Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

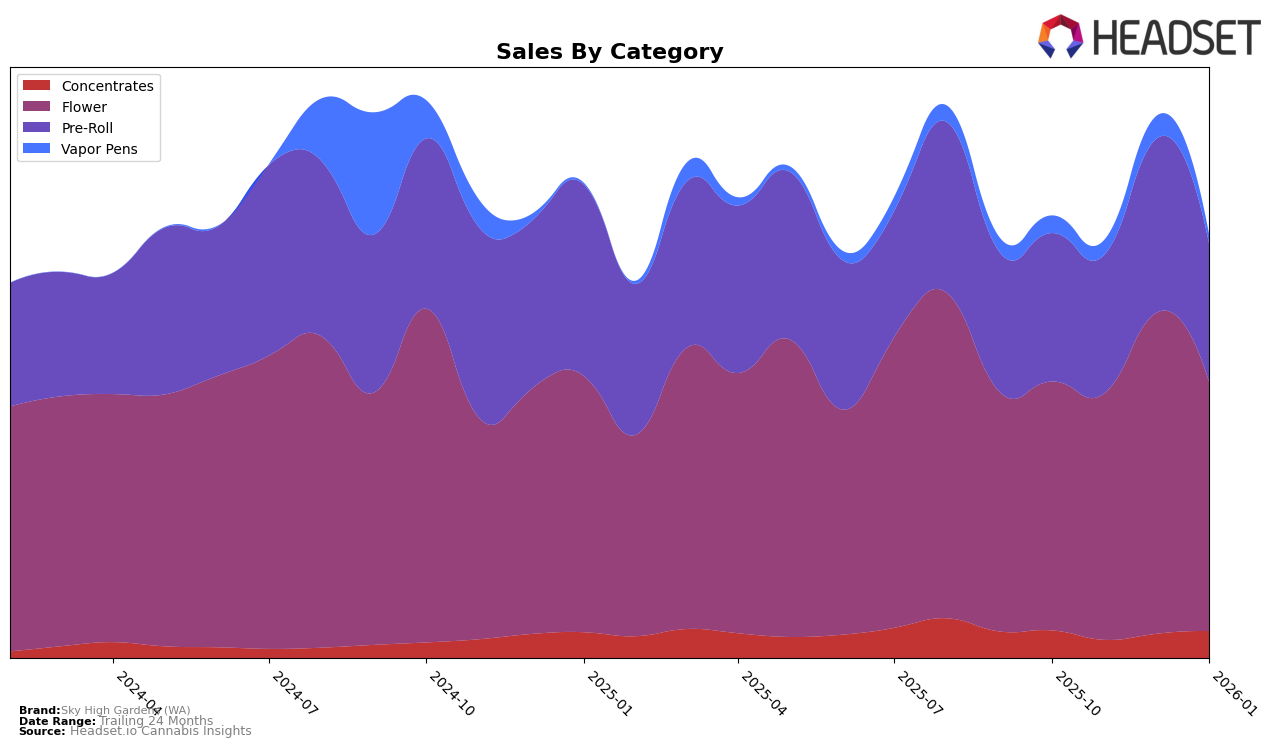

Sky High Gardens (WA) has demonstrated varied performance across different product categories within the Washington market. In the Flower category, the brand showed a promising upward movement, especially in December 2025, where it improved its ranking to 21st from 31st in October 2025. This suggests a positive reception for their flower products during the holiday season. However, the subsequent return to the 30th position in January 2026 indicates a need for sustained marketing efforts to maintain higher rankings. In the Concentrates category, Sky High Gardens did not make it to the top 30, which highlights a potential area for growth and strategic focus, given the competitive nature of this segment.

The Pre-Roll category showed a similar trend to the Flower category, with a notable improvement in December 2025, where the brand climbed to the 22nd position from 31st in October 2025. This improvement suggests a successful promotional strategy or product launch during this period. However, the brand's inability to maintain this momentum in January 2026, slipping to 28th, indicates potential challenges in sustaining consumer interest. The fluctuations across these categories underscore the dynamic nature of the cannabis market in Washington, and suggest that while Sky High Gardens has had successes, there are opportunities for improvement, particularly in the Concentrates category, where they have yet to break into the top ranks.

Competitive Landscape

In the Washington flower category, Sky High Gardens (WA) has experienced fluctuations in its market position, with its rank improving from 31st in October 2025 to 21st in December 2025, before dropping back to 30th in January 2026. This volatility in rank suggests a competitive landscape where brands like Seattle's Private Reserve and Agro Couture maintain relatively stable positions, consistently ranking within the top 30. Despite a peak in sales during December 2025, Sky High Gardens (WA) faces pressure from these competitors, as well as from WA Grower, which has shown resilience by improving its rank to 28th in January 2026. Meanwhile, Snickle Fritz has demonstrated significant upward momentum, climbing from 52nd to 33rd place over the same period, indicating an emerging threat. These dynamics highlight the need for Sky High Gardens (WA) to strategize effectively to maintain and enhance its market share amidst a challenging competitive environment.

Notable Products

In January 2026, Pineapple Chunk (3.5g) from Sky High Gardens (WA) maintained its top position in the Flower category, with sales reaching 960 units. Blue Dream Pre-Roll 2-Pack (1.2g) held steady at second place among Pre-Rolls, despite a drop from its peak sales in December. Blue Dream (3.5g) remained consistent in the third position, showing resilience across the months. Pineapple Chunk Pre-Roll 2-Pack (1.2g) dropped to fourth place in January, indicating a decline from its previous top spot in October. Sherb Cocktail (3.5g) entered the rankings at fifth place, showing potential for growth in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.