Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

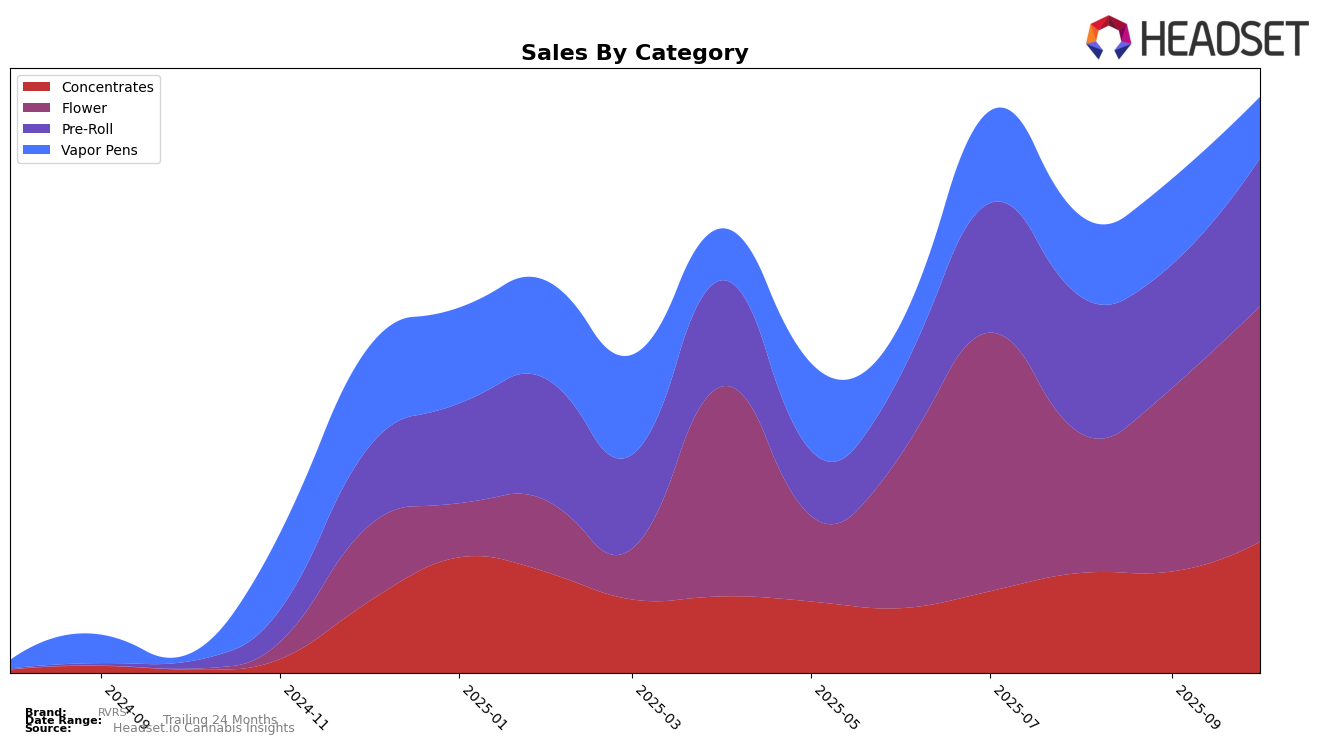

RVRS has shown a notable upward trajectory in the Colorado market, particularly in the Concentrates category, where it climbed from a rank of 32 in July 2025 to 27 by October 2025. This movement highlights a strengthening presence in a highly competitive category. The Pre-Roll category also saw a similar positive trend, with RVRS improving its ranking from 32 in July to 28 in October. However, the Vapor Pens category did not share the same success, as RVRS fell from 60 in July to 65 in October, indicating potential challenges in maintaining market share in this segment.

