10-Pack (5g) improved its rank to fourth place, having previously been unranked. Banana Jealousy Pre-Roll 10-Pack (5g) saw a decline, dropping from third in January to fifth in February 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.