Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

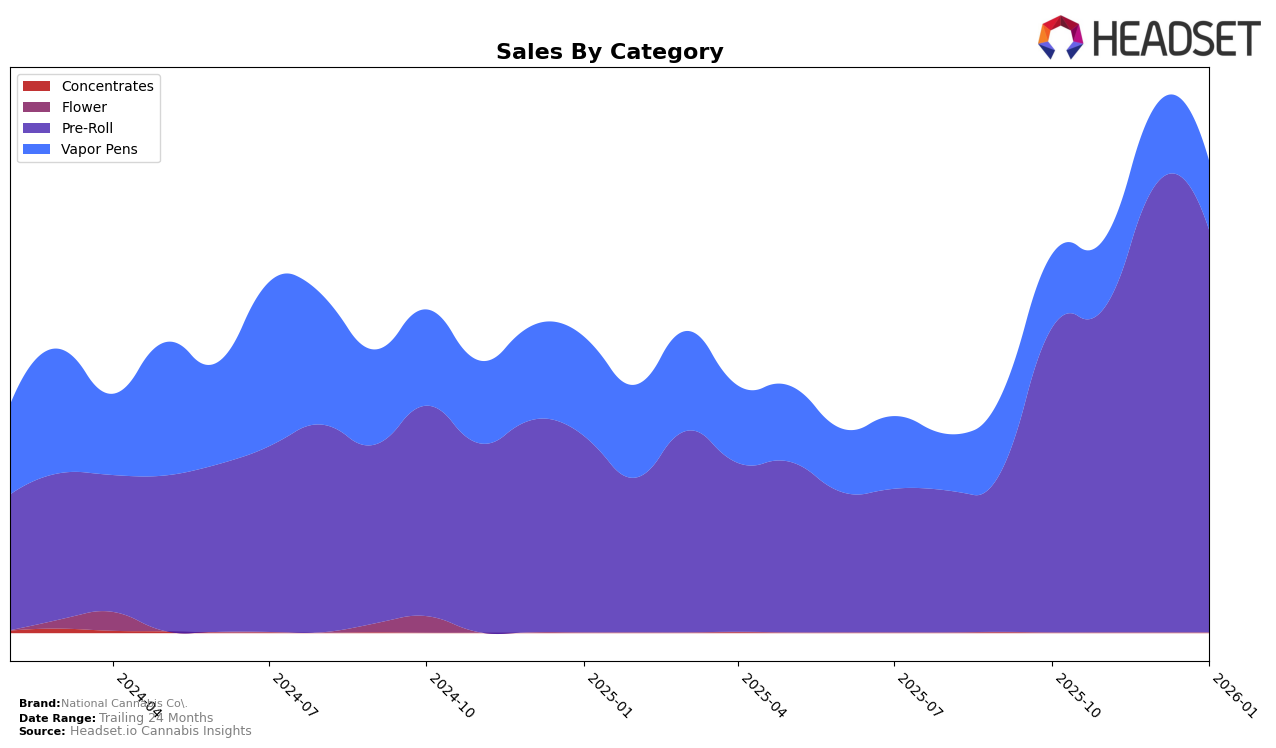

In the state of Oregon, National Cannabis Co. has demonstrated notable performance in the Pre-Roll category. Starting from October 2025, the brand climbed from a ranking of 34 to reach the 20th position by December, before slightly dropping to 21st in January 2026. This upward trajectory indicates a strong competitive presence in the Pre-Roll market, with sales peaking in December. However, it is worth noting that in the Vapor Pens category, National Cannabis Co. did not make it into the top 30 rankings during this period, suggesting potential areas for improvement or strategic focus.

While National Cannabis Co. shows promise in the Pre-Roll segment, the Vapor Pens category presents a contrasting picture in Oregon. The brand's rankings fluctuated slightly between 62 and 67, indicating a stable yet less competitive position compared to their Pre-Roll offerings. This consistent ranking outside the top 30 could be seen as a call to action for the brand to explore innovative strategies or product improvements to elevate their standing in the Vapor Pens market. The data highlights the importance of category-specific strategies to leverage strengths and address weaknesses in different market segments.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll category, National Cannabis Co. has experienced notable fluctuations in its ranking over the past few months. Starting from a position outside the top 20 in October 2025, it climbed to 27th in November and reached its peak at 20th in December, before slightly dropping to 21st in January 2026. This upward trend in rankings coincides with a significant increase in sales during December, indicating a positive reception to their offerings. However, competitors such as Rebel Spirit and Vibes (OR) have maintained relatively stable positions within the top 20, suggesting consistent consumer preference. Meanwhile, Lifted Northwest experienced a notable drop from 10th to 22nd in January, which may present an opportunity for National Cannabis Co. to capitalize on shifting market dynamics. As National Cannabis Co. continues to navigate this competitive landscape, understanding these trends and the performance of key competitors will be crucial for sustaining and improving its market position.

Notable Products

In January 2026, the Guava Botanical Infused Pre-Roll (1g) emerged as the top-performing product for National Cannabis Co., maintaining its rank from December and generating sales of 4792 units. The CBD/THC 1:1 Watermelon Wonder Infused Pre-Roll (1g) followed closely in second place, having swapped ranks with Guava Botanical from the previous month. The CBD/THC 1:1 Raspberry Skywalker Infused Pre-Roll (1g) consistently held the third position throughout the analyzed months. Oregon Apple Infused Pre-Roll (1g) remained steady in fourth place from October 2025 to January 2026. A new entry, Blood Orange Gelato Infused Pre-Roll (1g), debuted in the rankings at fifth place in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.