Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

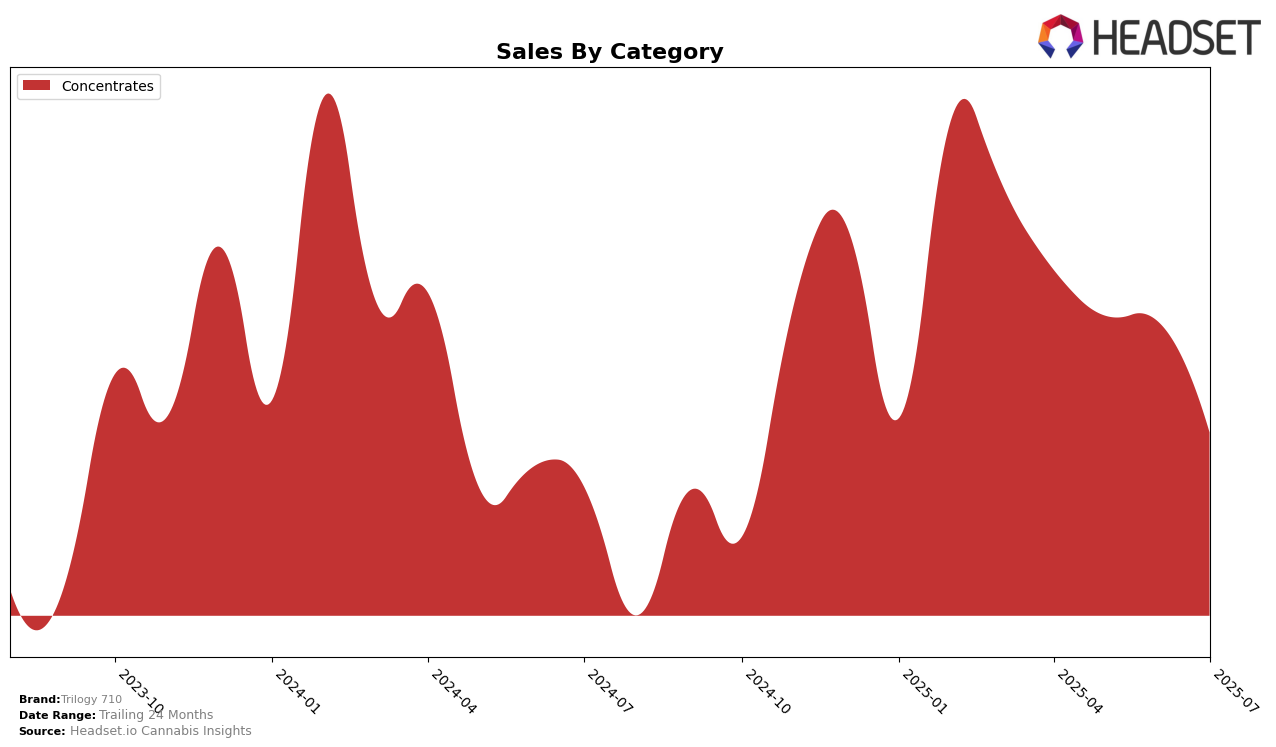

Trilogy 710 has experienced notable fluctuations in its market performance across various states and product categories. In the California market, the brand's presence in the Concentrates category has seen a downward trajectory over the months from April to July 2025. Starting at the 15th position in April, Trilogy 710's ranking slipped to 25th by July. This decline in ranking is coupled with a decrease in sales, with the most significant drop occurring between June and July. Such a trend indicates potential challenges the brand might be facing in maintaining its competitive edge within the California concentrates market.

Interestingly, in other states, Trilogy 710's absence from the top 30 rankings in any category suggests a limited presence or lower performance levels. This could be viewed as a missed opportunity for the brand to expand its footprint and capture more market share. The lack of top 30 rankings in these states highlights the need for strategic adjustments if Trilogy 710 aims to enhance its visibility and influence across a broader geographical landscape. Understanding the factors contributing to its performance in California could provide insights for improving its standing in other markets.

Competitive Landscape

In the competitive landscape of California's concentrates market, Trilogy 710 has experienced notable fluctuations in its ranking and sales performance from April to July 2025. Starting strong in April with a rank of 15, Trilogy 710 maintained a consistent position at 16 in May and June, before dropping to 25 in July. This decline coincides with a decrease in sales, suggesting potential challenges in maintaining market share. Competitors like Hashish House and Globs have shown variable performance, with Hashish House dropping out of the top 20 in May and June, while Globs remained outside the top 20 throughout the period. Meanwhile, Sun Smoke and Hashtag have shown improvements, with Sun Smoke climbing to 22 in June and Hashtag improving their rank each month. These dynamics indicate a competitive and shifting market, where Trilogy 710 must strategize to regain its earlier momentum and address the challenges posed by emerging and improving brands.

Notable Products

In July 2025, Trilogy 710's top-performing product was 710 Special Live Rosin (1g) in the Concentrates category, securing the number one rank with notable sales of 270 units. Banana Punch Live Rosin (1g) maintained its second-place position from June, highlighting its consistent popularity with 234 units sold. Venice Peach Live Rosin Badder (1g) and Venice Peach Live Rosin (1g) followed in third and fourth places, respectively, showing strong demand for the Venice Peach variant. Blue Zamurai Cold Cure Rosin (1g) rounded out the top five, indicating a diverse interest in Trilogy 710's Concentrates. Compared to previous months, the rankings suggest a stable preference for these products, with 710 Special Live Rosin (1g) making a notable leap to the top spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.