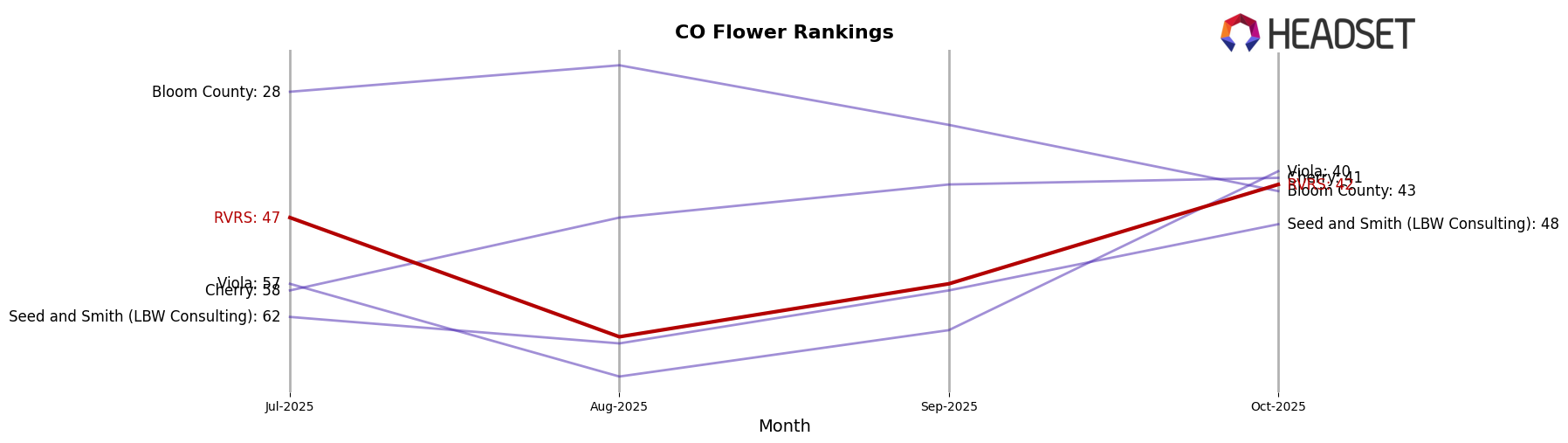

In the Flower category, RVRS experienced a volatile performance in Colorado, initially dropping from rank 47 in July to 65 in August, before rebounding to 42 by October. This fluctuation suggests a dynamic market environment where RVRS is attempting to stabilize its position. Notably, the sales figures in the Flower category showed a significant rebound, hinting at a successful strategic adjustment. Meanwhile, the absence of RVRS in the top 30 brands in other states or provinces across these categories indicates room for growth and expansion beyond Colorado.

Competitive Landscape

In the competitive landscape of the Colorado Flower category, RVRS has experienced fluctuating rankings over the past few months, which presents both challenges and opportunities. Notably, RVRS improved its position from 65th in August 2025 to 42nd by October 2025, indicating a positive trend in market presence. This upward movement is significant when compared to competitors like Viola, which also saw an improvement from 71st to 40th, and Cherry, which maintained a relatively stable rank around the low 40s. However, Bloom County experienced a decline, dropping from 24th to 43rd, which may have contributed to RVRS's improved rank. Despite these gains, RVRS's sales figures are closely trailing those of Seed and Smith (LBW Consulting), which also showed an upward trend in sales from August to October. This competitive analysis highlights the dynamic nature of the market and underscores the importance for RVRS to continue leveraging its strengths to maintain and improve its standing in the Colorado Flower category.

Notable Products

In October 2025, the top-performing product for RVRS was Dosi Punch Smalls Bulk in the Flower category, achieving the number one rank with sales of $5,040. Cherry Pie OG Smalls Bulk followed closely as the second top product, maintaining its position from the previous months. Cherry Pie OG Bulk held steady at the third rank, although its sales decreased from September. Sherbz Bulk secured the fourth position, while Chili Verde Bulk dropped from second place in August to fifth in October. The rankings reveal a consistent preference for bulk Flower products, with some fluctuations in positions among the top five over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.